China This Week: Rapid Nuclear Programme Expansion, EU Targets Refineries, Boeing Names New China Chief

This week in China, we explore key shifts in its domestic and foreign policy landscape. We also expand our coverage to look at the key developing international stories.

China Quote 🗩

“The 15th five-year plan period is a transitional phase, after which we will shift to a new stage of normalized assistance, “After the transitional period, we should maintain overall policy stability with minor adjustments, ensuring the continuity of fiscal investments, financial support and resource allocation policies. Less-developed regions are the main battleground for preventing a return to poverty.”

-Han Wenxiu, deputy director of the Communist Party’s office of economic affairs

Pakistan and Trump 2.0: A Snapshot

The theatrical performance put up in the White House during September when Donal Trump called Asim Munir his favourite Field Marshal was nothing short of farcical. However, in this showmanship and exaggerated antics that President Trump performs, it unfolds his foreign policy. Leveraging Trump’s love for flattery to make certain strides in US-Pakistan relations through neither reform nor reinvention, Pakistan is charting a new relationship with the United States based on rare earth minerals, military diplomacy and outright flattery.

This brings about a marked contrast with the Biden administration that had iced out Islamabad from its diplomatic circuit. Seen as unstable and unreliable, the United States saw Pakistan as uncomfortably close to Beijing and thus outside its strategic gamut. Presently, the same country is being recruited by the United States to forge closer ties. This is a direct result of the transactional nature of diplomacy that Trump likes to practice where every friendship is a deal and every deal a test of loyalty.

Rare Earth Minerals Diplomacy

Pakistan has been able to rework its relationships with the Trump administration by exploring its untamed mineral reserves. The Pakistani government claims to have a substantial stash of minerals worth approximately $8 trillion buried in Baluchistan. However, the extraction of these materials is difficult as the region is steeped in conflict and neglect.

The United States is in desperate need to diversify its rare earth procurement. China’s monopoly over supply and the recent tariff wars with the US, gave Pakistan the perfect opportunity to sneak its way in. In September 2025, the Pakistan’s Frontier Works Organisation (FWO – a military run endeavour) and Missouri-based US Strategic Metals signed a deal worth $500 million. This includes the shipment of neodymium, praseodymium and antimony all extremely critical to produce advanced weapons.

The Military and its Might

Is Pakistan is choosing to transact with rare earth minerals then Munir is the chief negotiator. His trajectory from Intelligence to Pakistan’s foreign policy architect is a clear sign of how the military still controls Pakistan’s global image and is far more powerful than the civilian government.

Munir’s solo trip to Washington, which was never done before a Pakistani general, has made is clear that he calls the shots. Rawalpindi controls foreign policy and not Islamabad.

Trump on the other hand has always responded to aggressive assertion. He prioritises strength and personal relations over formal norms and institutions. Munir is someone who fits Trump’s mould of what he calls ‘winners’. Pakistan is playing right in this gameplan and has used outright flattery to gain access to the US President as evidence by Munir’s nomination of Trump for a Nobel Peace Prize, public lauding and just the right amount of theatrical showman ship which meets Trump’s approval.

Beneath all that Jazz

While all this jazz is distracting it should not take away from the very realist logics that underpin this deal:

Firstly, the United States is in dire need to diversify its mineral sources, especially given its tumultuous relationship with China.

Secondly, Pakistan is forging a new strategic non-alignment when it comes to mineral diplomacy. While it has no intention of alienating Beijing at all – it is not afraid to trade with the United States when it comes to critical minerals. It deals in supply chains and not ideological rivalry.

Thirdly, Pakistan has asserted its strategic needs over loyalty. This has allowed its neighbouring countries a certain discomfort as South Asia is going through a geopolitical upheaval. India would be a little uncomfortable with this growing proximity.

However, in the larger scheme of things, Trump is a volatile man whose actions cannot be predicted. He is volatile and driven by sentiment. It takes little for him to change tracks without any serious consideration for consequences. India is a perfect case for this unpredictability.

