This Week in China: AI Urgency for Trump-Xi Talks, Top Regulator Probed, and BYD Overtakes Tesla

This week's Beyond the Great Wall provides an overview of key developments within China, along with insights into its foreign affairs.

China Quote 🗩

“China will remain fertile land for foreign investment for a long time to come”.

Xi Jinping

Trump and Xi Must Face AI Together, Now More Than Ever

In his latest New York Times column, Thomas L. Friedman delivers a stark warning from Beijing: the race toward artificial general intelligence (AGI) is escalating rapidly, and the world’s two AI superpowers — the US and China — must collaborate to manage its consequences. While media focuses on familiar geopolitical flashpoints like tariffs and Taiwan, Friedman argues the real existential challenge lies in creating a global governance framework for AGI — systems that could surpass human intelligence and reasoning.

Friedman paints a future where mass job displacement, loss of dignity through automation, and rogue or unregulated superintelligence lead to societal destabilisation. From Uber’s driverless cars to Ukraine’s robotic warfare and China’s humanoid robots dancing on national television, signs of a techno-transformation are already visible. Chinese experts, too, are deeply aware: one economist bluntly states, “with AI, people may never find jobs again.”

Yet trust between the US and China is at an all-time low. Still, Friedman insists on the urgency of “coopetition” — a term borrowed from Silicon Valley, where rivals align on standards to expand the market. Without shared AI trust protocols, the global economy risks collapsing into a high-tech cold war, where trade is reduced to soybeans and fear.

Citing historian Yuval Noah Harari, Friedman concludes that only through renewed human trust and global collaboration can AI be controlled — lest it begin controlling us. He urges Presidents Trump and Xi to step forward, not to debate the past, but to safeguard our shared future.

Economic Activity🏦

Trump’s tariffs will slow China’s economy and impede global trade, OECD forecasts

Igor Patrick writes in South China Morning Post that the OECD projects China’s growth will slow to 4.8% in 2025 and 4.4% in 2026, citing the impact of new US tariffs and rising geopolitical uncertainty. The tit-for-tat tariffs between the US and China are expected to raise costs, disrupt supply chains, and dampen global GDP, especially hurting commodity-exporting nations.

Former officials call for parity, reform in China’s pension system

Ji Siqi writes in South China Morning Post that former Chinese banking officials at the Boao Forum urged reforms to address regional disparities and ensure the sustainability of China’s pension system. Guo Shuqing proposed narrowing the urban-rural gap and boosting returns via market-oriented investments, while Zhou Xiaochuan cited Hong Kong’s pension model as a reform reference.

Inside China🐉

Li Xiaopeng – Former Chairman, China Everbright Group

Sentenced to 15 years for taking over 60 million yuan in bribes between 1994 and 2021 while working at major state-owned firms including ICBC and China Merchants Group. In return, he facilitated loans and business deals. His case is part of a wider anti-corruption drive that has also ensnared former ICBC executive Cong Lin.Wang Huimin – Former Chief Anti-Corruption Official, CSRC

Under investigation for suspected graft. His son, Wang Bangzhong, is also being probed, linked to their involvement in a Xinjiang poverty alleviation project. Wang previously worked at China Construction Bank before heading anti-corruption at the CSRC.Ren Chunsheng – Former Chairman, Shanghai Insurance Exchange

Expelled from the Communist Party and dismissed from public office over allegations of accepting large bribes. Investigations relate to his earlier roles at China Insurance Investment Co. and as a regulator of insurance fund investments.

China's dream of becoming a football superpower lies in tatters

Nick Marsh writes in BBC News that China’s ambition to dominate world football has unravelled amid humiliating defeats, corruption scandals, and lack of grassroots development. Despite President Xi Jinping’s “three wishes” for football glory, political interference, poor infrastructure, and a culture of bribery have stunted progress. Analysts say football’s failure reflects broader systemic issues within China’s governance model.

