China This Week: October Plenum Planned, Kindergarten Enrolment Crisis, Warships Join Russia Drills

This week in China, we explore key shifts in its domestic and foreign policy landscape.

China Quote 🗩

“We’ll likely see Chinese outbound FDI become far more common, as companies seek to maintain market access… Sellers will now either continue the brutal price competition at home or face off with fellow Chinese firms in markets beyond the US.”

Zhuang Bo, global macro strategist at Loomis Sayles Investment Asia, on Trump's order to end 'de minimis' tariff break expansion.

Economic Activity🏦

Trump’s South Korea Shipbuilding Deal Aims to Counter China’s Maritime Dominance

South China Morning Post reports that South Korea will channel US$150 billion—mainly via loans and guarantees—into revitalizing the US shipbuilding sector under its new trade pact with Washington. This initiative, dubbed “Make American Shipbuilding Great Again,” aligns with Trump’s tariffs and port-fee policies targeting Chinese vessels. While South Korea’s market share in new vessel orders rose sharply in early 2025, analysts caution that rebuilding US industrial capacity remains a long-term challenge, even with Korean firms like Hanwha Ocean acquiring American yards.

China’s Ruling Party to Hold Plenum on Five-Year Plan in October

Bloomberg reports that China’s Communist Party will convene its fourth plenum in October to draft its next five-year development plan, as the country grapples with mounting economic challenges. The Politburo confirmed the timing but did not disclose exact dates. The meeting of around 400 Central Committee members is expected to shape long-term strategy amid domestic slowdown and growing external pressures.

Guangzhou and Shenzhen post weaker-than-average GDP growth

South China Morning Post reports that Shenzhen and Guangzhou recorded first-half 2025 GDP growth of 5.1% and 3.8% respectively—both below China’s national average of 5.3%. Analysts blame the slowdown on weak global demand and a deepening local property slump. Shenzhen’s fixed-asset investment fell 10.9% and real estate development dropped 15.1%, despite strong gains in hi-tech output.

China’s industrial profits fall for second month amid price wars

The Straits Times reports that industrial profits in China dropped 4.3% in June, following a 9.1% decline in May, as aggressive price wars in sectors like EVs and solar panels continue to weigh on earnings. Beijing is pledging stricter regulation to curb destructive competition, amid concerns over overcapacity, deflation, and the impact of US tariffs.

China implements new tax reporting regime for digital platforms

King & Wood Mallesons reports that China has enacted new rules mandating quarterly tax-related disclosures by digital platforms operating in the country, including foreign firms. The regime aims to close tax gaps among live streamers, freelancers, and online merchants by requiring platforms to report income data and withhold taxes. Penalties for non-compliance can reach RMB 500,000, and the rules mark a shift toward real-time, data-driven enforcement of platform economy taxation.

‘Pervasive sense of fear’: China steps up exit bans as US tensions flare

Financial Times reports that China is expanding the use of opaque “exit bans” on both foreigners and Chinese nationals, deepening fears among businesses and diplomats as US-China tensions rise. Recent high-profile cases include a Wells Fargo banker and a US Commerce Department employee who were blocked from leaving the country. While most of the 53,000 bans last year were civil, rights groups warn of increasing criminal or politically motivated use, often without explanation or legal clarity.

Trump says he thinks US will have a 'very fair deal' on trade with China

Reuters reports that President Donald Trump expects a “very fair deal” with China as bilateral trade talks continue. Speaking at the White House, Trump said negotiations were progressing well, following over five hours of talks in Stockholm aimed at extending the tariff truce. A final agreement is expected before the August 12 deadline, as both sides seek to resolve rare earth and tariff disputes.

This lawsuit in court this week could throw a wrench in Trump's trade policy

CBS News reports that the U.S. Court of Appeals is reviewing a major challenge to Trump’s tariff powers under the International Emergency Economic Powers Act (IEEPA). Small business owners and states argue the former president bypassed Congress in imposing sweeping “Liberation Day” tariffs. If the court rules against Trump, it could curb executive tariff powers and reshape U.S. trade policy.