Who Benefits Most?

Pakistan stands to benefit most from this entire situation. The Frontier Works Organization that has etched this deal with the Americans are those who are wholly controlled by the military. This means that the profits generated from this deal are going to flow directly into the hands of those at the top of the military establishment. This will further consolidate the economic clout or milbus of the military.

Pakistan as a country has often oscillated between military rule and civilian governments. The consolidation of military capitalism in the country will do nothing to solve the economic crisis Pakistan perpetually is in. The deep imbalances and structural inequalities will only be exasperated.

Secondly, Baluchistan is a deeply insecure region. The safety concerns over extraction and mining will be tested repeatedly. What this means is that newer actors – both private and state will find their way into an already complicated region with repercussions for South Asia and the world.

Trump and Munir have put on a polished show of camaraderie and theatre. It plays well. It is clever and transactional, yet thin on substance and heavy with risk. Pakistan has stepped into this bet with more hope than thought. When the lights dim and the cameras move on, one question will matter: can Pakistan turn this opening into real, shared value, or will it be valued only when it can be used?

A Secure Apex but a Brittle Bence: The Disciplinarian Turn in China’s High Command

China’s latest military purge looks like a consolidation that elevates disciplinarians and sidelines the “up-from-the-ranks” cohort. On October 17, Beijing expelled CMC vice chair He Weidong and political work chief Admiral Miao Hua, its most senior removals since the Cultural Revolution, after months of public absence and opaque probes. He, a Politburo member closely tied to Taiwan planning, had overseen major drills after the Pelosi visit in 2022.

The cascade began in mid-2023 around the Rocket Force. U.S. intelligence assessed in early 2024 that corruption had rendered parts of China’s new missile inventory unreliable, prompting Xi’s broader clean-out. This was an indictment of procurement and quality control at the heart of deterrence.

Two signals now stand out. First, the optics: at a recent national parade, only Zhang Youxia, first-ranked CMC vice chair and archetypal “princeling”, appeared in uniform on the rostrum. While unit commanders went unnamed suggesting both churn and caution. Second, personnel: discipline czar Zhang Shengmin’s promotion on October 23 to replace He formalizes a “two-Zhangs” axis (Youxia + Shengmin) that prioritizes control and inspection over operational experimentation.

Meanwhile, Defence Minister Dong Jun still lacks a CMC seat. This is an unusual downgrade versus his predecessor which limits his clout in internal decision-making and external mil-to-mil diplomacy.

Net assessment: Xi Jinping remains at the apex. Yet the bench beneath him has shrunk and stiffened. Promotions are delayed. Files sit. The purge may tidy the chain of command. It also raises a quieter risk: a military that avoids mistakes by avoiding initiative.

Economic Activity🏦

China’s leaders meet to draft 15th Five-Year Plan amid slowing growth and US tensions

The Straits Times reports that China’s top leadership began a four-day closed-door meeting in Beijing on Oct 20 to finalise the 15th Five-Year Plan (2026–2030), focusing on technological self-reliance, social welfare and economic recovery as the country faces weak consumption and trade frictions with the US.

China’s consumer spending slowdown deepens despite policy support

The New York Times reports that China’s household consumption has weakened further, with retail sales and service activity lagging despite government efforts to boost demand. Economists warn that falling consumer confidence, high youth unemployment and a prolonged property slump are undermining recovery prospects ahead of next year’s new five-year economic plan.

China turns US trade tactics against Washington amid rare-earth showdown

The Economist reports that Beijing is increasingly outmanoeuvring the US in their trade war by deploying export controls on rare earths and critical minerals, mirroring Washington’s own sanctions strategy. As Xi Jinping and Donald Trump prepare to meet in South Korea, China’s new licensing regime for rare earths and batteries has exposed US supply vulnerabilities, underscoring Beijing’s growing leverage and confidence in economic confrontation.