China and the World🌏

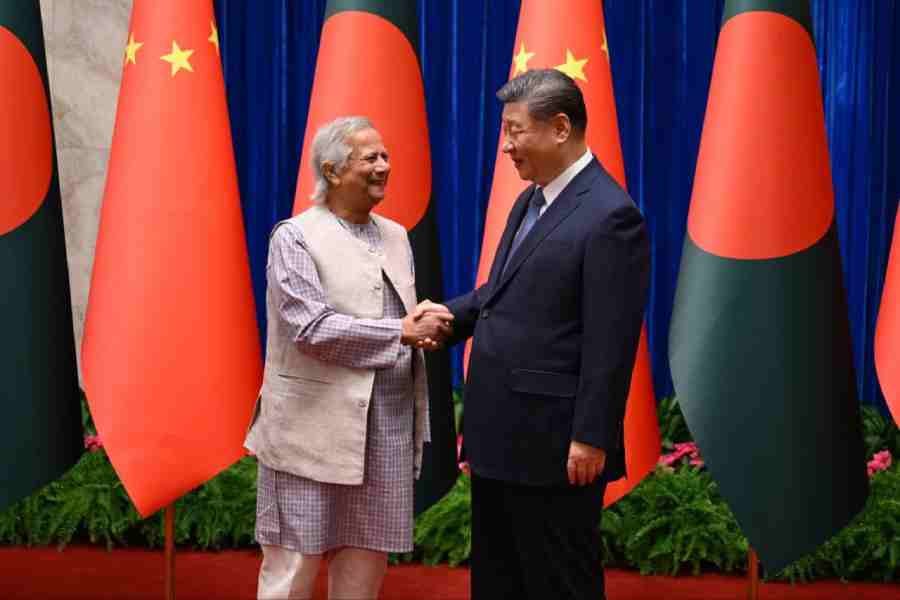

Yunus, Xi Discuss Expanding Economic Ties; Chinese President Assures Support to Bangladesh's Interim Govt

The Week reports that Chinese President Xi Jinping assured strong support for Bangladesh's interim government during Chief Adviser Muhammad Yunus’s visit. Xi pledged expanded trade ties, relocation of Chinese manufacturing, and duty-free access until 2028. The leaders also discussed infrastructure, renewable energy, Rohingya repatriation, and reduced loan interest rates, marking a deepening strategic partnership.

