This Week in Beyond The Great Wall: What's Next for US-China Relations, Xi's Visit to Latin America, and Tax Cuts

This week's Beyond the Great Wall examines the future of US-China relations in the wake of Trump's election victory. We also highlight the key stories emerging from China and the broader developments shaping its diplomatic strategy on the global stage.

China Quote✒️

"China has to consider what to do with the sanctions before being able to have any engagement with Marco Rubio"- Zhu Junwei, a former researcher in the people's Liberation Army , now director of American research at Grandview Institution in Beijing.

The Eagle & The Red Dragon: What Lies Ahead for US-China Relations

Written By Priyanka Garodia - Geopolitical Research Analyst, South Asia

The election of Donald Trump as President of the Unites States of America 2024 has left the world in a state of anticipation and anxiety over the future. Given his erratic, non-rational and highly transactional leadership style, US foreign policy is surely going to see some changes from the Biden Administration. The future of US-China relations is expected to see a deepened confrontation with economic issues taking precedence. Trump’s previous terms as president (201-2020) saw a hardline stance adopted with China with trade tariffs, sanctions and import bans, espionage and military strategy in the Indo-Pacific. His second term is expected to be in-line with this given the nature of his campaign based on competitive nationalism and transactional diplomacy.

Arena One: Trade and Tariffs

Trump has been vocal about tariff imposition being his most preferred way of dealing with countries that he sees as a threat to US interests. His most notable policies from his first term have been the imposition of tariffs on Chinese goods to pressure China into a trade concession and reduce the US trade deficit. Despite some thaw with the “Phase One” trade deal in 2020, most of these tariffs have remained in place. It is expected that Trump will continue with tariffs as mentioned during his campaign runs. Trump’s ‘America First’ agenda seeks to put in first place the needs to American industries and workers with limited consideration for the global economy. In line with this, he has time and again stated that a tariff imposition of up to 60% on Chinese goods and 10% on other imports can be expected.

While the rhetoric may have gotten him elected as President of the United States, the actual imposition of said tariffs will not only complicate things for China but also US consumers. The tariffs proposed will have deep consequences on the global supply chain and China could see a potential problem with its manufacturing industry. China is currently undergoing an economic crisis, especially with its real estate sector in trouble. This was a crucial sector that absorbed most of the consequences of the tariffs imposed in 2016, thus this decline could lead to problems for China. Similarly, factories and manufacturing could see a decline that could lead to trouble in household prices. For the US, the tariffs could mean a possible exacerbation of inflation rates and higher prices for consumers. US allies will also face the brunt of reduced production in China with their exports being slashed of raw materials.

Arena Two: The Battle for Technological Supremacy

The US-China tech rivalry has only intensified in recent times with newer manifestations. The “tech cold war” is not just a fight to establish technological supremacy but it has also been seen as extension of asserting global influence and protecting national security. The first Trump term had heavily restricted multiple giants like Huawei and ZTE, limiting their access to US markets. He restricted investment in sectors that was deemed critical to national security by Chinese companies. With his second term approaching, similar measures can be expected. Chinese tech companies will be allowed limited space to operate, and given Trump’s attitude of dealing with allies, the same will be expected of them. The semiconductor technology domain has become one area of contested power relations between the two countries and the chips war is expected to continue. Artificial intelligence (AI) and its future utility including in areas of defense will also be a major source of contention between US and China.

Trump’s idea of America’s presence in the global world is in a highly reduced capacity. If America were to withdraw from the world and retreat into its own domestic sphere, a vacuum may very well emerge in global leadership. Beijing’s recent national priority has been technological and military development. If America reduces contact with China, then they will be forced to seek alternate methods and become self-reliant for their own needs. Beijing’s effort at creating alternatives to American reliance includes large infrastructure projects like the Belt and Road Initiative, by becoming a major international aid don and through economic initiative like the Regional Comprehensive Economic Partnership (RCEP). A possible fallout of such polarisations includes a highly fragmented digital landscape. Thus, a bifurcated global tech domain would help no one.