EU targets Chinese refineries and trader in latest Russia sanctions package

Reuters reports that the European Union has added two Chinese refineries and state-owned trader Chinaoil to its 19th package of sanctions against Russia for allegedly helping Moscow bypass energy restrictions. The new measures expand the EU’s focus to third-country entities accused of facilitating Russian oil exports. Brussels said the listings aim to tighten enforcement of the G7 price cap and curb sanction evasion through Asian intermediaries, while Beijing criticised the move as “illegal extraterritorial pressure.”

EU unveils plan to shield industries from China and US trade pressures

Bloomberg reports that the European Union is preparing new measures to protect key industries from competitive threats posed by China’s subsidies and US industrial policies. The plan, discussed ahead of an EU leaders’ summit, aims to boost domestic manufacturing, streamline green-tech funding, and reduce strategic dependencies as global trade tensions intensify.

Egypt’s Suez Canal Zone secures $65 million Chinese textile investment

Ahram Online reports that Egypt’s Suez Canal Economic Zone signed four contracts with Chinese textile firms worth $65 million to build factories covering 238,000 sq m in Sokhna 360 industrial city. The projects, expected to create over 3,000 jobs, reflect growing Chinese investment in Egypt’s manufacturing sector and the zone’s push to localise production and boost exports.

Inside China🐉

China appoints Zhang Shengmin as new vice chairman of Central Military Commission

ABC News reports that President Xi Jinping has named General Zhang Shengmin as the new vice chairman of China’s Central Military Commission, making him the country’s second-highest-ranking military official. Zhang, previously head of the military’s anti-corruption agency, replaces a series of purged commanders amid ongoing efforts to tighten control and enforce discipline within the armed forces.

Xi may not rule ‘forever,’ argues ex-CIA analyst, as PLA purges reshape succession calculus

Sinocism reports that the Fourth Plenum comes amid sweeping PLA expulsions that could trigger major personnel changes, including within the Central Military Commission. Former CIA analyst Chris Johnson argues that Xi’s priority is regime stability and a managed succession over personal power or an immediate Taiwan push, though elite politics remain opaque.

China and the World🌏

China and US in race to dominate next-generation nuclear power

The New York Times reports that China is rapidly advancing its nuclear energy programme, constructing dozens of reactors and exporting technology abroad as part of a global bid for energy influence. The US, meanwhile, is struggling with regulatory hurdles and limited funding, raising fears that Beijing could outpace Washington in setting global standards for clean nuclear technology.

US–China trade talks in Malaysia seen as key step toward Xi–Trump summit

South China Morning Post reports that high-level US–China trade talks held in Kuala Lumpur this week are being viewed as crucial groundwork for a possible meeting between Presidents Xi Jinping and Donald Trump later this year. Negotiators focused on tariff rollbacks, technology access, and agricultural purchases, signalling a cautious thaw after months of strained ties. Analysts say the talks could help stabilise global markets if they lead to a limited deal ahead of the planned leaders’ summit.

Chinese agents accused of targeting dissidents across Britain

New Statesman reports that British intelligence agencies have identified growing efforts by Chinese operatives to surveil, intimidate and coerce exiled activists and critics living in the UK. The investigation details alleged harassment campaigns, cyber operations and attempts to influence diaspora groups, prompting renewed debate in London over how to counter foreign interference.

China and Indonesia establish joint remote-sensing centre for environmental monitoring

South China Morning Post reports that Beijing and Jakarta have agreed to set up a China–Indonesia Remote Sensing Application Centre to enhance cooperation on climate monitoring, disaster prevention, and sustainable development. The initiative, part of China’s broader space diplomacy efforts, will use satellite data for forest management, maritime surveillance, and pollution tracking. Analysts see the move as strengthening bilateral scientific ties and extending Beijing’s influence in Southeast Asia’s environmental governance.

Boeing appoints ex-White House adviser as China president to repair strained ties

CNBC reports that Boeing has named former White House China adviser David Fagan as its new China president, tasking him with rebuilding relations after years of political tension and weak aircraft sales. Fluent in Mandarin and experienced in trade and technology policy, Fagan is expected to lead efforts to restore Boeing’s position in the Chinese aviation market.