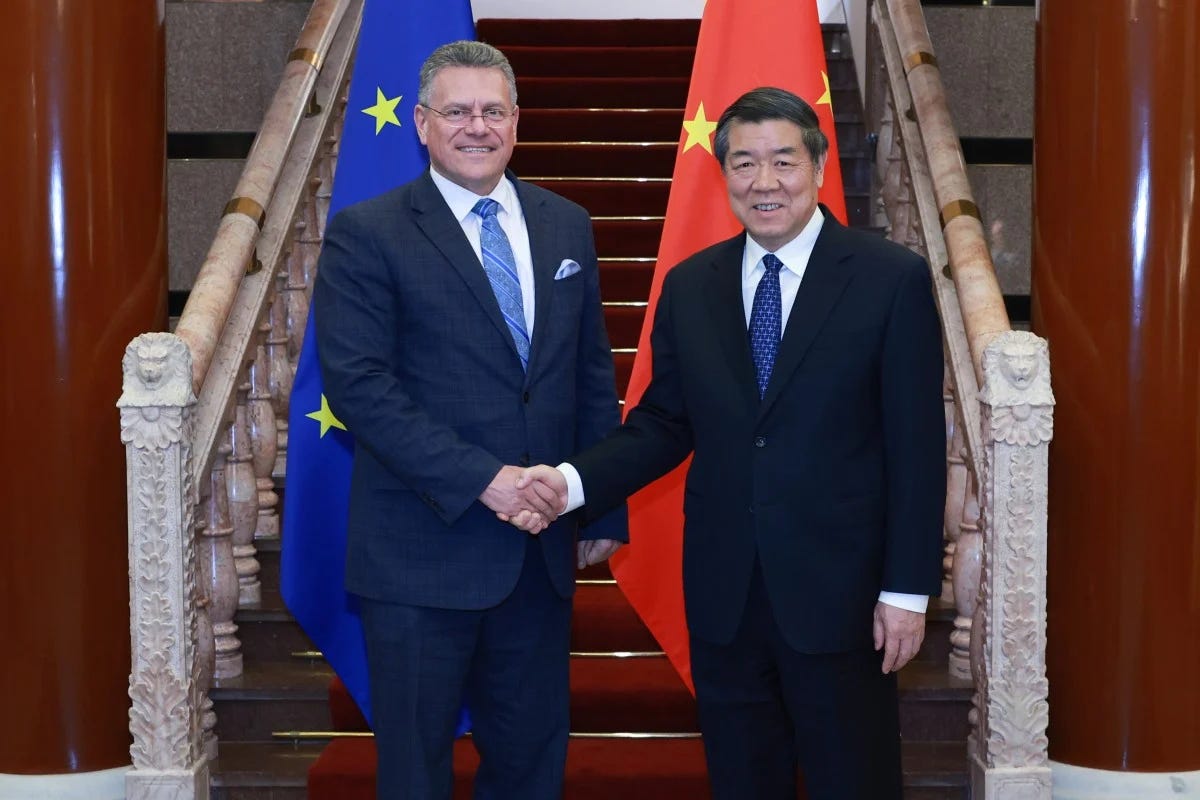

EU trade commissioner says bloc seeks to deepen cooperation with China

Finbarr Bermingham writes in the South China Morning Post that European Trade Commissioner Maros Sefcovic signalled a softened EU tone towards Beijing during a visit to China, calling for deepened trade and investment ties. Meeting Vice-Premier He Lifeng, both sides pledged to resist unilateralism and protect the multilateral trading system, amid concerns over Trump’s renewed protectionism.

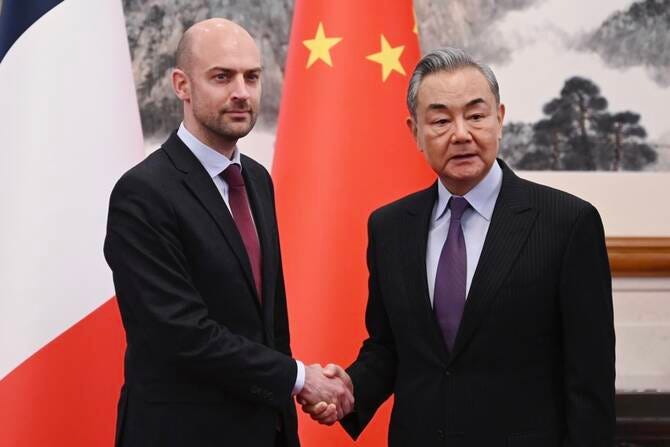

French FM urges ‘powerful’ ties with China

Arab News reports that French Foreign Minister Jean-Noel Barrot called for a “powerful Franco-Chinese partnership” during his visit to Beijing, amid global instability. In talks with Chinese counterpart Wang Yi, Barrot addressed the Ukraine war, Middle East tensions, and EU-China trade issues. His visit aims to deepen cooperation while maintaining pressure on Beijing over its ties with Moscow.

Taiwan jails four soldiers, including three who worked in presidential office, for spying for China

Helen Davidson writes in The Guardian that Taiwan has sentenced four soldiers to up to seven years in jail for leaking military secrets to Chinese intelligence. The convicted men, who worked in sensitive security units including the Presidential Office, were found guilty of espionage in exchange for modest payments. The case underscores rising cross-strait infiltration and national security concerns.

China hopes Europe will make 'rational choice' as transatlantic alliance shifts

Reuters reports that China's state-run Global Times urged the EU to turn further towards China amid growing uncertainty in US policy, especially after President Trump announced new tariffs on imported vehicles. As EU trade chief Maros Sefcovic visits Beijing, China positions itself as a stable partner while tensions rise over trade imbalances and restricted market access.

China's Xi to meet with BMW, Mercedes, Qualcomm CEOs, sources say

Reuters reports that Chinese President Xi Jinping is set to meet CEOs of BMW, Mercedes-Benz, and Qualcomm in Beijing, as China seeks to revive foreign investor confidence amid declining FDI and US tariff pressures. The meeting follows the China Development Forum, where Premier Li Qiang pledged stronger macroeconomic support and urged global economic cooperation.