Arena Three: Climate Change and Global Cooperation

Trump’s views on climate change and sustainable development are marked by deep skepticism and non-commitment. His withdrawal from the Paris Agreement in 2017 and general disengagement from the international climate change discourse is in direct contrast with China’s stance. While Trump believes that America should oversee its own energy interests and environmental issues, China is committed to addressing the issue of climate change in a collective and collaborative manner. It has invested heavily in renewable energy projects including technological sharing with its regional nemesis India. While it has its own problems, China is increasingly portraying itself to be a green technology leader. With Trump backing out from climate change governance, Beijing may very well position itself as the next global leader in tackling the climate problem.

Conclusion

As Trump is electing his staff and advisors, there remains deep concern over the future of Sino-US relations. Every individual will either escalate the crisis or prevent it. However, given Trump’s high personal style of governance, the ultimate decision making remains with him. The choice of making Stephen Miller as Chief of Staff, Robert Lighthizer as economic advisor, Elon Musk, Vivek Ramaswamy as advisors and staff members proves that a strong anti-China sentiment is present. People like Miller who have very hardline views on China, who not only see the rivalry between the two nations in economic terms but also ideologically, might amplify the assumption that China is a national security threat. With more moderate picks like Tulsi Gabbard as the Director of National Intelligence, we may have some voice of reason prevail. However, the entire agenda of the Trump administration will be to “Make America Great Again” and focus on preserving and increasing America’s power. Diplomatic engagements and multilateral cooperation will be limited, given Trump’s style of transactional diplomacy and both countries face great internal pressure to appear as strongmen capable of taking each other on. Trump will no doubt choose policies that favour American self-interest over international peace. The next four years will play a crucial role in not only determining the future of bi-lateral ties between the two governments but also geopolitics on the whole.

Blindspot👁️

Economic Activity🏦

China cuts taxes for home purchases in fiscal policy support

The Business Times reports that China has reduced home purchase deed taxes to 1% for first- and second-home buyers of flats under 140 square metres, down from 3%. This move, effective December, aims to lower housing costs, boost property sales, and stabilise the economy. Other measures include eliminating VAT for homes owned for over two years and easing buying restrictions in major cities.

China Consumer Prices Rise at Slower Rate in October

Al Arabiya reports that China’s consumer inflation rate slowed to 0.3% year-on-year in October, down from 0.4% in September, indicating sluggish demand despite measures to boost economic activity. Factory-gate prices fell 2.9% year-on-year, extending deflation since 2022. Analysts recommend targeting consumer-side stimulus to enhance domestic demand and avoid exacerbating overcapacity issues.

China Taps Global Bankers for Feedback to Lift Market Confidence

Cathy Chan writes in Bloomberg that China’s securities regulator has increased engagement with global banks, seeking insights into market trends and foreign investment flows. These interactions, now occurring weekly or on an ad-hoc basis, aim to assess the impact of recent stimulus measures and improve market confidence amid slow dealmaking and foreign investment challenges.

China’s Singles’ Day Shopping Event Watched for Signs of Rebounding Consumption

The Straits Times reports that China’s Singles’ Day shopping festival, centred on November 11, is under scrutiny for indications of economic recovery amidst sluggish consumption. Analysts project 1.2 trillion yuan in sales, a 15% rise from 2023. However, bulk-buying practices for discounts may harm profit margins and brand perception. Despite recent stimulus measures, achieving robust pre-pandemic growth remains uncertain.

COSCO Shipping builds a full supply chain in Europe

Li Rongqian writes in Caixin state-owned China COSCO Shipping Corp. Ltd. has opened a new sea-land route that reduces the time it takes to transport goods from China to Europe by one-fifth compared with the shipping route via Africa’s Cape of Good Hope. The new route is along what is known as the “southern corridor,” which has gained traction among Chinese and European traders looking for ways to avoid transporting goods through Russia and the Red Sea. On the route, cargo is taken by train out of the eastern Chinese city of Qingdao, through Kazakhstan and on to a ship to cross the Caspian Sea. It is then hauled overland through Azerbaijan and Georgia to the port of Poti on the Black Sea, where it is loaded on a freighter to Serbia and other parts of Europe.