Tech in China🖥️

China-made flying car completes first test flight in the UAE

Al-Monitor reports that Chinese firm XPeng AeroHT successfully conducted the first overseas test flight of its electric flying car in Dubai. The demonstration marks a milestone in China’s push to commercialise low-altitude aviation and reflects growing Middle East interest in partnering with Chinese firms on future mobility technologies.

China’s smartphone makers target Xiaomi’s dominance, not Apple’s

Bloomberg reports that Chinese smartphone brands are focusing on competing with Xiaomi’s mass-market appeal rather than challenging Apple’s premium segment. As domestic demand softens, mid-tier manufacturers such as Transsion, Honor and Realme are prioritising affordable innovation and overseas expansion to capture emerging market growth.

DBG and BYD gain ground in India’s electronics sector, but Dixon and Bhagwati stay ahead

Communications Today reports that Chinese manufacturer BYD and DBG are expanding their footprint in India’s electronics manufacturing market, though domestic firms Dixon Technologies and Bhagwati Products continue to dominate. The shift reflects growing Chinese investment and competition under India’s production-linked incentive schemes for electronics and smartphone assembly.

Global Risk🗺️

Rodrigo Paz elected Bolivia’s first conservative president in decades

PBS NewsHour reports that Rodrigo Paz won Bolivia’s presidential runoff, marking a historic shift as the country’s first conservative leader in over 20 years. Paz, a former senator and son of ex-president Jaime Paz Zamora, defeated socialist candidate Andrónico Rodríguez after campaigning on restoring investor confidence and curbing corruption. His victory ends the long dominance of the leftist Movement for Socialism, signalling a potential reorientation of Bolivia’s economic and foreign policy.

Erdogan seeks to buy 40 fighter jets from Qatar in UK-brokered deal

The Jerusalem Post reports that Turkish President Recep Tayyip Erdogan has requested to purchase 24 used and 16 new Eurofighter Typhoon jets from Qatar in a deal worth several billion dollars, facilitated by the United Kingdom. The move, part of Erdogan’s Gulf tour, comes as Türkiye seeks to diversify beyond US-made F-16s and strengthen defence ties with European NATO allies. Analysts warn the agreement deepens the Qatar-Türkiye partnership, which critics link to a broader Islamist alliance.

Trump’s back channel with Hamas explores disarmament terms

Al-Monitor reports that Hamas officials signalled willingness to surrender heavy weapons under a potential US-brokered deal, as part of Donald Trump’s post-ceasefire initiative for Gaza. Mediators said the talks, involving regional intelligence channels, centre on Hamas transitioning to a political role while an international mission oversees security though Israel has opposed any arrangement allowing the group to retain control in Gaza.

Vance says Gaza ceasefire holding as US pushes for next phase of peace plan

BBC News reports that US Vice-President JD Vance described implementation of the Gaza ceasefire as “going better than expected” during his visit to Israel, warning Hamas to cooperate or face destruction. The truce, brokered by President Trump earlier this month, remains fragile after a flare-up that killed dozens. Vance, joined by envoys Jared Kushner and Steve Witkoff, urged Israel to begin talks on Trump’s 20-point peace plan, which envisions Hamas’s disarmament, an interim Palestinian administration, and an international stabilisation force.

Syrian forces negotiate truce with French-led jihadist group near Aleppo

France 24 reports that Syrian government forces have entered talks with a French-led jihadist faction entrenched in a camp outside Aleppo, following days of clashes that left dozens dead. The group, composed mainly of foreign fighters linked to remnants of Hurras al-Din, agreed to surrender heavy weapons in exchange for safe passage, marking one of the first negotiated settlements under Syria’s post-Assad transitional government.