China swoops in to replace Asian USAID projects axed by Trump

Iain Marlow and Philip J. Heijmans write in Fortune that China has stepped in to fund education and nutrition programmes in Cambodia shortly after the US cancelled similar USAID projects under a Trump-led overhaul. The $40 million cuts have opened a geopolitical vacuum, allowing Beijing to boost its soft power in Southeast Asia and beyond through targeted development assistance.

Taiwan Probes China Chipmaker SMIC for Allegedly Poaching Staff

Debby Wu writes in Bloomberg that Taiwan has launched a major investigation into Chinese chipmaker SMIC for allegedly poaching local engineers to access advanced semiconductor technology. Authorities say SMIC posed as a Samoa-based firm to recruit Taiwanese talent. Raids were conducted at 34 sites, and 90 individuals were questioned amid a wider probe into 11 Chinese firms.

US adds Chinese tech firms to its export control list, says they sought US knowhow for military use

Elaine Kurtenbach writes in AP News that the US has added over 80 entities, including 50+ Chinese firms, to its export control list for allegedly seeking advanced US technologies for military use. China protested the move, calling it unjust and harmful to global supply chains. Beijing-based AI institutions and Inspur subsidiaries were among those targeted.

Trump says tariffs are negotiating tool for TikTok sale

Dan Primack writes in Axios that President Trump hinted at reducing tariffs on Chinese goods if Beijing approves the sale of TikTok. With a divestment deadline of April 5 looming, Trump framed the potential tariff cut as leverage in negotiations. The ByteDance-owned app is under pressure to sell amid US national security concerns, but no final deal has been reached.

US sent another Typhon missile: ‘The more the merrier’

INQUIRER.net reports that the Armed Forces of the Philippines welcomed the reported deployment of a second US Typhon missile system to the country. AFP officials said the additional system would boost training capabilities. The first Typhon, deployed in 2024, remains stationed in Ilocos Norte near Taiwan.

China frees Mintz staff in move to soothe foreign sentiment

Antoni Slodkowski and Liz Lee write in Reuters that China has released all five local employees of US due diligence firm Mintz after two years in detention. Their release, coinciding with the China Development Forum, signals Beijing’s attempt to reassure foreign investors amid declining FDI and growing scrutiny of consultancy firms operating in China.

Alibaba-affiliate Ant combines Chinese and U.S. chips to slash AI development costs

Evelyn Cheng writes in CNBC that Ant Group is using a mix of Chinese and U.S. semiconductors to reduce AI training costs and time by 20%, while limiting reliance on Nvidia. Ant also unveiled healthcare AI upgrades now deployed in major hospitals, built on models like DeepSeek and Qwen. The move reflects a strategic diversification amid tightening U.S. chip restrictions.

The World May be Facing a Fundamental Turning Point in U.S.-China Asset Pricing

Zhou Junzhi writes in Caixin that recent shifts in global capital flows—Chinese equities rebounding, U.S. stocks weakening, and a stronger demand for safe-haven assets—may signal a turning point in US-China asset pricing. While China grapples with weak domestic demand, the US continues to benefit from an AI-driven tech surge, widening asset valuation disparities.

Hutchison, government seek ‘reasonable way out’ as Panama ports deal deadline nears

Jeffie Lam and Lam Ka-sing write in South China Morning Post that CK Hutchison and the Hong Kong government are exploring alternatives to a controversial US$23 billion deal to sell its Panama port assets to a BlackRock-led group. Beijing has expressed discontent, raising pressure amid Sino-US tensions, while legal experts warn of costly consequences regardless of the outcome.

Tech in China🖥️

Chinese electric carmaker BYD sales beat Tesla

Peter Hoskins writes in BBC News that BYD’s 2024 revenue surged to $107 billion, surpassing Tesla’s $97.7 billion, driven by strong hybrid vehicle sales. BYD also sold 4.3 million vehicles globally, far more than Tesla’s 1.79 million EVs. Amid Musk-related political controversies and EV price wars, BYD’s affordable Qin L model and rapid-charging tech have sharpened its competitive edge.