Asian stocks slide on weak China data, yen firms after BOJ decision

Reuters reports that Asian equities fell amid disappointing Chinese economic data and a sharp drop in copper prices. The yen strengthened after the Bank of Japan raised its inflation forecast, fueling expectations of a possible rate hike. Meanwhile, markets digested a flurry of global developments including new U.S. tariffs, strong U.S. tech earnings, and the Fed’s decision to hold rates steady. Chinese and Hong Kong stocks led regional losses, while the dollar hovered near a two-month high.

Inside China🐉

Beijing official admits readiness ‘gaps’ after deadly floods

France 24 reports that over 30 people died and 80,000 were evacuated in northern China after torrential rains caused widespread flooding and landslides. A senior Beijing official acknowledged failures in preparedness, noting that early warnings and contingency plans were inadequate. Power outages affected over 130 villages, and major infrastructure was damaged. Relief efforts are ongoing, with the central government allocating over $68 million for disaster response.

China Deploys Giant Cannibal Mosquitoes to Fight Chikungunya Outbreak

Bloomberg reports that Chinese scientists have released swarms of large "elephant mosquitoes" in Guangdong to combat a major chikungunya outbreak. The larvae of these 2 cm-long mosquitoes prey on the smaller Aedes species that spread the virus. Health authorities hope this biological tactic will help contain the country’s largest recorded chikungunya epidemic.

China Rolls Out Childcare Subsidy to Boost Births, Sentiment

Bloomberg reports that China has introduced a nationwide childcare subsidy of 3,600 yuan ($502) annually per child under age three, retroactive from January 1. The move aims to ease the financial burden of parenting and reverse the country’s declining birth-rate. The subsidy applies equally to first, second, or third children and marks the latest effort to support young families amid mounting demographic and economic pressures.

Chinese kindergartens in crisis as enrolments plunge 25% in 4 years

Financial Times reports that China’s kindergarten enrolments have dropped by 12 million since 2020, forcing the closure of over 41,000 preschools amid a sharp decline in births. The crisis reflects the broader demographic contraction, with population decline continuing despite new subsidies and reforms. Operators are converting kindergartens into nursing homes, but demand remains low. Experts suggest Beijing could use the shrinking student population to improve education quality, but the fate of vast idle infrastructure remains a challenge.

Shaolin ‘C.E.O. Monk’ Is Accused of Embezzlement and Affairs With Women

New York Times reports that Shi Yongxin, the high-profile abbot of China’s Shaolin Temple, is under investigation for embezzling temple funds and having improper relationships with women. Once celebrated for commercialising and globalising the 1,500-year-old monastery, Shi now faces severe backlash, with his clergy certificate revoked by China’s Buddhist Association. The scandal has reignited long-standing concerns about the intersection of religion, money, and image in modern China. Companies linked to Shi Yongxin, the disgraced head of China’s renowned Shaolin Temple, have been deregistered.

China and the World🌏

Thailand and Cambodia reaffirm ceasefire after China-brokered meeting in Shanghai

ABC News reports that Thailand and Cambodia have recommitted to a fragile ceasefire after China helped mediate peace talks in Shanghai. Despite ongoing skirmishes and mutual accusations of violations, both sides expressed appreciation for China’s role. The truce follows joint pressure from Malaysia, China, and the US, including trade leverage from President Trump.

Nvidia’s China-bound H20 AI chips face Beijing scrutiny over ‘tracking’ and security concerns

CNBC reports that Chinese regulators have summoned Nvidia to clarify national security concerns over its H20 AI chips, just weeks after Washington allowed their export to resume. Beijing cited potential vulnerabilities, including tracking and remote shutdown functions, while referencing U.S. lawmakers’ calls for mandatory surveillance features in exported chips. The scrutiny adds a new layer of geopolitical risk for Nvidia, which is trying to recover from a $4.5 billion write-down on unsold H20 stock earlier this year.