Inside China🐉

Driver Rams Crowd in China, Killing 35, Police Cite Divorce Dispute

Huizhong Wu and Ng Han Guan report in AP News that a 62-year-old man, upset over his divorce settlement, drove his car into a crowd at a sports complex in Zhuhai, killing 35 and injuring 43 others. Authorities detained the driver, found injured with a knife in his vehicle. Chinese leader Xi Jinping called for strict punishment and urged strengthened risk prevention measures.

Former Defense Minister Liang dies at 84

Jiang Chenglong writes in China Daily that Liang Guanglie, China's former Minister of National Defense, passed away at 84 in Beijing. Liang, a decorated Party member and military leader, served from 2013 to 2018 as defence chief and held the rank of general. Enlisting in 1958, he played a significant role in national defence and military development.

Award-winning mathematician Ma Xiaonan leaves Europe for China

Ling Xin writes in the South China Morning Post that Chinese mathematician Ma Xiaonan has left Europe to join Nankai University in Tianjin as a chair professor at the Chern Institute of Mathematics. An expert in differential geometry, Ma cited the institute’s innovative spirit as a key draw. His work, with applications in physics and computer graphics, has earned him prestigious awards such as the Sophie Germain Prize.

China and the World🌏

Trump haunts APEC Meet in Peru, might even overshadow the sit down between Presidents Biden and Xi

Eric Martin writes in Bloomberg that at the Apec CEO Summit, JPMorgan's Jamie Dimon cited Donald Trump's tariff strategy as a negotiation tool, warning against creating global economic retaliation. The meeting, dominated by Trump’s policies, raised concerns over US-China trade dynamics and rising protectionism. Outgoing US trade representative Katherine Tai highlighted the need for targeted tariffs, while experts warned of economic risks for the Pacific Rim under Trump’s second term.