China Admits It Has Tech To Sabotage Undersea Cables; Unveils Powerful Deep-Sea Cable Cutter That Can Disrupt World Order

Sakshi Tiwari writes in EurAsian Times that China has publicly revealed a deep-sea cable-cutting device capable of severing undersea cables at depths of 4,000 metres. Developed by a state-backed research body, the dual-use tool has sparked global concern amid rising undersea cable sabotage incidents and growing fears of hybrid warfare. Analysts warn of its strategic implications, particularly in a US-China conflict scenario.

China's VC Investment in AI Lags Far Behind US, Qiming Managing Partner Says

Ning Jiayan writes in Yicai Global that China’s AI-related VC investment reached USD14 billion in 2024, compared to the US’s USD76 billion. Duane Kuang of Qiming Venture Partners sees the disparity as a chance for China to invest more rationally. Despite DeepSeek’s success, Chinese tech firms’ AI commitments remain modest amid rising global competition.

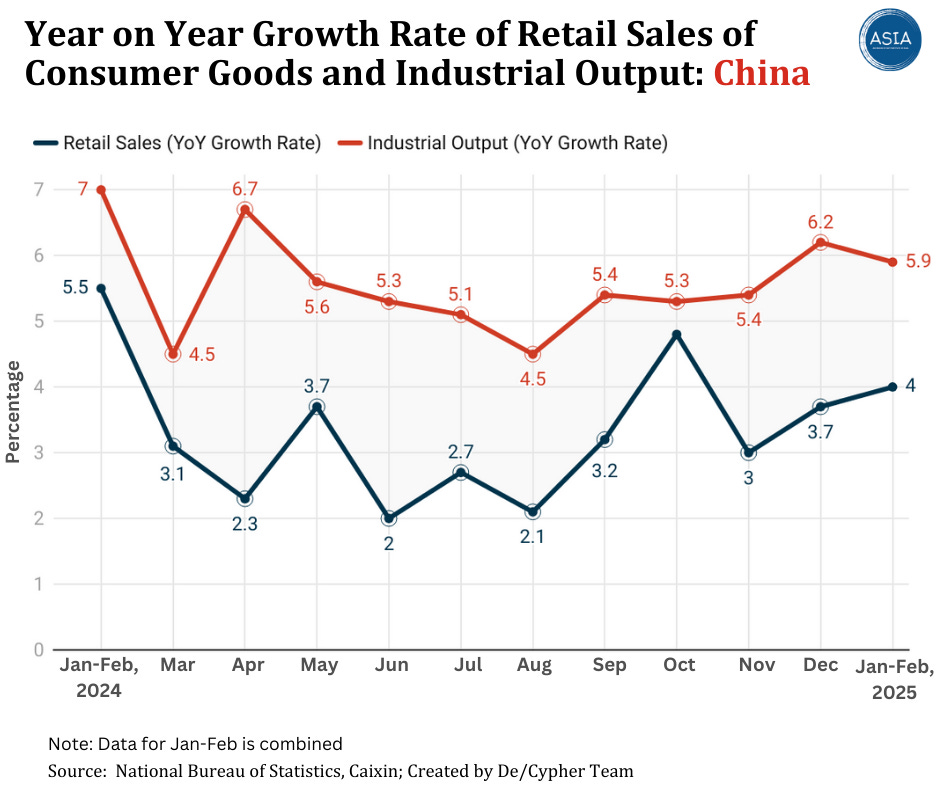

De/Cypher Data Dive📊

Consumer sentiment in China has improved sharply from last year, a survey by Deutsche Bank AG has revealed. Some 54% of respondents polled this quarter said they feel financially better off than a year ago, up from 44% on average in 2024.

Image of the Week📸

A drone photo taken on March 27, 2025 shows the air module of XPENG's flying car AEROHT conducting a flight demonstration at Liuye Lake Tourist Resort in Changde City, central China's Hunan Province. A ceremony for the flying car's maiden flight in Hunan was held by Chinese electric vehicle maker XPENG here on Thursday. The flying car consisting of a ground module, an electric vehicle, and an air module, performed the application scenario of cross-water flight on the day. Photo: Xinhua/Chen Sihan

- - -