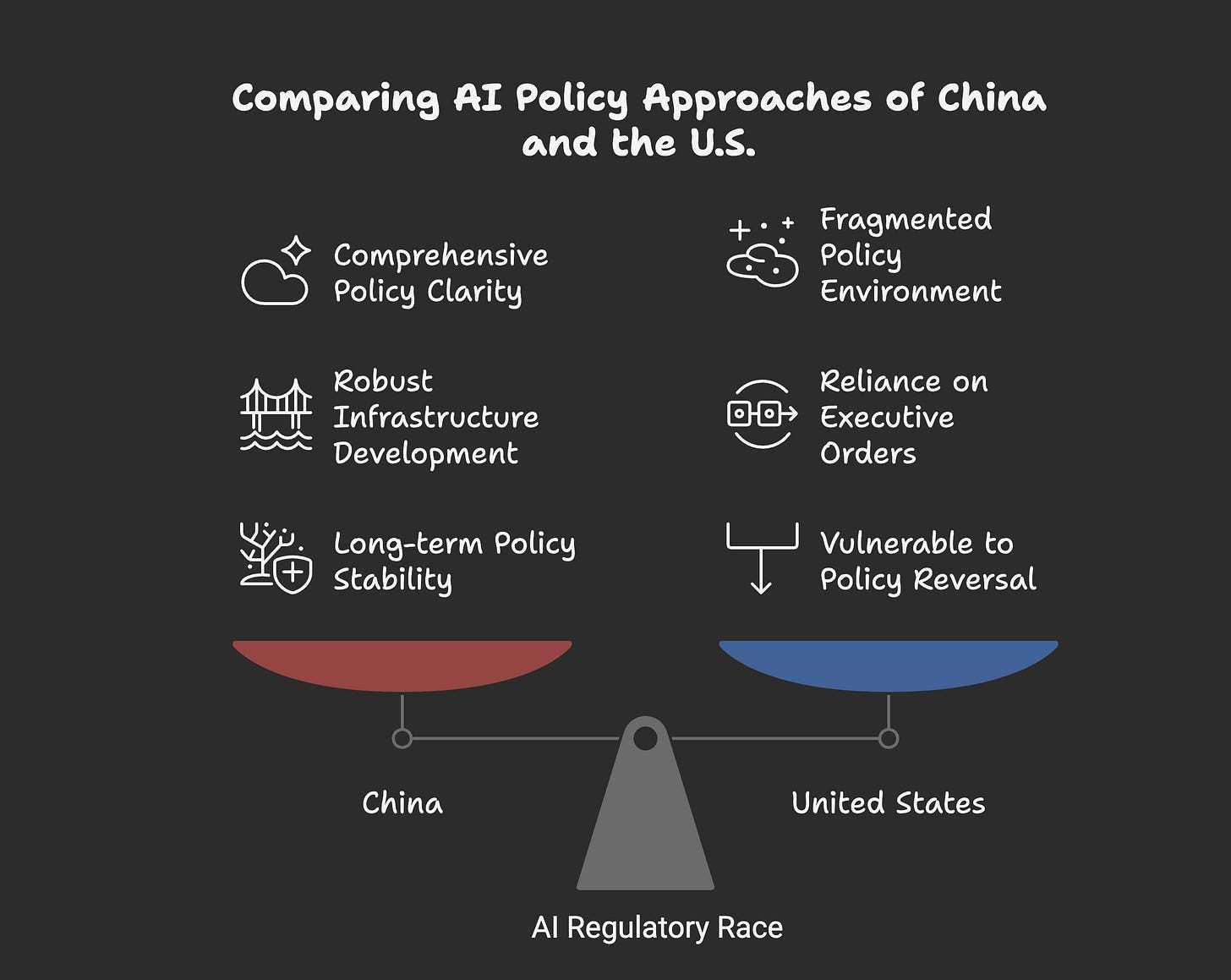

China calls for global 'consensus' on AI regulation

DW reports that Chinese Premier Li Qiang has urged countries to build a global consensus on AI governance, warning against monopolistic control by a few nations. Speaking at the World Artificial Intelligence Conference in Shanghai, Li announced a China-led body for open-source AI cooperation and criticised restrictive chip policies that hinder equitable global development.