Former Assad mouthpiece Al-Thawra faces test under Syria’s new rulers

EDGE News reports that Syria’s state newspaper Al-Thawra, long a propaganda tool under Bashar al-Assad, is struggling to reform under new editor Nour al-Din al-Ismail following the regime’s fall. Despite promises of editorial independence and professionalisation, remnants of censorship, self-censorship and reverence for authority persist, reflecting Syria’s enduring culture of fear and political control even after Assad’s ouster.

Russian oil shipments to India set to collapse after US sanctions

Bloomberg reports that India’s imports of Russian crude are expected to drop to nearly zero following new US sanctions on Rosneft and Lukoil. Refiners in India are struggling to arrange payments and shipping insurance, disrupting one of Moscow’s largest oil export markets. The sharp decline threatens to tighten global supply and increase costs for Indian refiners, who had relied heavily on discounted Russian barrels since 2022.

India to overhaul GDP and services data from early 2026

The Economic Times reports that India’s Ministry of Statistics plans a major revamp of national economic indicators, including GDP, services output and inflation data, starting early 2026. The update will align calculations with current price structures, digital economy metrics and post-pandemic consumption patterns. Officials say the overhaul aims to improve data reliability and international comparability as part of a broader statistical modernisation drive.

Investors brace for peso devaluation after Argentina’s elections

The Financial Times reports that markets are pricing in a 12% fall in the Argentine peso after weekend midterm elections, despite a $40 billion US aid package backing President Javier Milei’s reform agenda. Investors fear Milei’s currency peg is unsustainable amid depleted dollar reserves and weak political support. Analysts warn a poor showing by Milei’s party could derail fiscal and labour reforms, forcing Argentina to abandon its peso–dollar band and risking renewed debt instability.

Brazil’s corporate bond market shaken by credit worries

Valor International reports growing investor unease over Brazilian corporate debt as companies like Ambipar, Braskem and Raízen face financial strain. Ambipar’s near-bankruptcy has triggered a 3% drop in Brazil’s corporate bond index, while Braskem and Raízen bonds have also weakened amid restructuring rumours. Despite fears of contagion, analysts say broader market fundamentals remain stable, with fund inflows and high-quality issuers still attracting investment.

Deutsche Bank and Trade Republic drive retail shift into private equity

Private Equity Insights reports that Deutsche Bank and fintech platform Trade Republic are spearheading efforts to open private equity markets to retail investors in Germany. Deutsche Bank’s new fund with Partners Group requires a minimum €10,000 investment, while Trade Republic’s tie-up with EQT and Apollo allows entry from just €1. The move reflects growing appetite among German savers to diversify from low-yield deposits, marking a cultural shift in Europe’s largest economy towards long-term, higher-return assets.

US mulls taking equity stakes in quantum computing companies

The Quantum Insider reports that the Trump administration is considering taking partial ownership of key American quantum computing firms to secure national competitiveness and prevent foreign influence. The proposal, led by Treasury Secretary Scott Bessent, would involve direct federal investment in select companies developing advanced quantum hardware and algorithms. Officials say the move aims to accelerate breakthroughs while safeguarding intellectual property from rivals such as China.

Pakistan leverages rare earths and diplomacy to woo Trump administration

CNN reports that Pakistan has emerged as a key player in Trump’s reshaped global diplomacy, using rare earth exports and flattery to secure closer ties with Washington. Prime Minister Shehbaz Sharif and Field Marshal Asim Munir have strengthened relations through trade deals, missile purchases, and cooperation on critical minerals, earning praise from Trump. Analysts say Pakistan’s military-led strategy capitalises on US efforts to diversify rare earth supplies away from China, though concerns remain over the army’s growing political influence.

Pakistan turns to security exports amid economic crisis, sparking ‘mercenary state’ debate

World Politics Review reports that Pakistan is increasingly monetising its military power to secure foreign income, highlighted by a new mutual defence pact with Saudi Arabia. The deal marks Islamabad’s pivot from aid dependence to positioning itself as a regional security provider for states seeking alternatives to US protection. Analysts warn the move risks deepening military dominance over Pakistan’s economy and politics, with critics describing the strategy as transforming the country into a “mercenary state.”