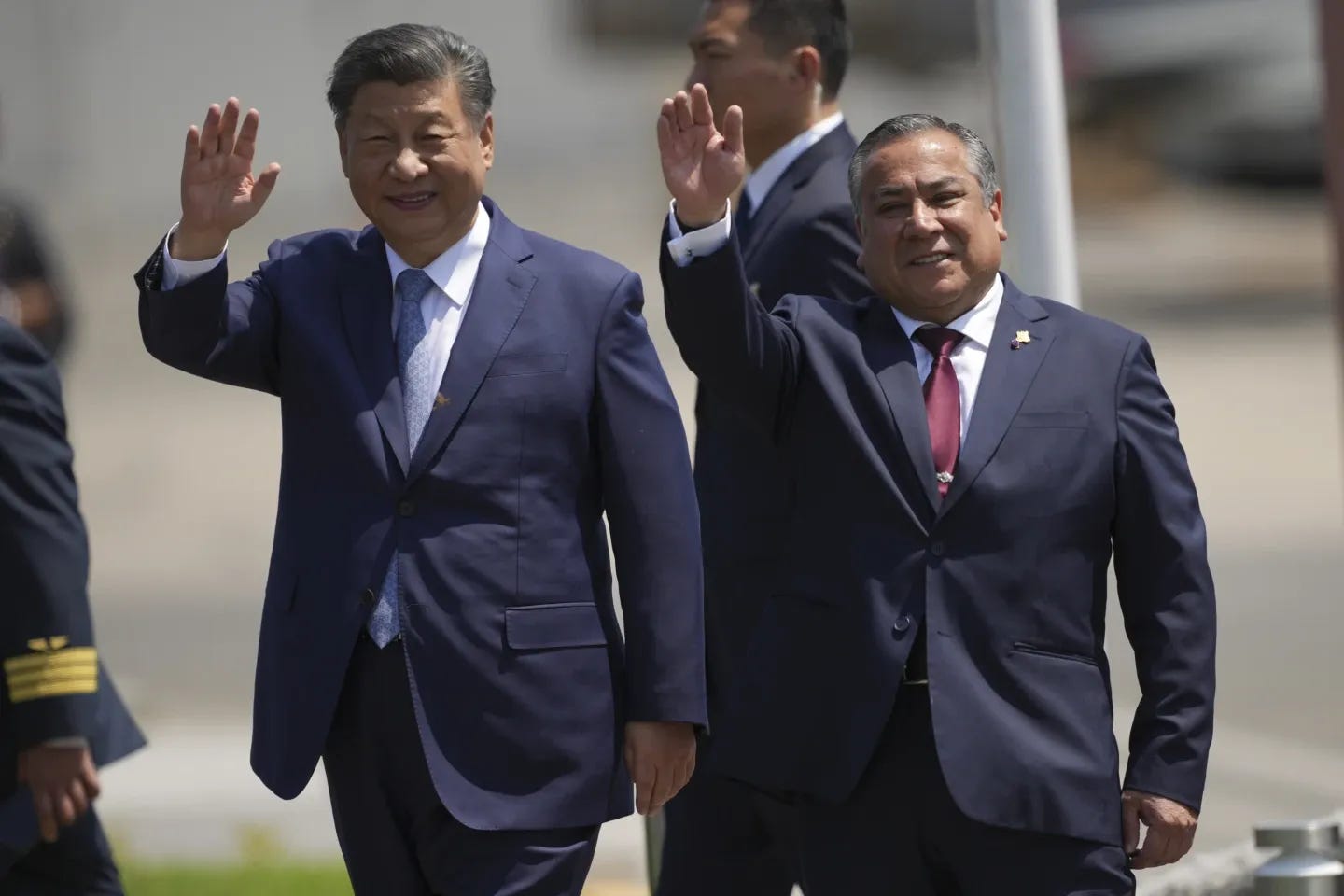

Biden and Chinese President Xi Jinping to meet in Peru this weekend

Kathryn Watson and Gillian Morley write in CBS News that President Biden will meet Chinese President Xi Jinping during the APEC summit in Lima, Peru. Expected to be Biden’s last meeting with Xi as president, the discussions will address U.S.-China cooperation on military communications, AI, and counternarcotics, alongside Russia-China relations. The meeting underscores efforts to stabilise the Indo-Pacific amid U.S. political transitions.