China warns against Japan's first space defence guidelines

Japan Today reports that China has criticised Japan’s new “space domain defence guidelines,” calling them a pretext for military expansion. The Japanese guidelines cite threats from “killer satellites” developed by China and Russia, while China accuses Japan and the US of escalating the risk of a space arms race under the guise of defence cooperation.

Chinese warships arrive in Russia’s far east for joint Pacific naval exercise

South China Morning Post reports that Chinese destroyers Shaoxing and Urumqi have docked in Vladivostok ahead of the five-day “Joint Sea 2025” drill with Russia. The naval exercise will include submarines and aircraft, and will be followed by a joint maritime patrol. While China’s defence ministry claims the drills aren’t aimed at any third party, they coincide with the massive US-led “Resolute Force Pacific” exercise across the Asia-Pacific.

The U.S. military is investing in this Pacific island. So is China.

Washington Post reports that the U.S. is expanding military infrastructure in Palau to counter China, including radar sites and a harbour for warships. But Chinese-linked resorts, land leases near U.S. sites, and alleged ties to organised crime have raised security concerns. Officials warn Beijing could exploit these developments for surveillance or disruption in a future conflict. Palau’s government has responded with visa bans and deportations, while Washington is seeking more law enforcement support to combat Chinese influence.

Taiwan: Voters reject bid to recall opposition lawmakers

DW reports that Taiwanese voters have rejected a mass recall of 24 opposition Kuomintang (KMT) lawmakers, dealing a blow to President Lai Ching-te’s efforts to retake control of parliament. The failed recall, Taiwan’s largest, followed criticism of KMT’s pro-China leanings and obstruction of defence funding. The ruling DPP accepted the outcome, while KMT called the recall a political power grab. A second round of votes is due in August.

Nickel workers powered the EV battery boom. Now, layoffs have hit.

Rest of World reports that plummeting nickel prices and slowing EV demand are triggering layoffs in Indonesia’s Morowali Industrial Park, the world’s largest nickel hub. Tens of thousands of workers in high-risk smelting and mining jobs now face uncertain futures, with many earning low base wages and relying on overtime. China’s Tsingshan Group, which co-owns the zone, has driven rapid expansion, but oversupply and a global pivot to non-nickel batteries are eroding profits. Workers describe gruelling hours, frequent accidents, and limited advancement, as the sector’s boom gives way to growing precarity.

China's struggling EV maker Neta in deep trouble in Thailand

Nikkei Asia reports that Chinese EV brand Neta is facing a major crisis in Thailand after failing to meet local production requirements despite receiving $84 million in government subsidies. The parent company’s restructuring has disrupted parts supply and payments to local vendors, forcing some dealerships to cut prices by up to 50%. The situation has sparked backlash and may prompt Thai authorities to reconsider their EV policy, which had heavily favoured Chinese automakers.

Pakistani Tycoon Partners With China’s Chery to Launch EV Manufacturing

Bloomberg reports that Mian Mohammad Mansha’s Nishat Group is investing $100 million to produce electric vehicles in Pakistan through a joint venture with China’s Chery Automobile. NexGen Auto, a Nishat subsidiary, will locally assemble five models under the Omoda and Jaecoo brands starting October. The move marks a major step toward EV localization in Pakistan’s automotive sector.

TikTok’s messy merger in Indonesia could be a preview of what’s to come in the U.S.