US universities face deep cuts amid higher endowment tax

Financial Times reports that leading US universities are preparing major spending cuts as the Trump administration raises the endowment excise tax from 1.4% to as high as 8%. Institutions such as Harvard, Yale, and Princeton expect to pay over $1 billion each over five years, forcing hiring freezes and reduced PhD enrolments despite strong investment returns. Officials warn the move could harm research and teaching quality, with critics calling the policy “economically suicidal” for undermining higher education’s role in US innovation.

Norway to review $1.7 trillion wealth fund strategy amid shifting global risks

Bloomberg reports that Norwegian Prime Minister Jonas Gahr Støre has called for a comprehensive review of the country’s $1.7 trillion sovereign wealth fund, the world’s largest. The move comes amid concerns over market volatility, energy transition risks, and ethical investment standards. The review will assess whether the fund’s strategy—heavily weighted toward equities—remains sustainable as returns moderate and geopolitical tensions rise.

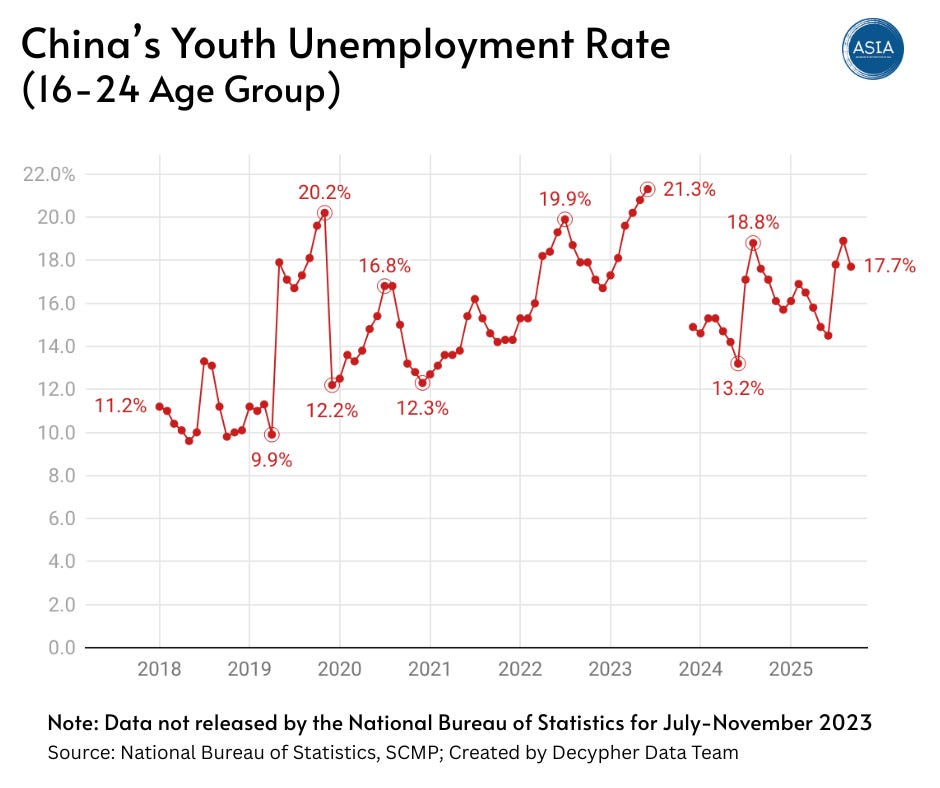

Decypher Data Dive📊

China’s urban youth unemployment rate eased slightly in September but remained worryingly high, reflecting persistent difficulties for young people navigating a tough and saturated job market. The jobless rate among 16- to 24-year-olds, excluding students, fell to 17.7% in September, down from 18.9% in August, according to data released by the National Bureau of Statistics.