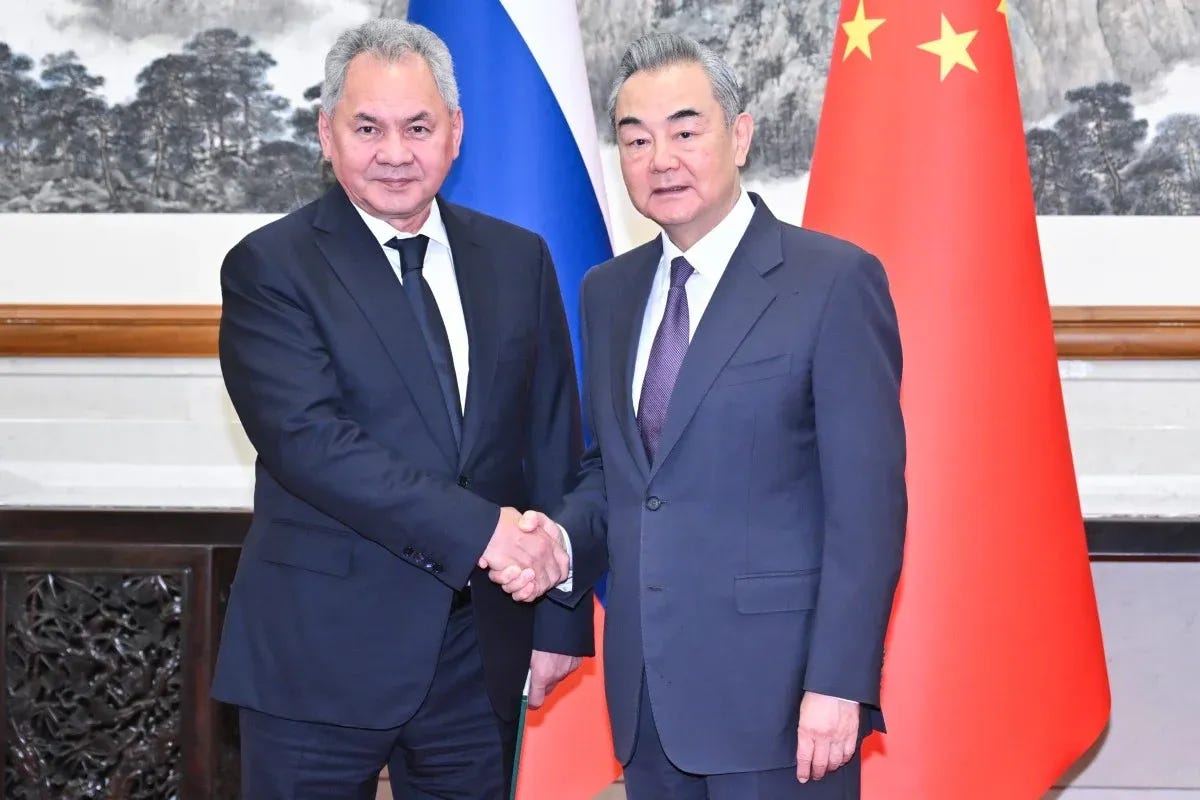

Russian Security Chief Calls for Joint Counter to US Containment with China

Reuters reports that Sergei Shoigu, Russia's top security official, met Chinese Foreign Minister Wang Yi in Beijing, advocating collaboration against US “containment.” The talks, following Donald Trump’s re-election, emphasised strengthening China-Russia strategic ties amid evolving global challenges. Shoigu highlighted unprecedented cooperation, while Wang reaffirmed solidarity to protect shared interests and global stability.

Indonesia, China Seal $10bn in Deals on President Prabowo’s Visit

Sheany Yasuko Lai writes in Arab News that Indonesian President Prabowo Subianto's first overseas tour since taking office saw the signing of $10 billion in business agreements with China. The deals span renewable energy, health, and food security. Prabowo and President Xi Jinping also elevated security cooperation as a key pillar of their partnership. Analysts suggest this visit strengthens Prabowo’s international credibility while balancing ties with the US and China.

China Calls for Enhanced Early Warning Systems at COP29

Xinhua reports that Chinese Vice Premier Ding Xuexiang, representing President Xi Jinping, urged stronger early warning systems and climate adaptation measures at a high-level meeting during COP29 in Baku. Ding proposed global cooperation in risk assessments, a global early warning network, and a climate adaptation partnership. China unveiled its Action Plan on Early Warning for Climate Change Adaptation (2025-2027), supporting South-South cooperation through equipment and training.

Beijing demands Islamabad favour army over police for protection of Chinese interests

Intelligence Online reports that China is pressuring Pakistan to allow its security personnel to protect Chinese citizens amid escalating attacks, including a recent car bombing in Karachi targeting engineers. Beijing has proposed a joint security system with operational control, but Pakistan remains resistant, opting for intelligence support over direct involvement. The discussions underscore tensions over CPEC-related security challenges.

China delimits a contested South China Sea shoal in a dispute with the Philippines

AP News reports that China has set geographic baselines for Scarborough Shoal, escalating tensions with the Philippines over the contested South China Sea territory. The move follows Philippine President Ferdinand Marcos Jr.'s signing of laws demarcating claims in the region. Beijing claims the delimitation aligns with international law, while Manila asserts sovereignty based on a 2016 arbitration ruling dismissing China's expansive claims.

China Must Face ‘Higher Cost’ for Backing Russia in Ukraine, Says Next EU Foreign Policy Chief

Jennifer Rankin reports in The Guardian that Kaja Kallas, the incoming EU foreign policy chief, stated that China should bear greater consequences for supporting Russia in the Ukraine war. Addressing MEPs, Kallas emphasised Ukraine’s victory as a priority and called for strengthened defence cooperation within the EU while avoiding duplication of NATO's role. She warned against short-term peace deals and highlighted the need for Europe to deter authoritarian alliances.