Rest of World reports that TikTok’s $840 million merger with Indonesian e-commerce giant Tokopedia has backfired, with sellers reporting steep revenue drops, algorithmic penalties, and loss of control. Pressured to adopt video-based marketing, many merchants are fleeing to rival platforms. Critics say ByteDance misread local shopping behavior and overcentralised control. The episode offers a cautionary tale as TikTok faces similar localisation demands in the U.S. amid regulatory scrutiny and national security concerns.

Tech in China🖥️

Chinese researchers suggest lasers and sabotage to counter Musk’s Starlink satellites

AP News reports that Chinese military-linked scientists have proposed using lasers, sabotage, and “space stalker” satellites to disrupt Starlink’s growing global footprint, which they view as a U.S. strategic asset. Starlink, now operating over 8,000 satellites, played a key battlefield role in Ukraine and remains closely tied to U.S. defence agencies. China fears its round-the-clock coverage could aid surveillance or conflict over Taiwan, and is accelerating efforts to build rival constellations like Guowang and Qianfan. Nearly all Chinese research on Starlink surged after Russia’s 2022 invasion of Ukraine.

BYD distracted the world while Chinese EV peers staged a coup

Rest of World reports that while BYD grabbed headlines for overtaking Tesla, lesser-known Chinese EV makers like Geely, Chery, and Wuling have quietly expanded abroad by building local production and service ecosystems. Chinese brands now dominate markets like Brazil and Thailand, capturing 85% of EV sales in each. With low-cost supply chains and rapid product cycles, they offer emerging markets a compelling value proposition. However, service quality and long-term brand loyalty remain key challenges as they shift from exporters to global incumbents.

Decypher Data Dive📊

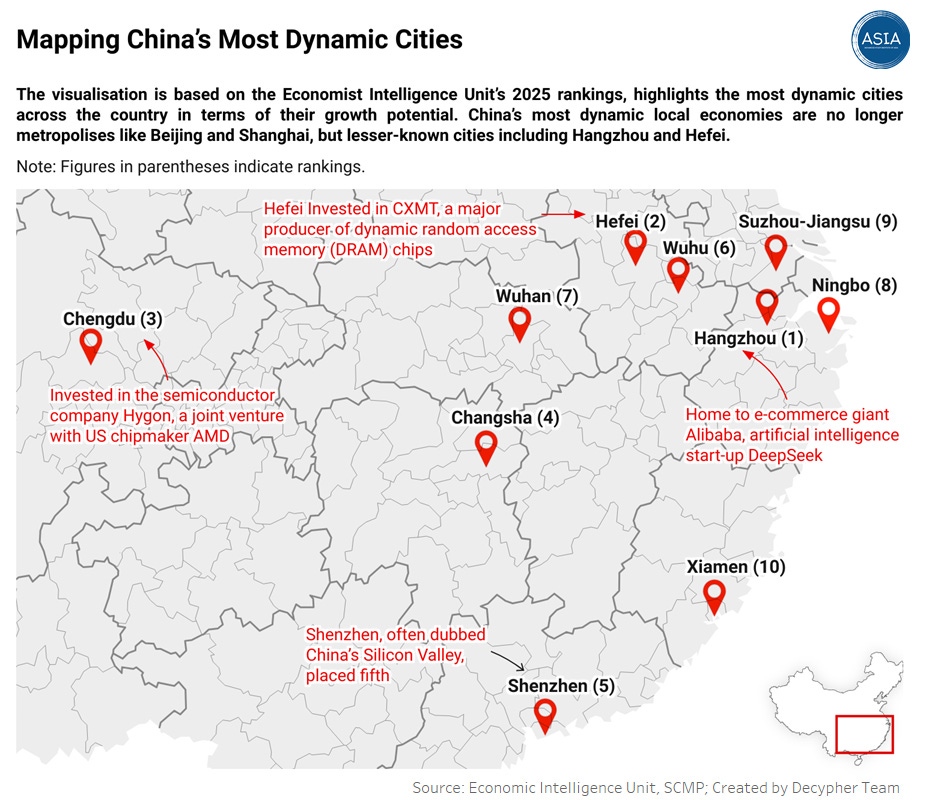

The Economist Intelligence Unit's annual report ranks Chinese cities based on their growth potential, with Hangzhou an eastern city and home to tech giants like Alibaba, AI startup DeepSeek, and other major technology firms securing the top spot for the fifth year in a row.