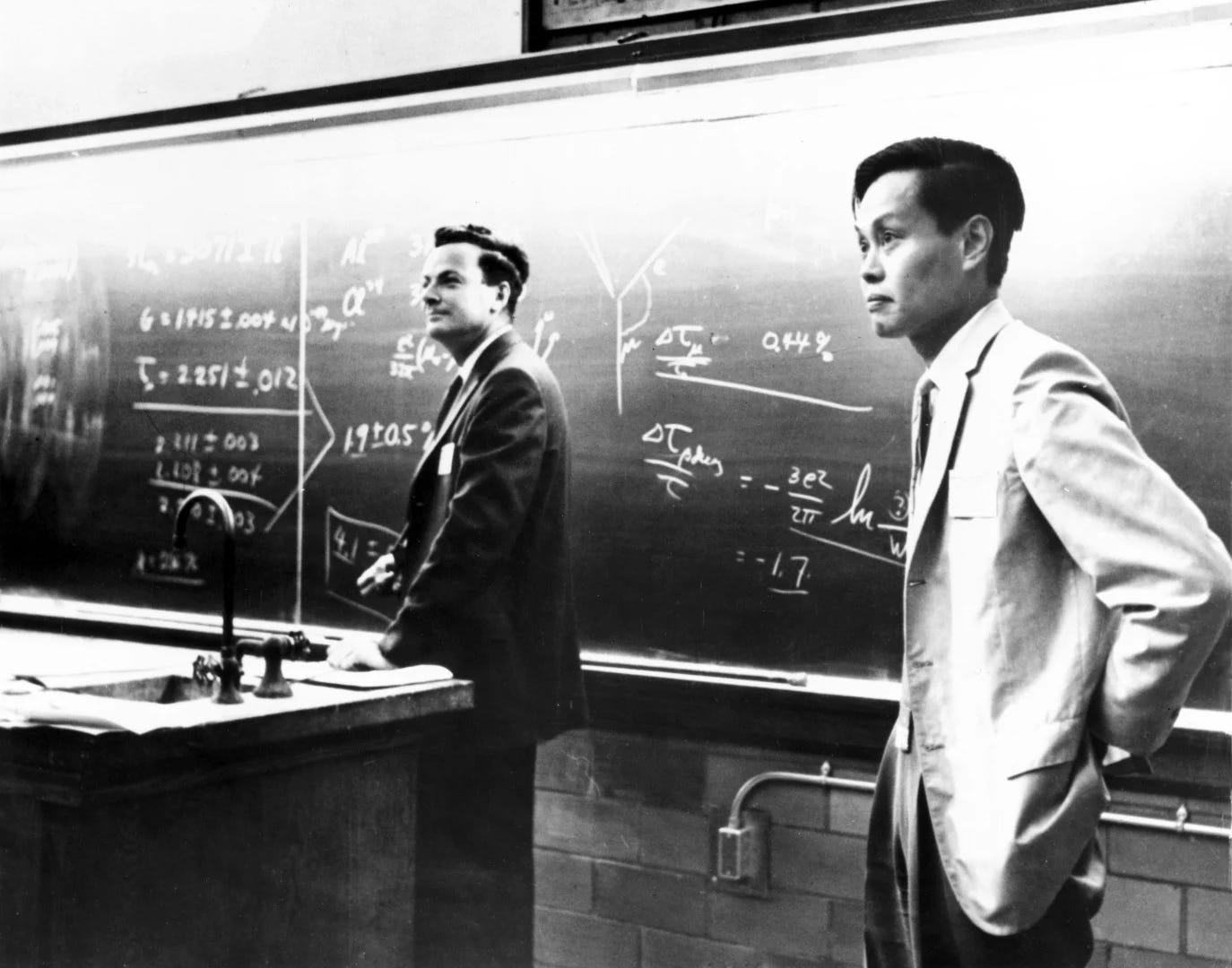

Image of the Week📸

Nobel Prize-winning theoretical physicist Chen-ning Yang died in Beijing, weeks after marking his 103rd birthday.

— — —

Microessays By Priyanka and Manash

Data By Bhupesh

Edited By Aurko

Produced by Decypher Team in New Delhi, India

— — —