Trump picks China critic Rubio as secretary of state, Gabbard as intelligence director

South China Morning Post reports that President-elect Donald Trump has nominated Senator Marco Rubio as secretary of state and Tulsi Gabbard as intelligence director. Rubio, known for his hardline stance against China and support for sanctions, represents a shift towards aggressive foreign policy. Gabbard, a non-interventionist and former Democrat, was praised for her "fearless spirit" despite her past criticism of Trump. These picks reflect contrasting approaches within Trump’s administration.

Xi Jinping Faces Pressure to Secure Chinese Workers Overseas

Kathrin Hille and Humza Jilani report in Financial Times that President Xi Jinping faces growing criticism following a bomb attack by Pakistan separatists that killed two Chinese engineers. With $62 billion invested in Pakistan’s China-Pakistan Economic Corridor (CPEC), violence has sparked discontent over inadequate security measures. Beijing has urged Islamabad to allow Chinese private security contractors, despite legal restrictions and Beijing’s own limits on such companies.

Chip Manufacturers Shift to Vietnam Amid US-China Tensions

Jowi Morales reports in Tom's Hardware that semiconductor companies like Hana Micron, Amkor Technology, and Intel are expanding operations in Vietnam as geopolitical tensions drive a shift from China. Vietnam has attracted over $2.5 billion in investments, aiming for an 8-9% global market share in back-end chip manufacturing by 2032. The country's strategic push positions it as a rising semiconductor hub.

Tech in China🖥️

China Builds Prototype Nuclear Reactor for Aircraft Carrier

Taipei Times reports that China has constructed a prototype nuclear reactor for a surface warship, suggesting progress toward its first nuclear-powered aircraft carrier. Analysis by the Middlebury Institute of International Studies reveals the reactor is housed at Base 909 in Sichuan. Nuclear-powered carriers could significantly boost China's naval reach, aligning with Xi Jinping's vision for maritime dominance. While China’s fourth carrier remains unconfirmed as nuclear-powered, experts suggest concurrent construction of multiple carriers is possible.

China Launches Lijian-1 Y5 Rocket, Entering International Commercial Space Market

CGTN reports that China successfully launched the Lijian-1 Y5 carrier rocket on November 11, delivering 15 satellites, including the Jilin-1 Gaofen and a remote-sensing satellite for Oman, into orbit. Developed by CAS Space, this marks the rocket's fifth mission since its 2022 debut and highlights its entry into the international space market. The mission showcases advancements in payload adaptability and in-orbit AI analysis capabilities for applications like land surveys and disaster monitoring.

China’s Cleantech Boom Boosts Its Climate Confidence

Edward White writes in Financial Times that China's success in renewable energy and electric vehicles is strengthening its global climate diplomacy as COP29 opens. With 1,200 GW of solar and wind capacity achieved six years ahead of schedule and EV sales targets on track for 2025, China is positioning itself as a green technology leader. However, concerns over its reliance on coal and Western scepticism about its industrial policies challenge its dual carbon goals. Beijing aims to leverage these achievements to counter political and trade pressures from the US and Europe.

Zhuhai Air Show Highlights China's Aerospace Aspirations

Sophie Yu and David Kirton write in Reuters that China's Zhuhai Air Show spotlighted major aerospace advancements, including COMAC's announcement of Air China as the first customer for the C929 widebody jet. The show also featured the rebranding of COMAC’s ARJ21 to the improved C909 and the debut of the J-35A stealth fighter. Additionally, AVIC revealed a model of China's first commercial uncrewed spaceplane, aimed at cargo delivery to its space station, further highlighting China’s ambitions in aerospace innovation.