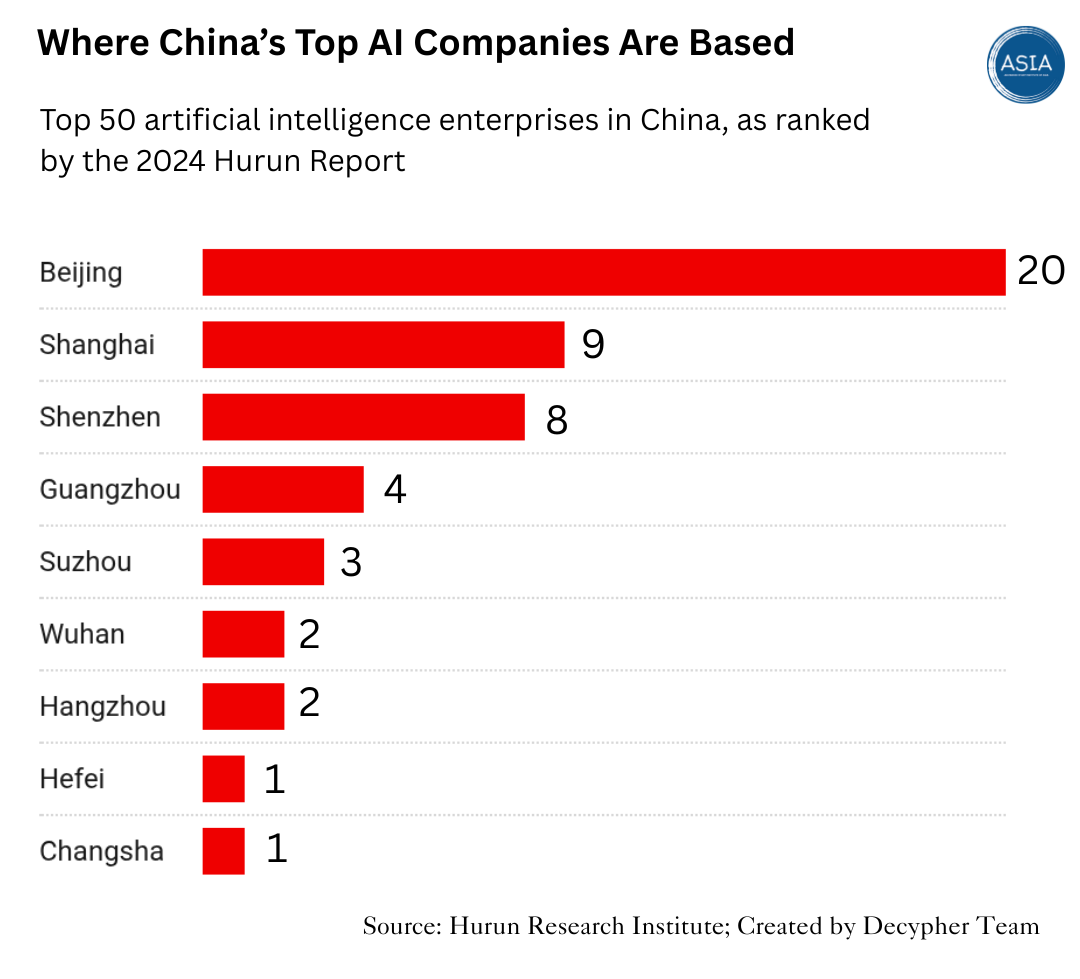

The 2024 Hurun Report highlights the concentration of China’s top AI companies across major cities. Beijing dominates the landscape, with 20 out of the top 50 AI enterprises headquartered there.

Image of the Week📸

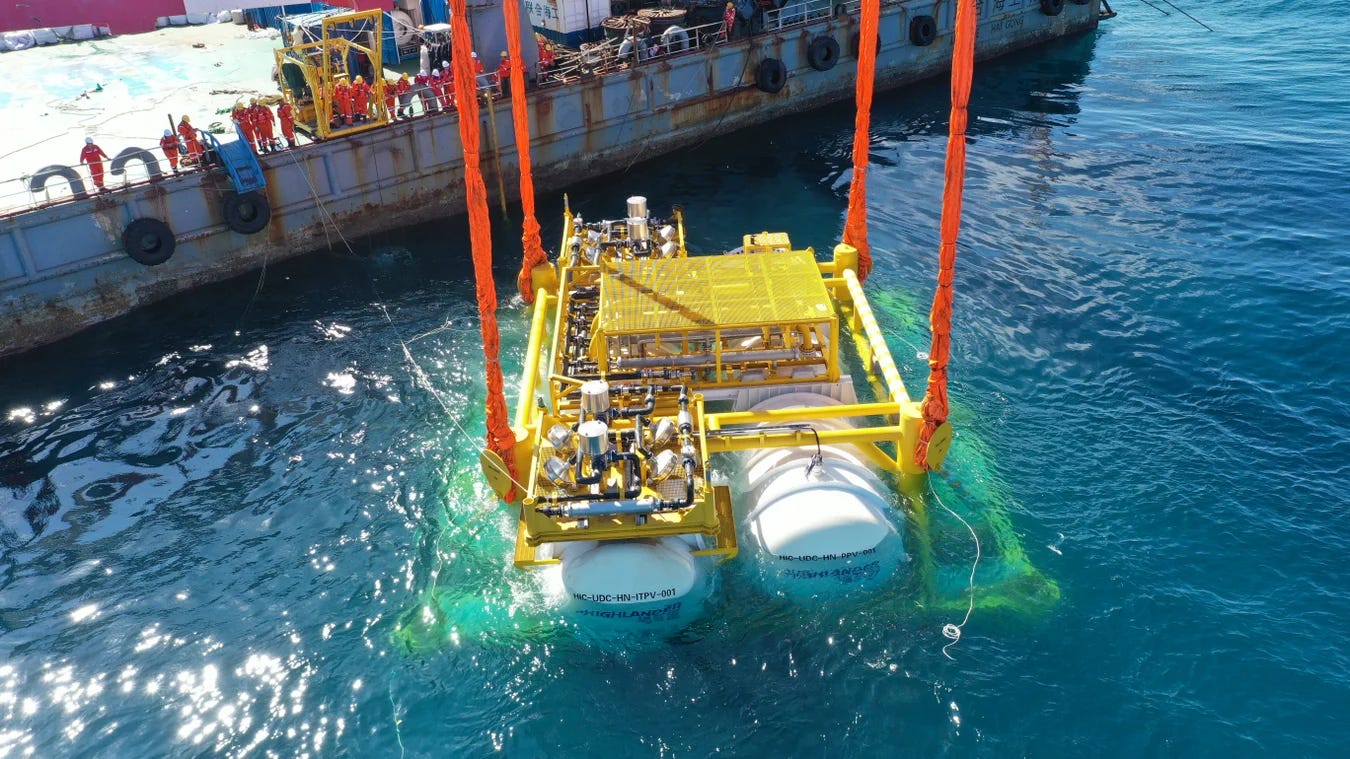

China Is Putting Data Centres in the Ocean to Keep Them Cool

— — —

Data By Bhupesh

Edited By Aurko

Produced by Decypher Team in New Delhi, India