De/Cypher Data Dive📊

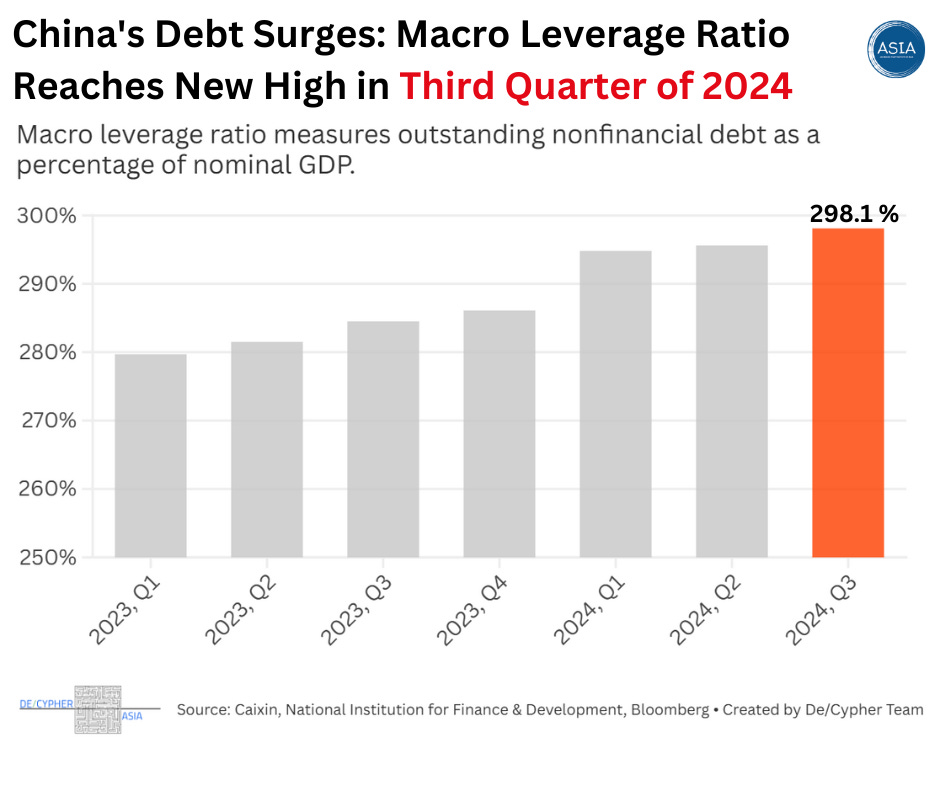

China's macro leverage ratio continued to rise, reaching a new high in the third quarter of 2024. The ratio increased 2.5 percentage points to 298.1%. The macro leverage ratio calculates the outstanding nonfinancial debt — borrowings by households, nonfinancial companies, and the government — as a percentage of nominal GDP. (Caixin)

In a related effort to address growing fiscal risks, China unveiled a 10 trillion yuan ($1.4 trillion) package aimed at managing the immense hidden debt burden of local governments. For years, local administrations have accumulated off-the-books liabilities to fund infrastructure projects, posing significant risks to the financial system. As of the end of 2023, these hidden debts had reached 14.3 trillion yuan. (Caixin)

Lula’s embrace of Xi sets up a clash over Trump’s China policy

By Simone Iglesias, Daniel Carvalho, and Beatriz Reis, Summarised by De/Cypher Team

Brazilian President Luiz Inácio Lula da Silva is deepening ties with China through ambitious infrastructure projects that aim to connect Brazil to the Asia-Pacific via the Pacific Ocean. A new road network, including a 10-kilometre corridor to Peru, could reduce transit times to Chinese ports by 10–12 days, potentially boosting Brazil's GDP by $22 billion annually. Lula is courting Chinese investment in four key areas: domestic infrastructure, regional integration, clean energy transition, and industrial modernisation. These plans align with China’s Belt and Road Initiative (BRI), though Brazil avoids formally joining it.

China’s investments, including the Chancay Port in Peru, are transforming Latin America’s connectivity to Asia. However, these moves face criticism from the US, particularly under Donald Trump’s protectionist policies. The US cautions Brazil against dependency on China, citing economic and national security risks. Meanwhile, Lula capitalises on Beijing's strategic need for commodities and markets amid its strained relations with the US and Europe.

Despite mutual benefits, Brazil's pivot to China has sparked internal debates about BRI membership and dependency risks. Lula envisions using Chinese investments to shift Brazil’s economic focus from the Atlantic to the Pacific, driven by Asia’s demand for food and commodities. While fostering economic opportunities, this pivot challenges US influence in Latin America and highlights Brazil's balancing act in global geopolitics.

Read the full article on Bloomberg.

Image of the Week📸

---