China This Week: India-China Ties, Trust Property Woes, and Lunar New Year Trends

This week's Beyond the Great Wall examines China’s cautious diplomatic reset with India, its unresolved trust property dilemma, and other key developments.

China Quote 🗩

“China, which is a gigantic market, we do have some challenges, because they won't allow us to transfer training video outside of China. And then the U.S. won't let us do training in China," - Elon Musk on the issues surrounding Full Self Driving in Tesla in China which was supposed to begin by 2024.

A Slight Thaw in India-China Relations: What Does it Mean?

By De/Cypher

The frigidity between India and China has witnessed a recent thaw, with the Foreign Secretary Vinay Kwatra and Foreign Minister Vikram Misri visiting China recently. The high-profile meetings have been hailed as a strong indicator of normalising Indo-China relations which saw significant decay since the Galwan Valley Clash in 2020.

The latest meeting between Foreign Minister Misri and his Chinese counterpart Wang Yi included a commitment to revive people-to-people exchanges, the resumption of the Kailash Mansarovar Yatra and direct flights between New Delhi and Beijing. Discussions on increasing cultural and academic exchanges were also done to ease visa restrictions for journalists and researchers. These are small steps which could help serve as concrete confidence building measures between the two Asian giants. The details of most of these measures are yet to be finalised from both sides.

An earlier visit of Indian Foreign Secretary Vinay Kwatra to Beijing was a demonstration of India’s calibrated approach of strategic caution and diplomatic engagement. He stressed that India viewed China’s chairmanship of the Shanghai Cooperation Organisation positively and that India must maintain diplomatic relations with China to promote regional stability. This came in line with India’s strong commitment to use multilateral regional blocs to foster diplomatic relations while maintaining its autonomy.

However, India is being extremely cautious when it comes to China. Not participating in exaggerated optimism, the Indian side is fully aware of the structural problems that circumvent China becoming an ally. The LAC is still a volatile area which has seen significant militarisation take place on both sides. The Demchok and Depsang Plains remain areas with strong troop deployment, keeping both India and China in check. While the Chinese Foreign Minister’s statement called for “mutual understanding and mutual support”, India is highly wary of China’s strategic intentions. China’s proximity with Pakistan, its increasing aggression in the Indo-Pacific, its strong desire to reshape the world order are causes of great insecurity for India.

India’s pragmatism as exemplified by the caution it uses in dealing with China is commendable. It needs to leverage these talks into extracting actual tangible gains without compromising on national security. A realistic understanding of its capabilities tied with a willingness to engage with China is the approach that is needed. However, this cautious cooperation needs to be balanced against a willingness to be prepared for strong competition with its neighbour.

China’s Trust Property Dilemma

By De/Cypher

The ownership of trust property in China has been a longstanding legal issue. Unlike common law countries, where trust property ownership is divided between legal and equitable ownership, China’s legal system does not offer a clear answer. This has caused confusion regarding whether trust property belongs to the settler, trustee, or beneficiary. In 2019, the Supreme People’s Court (SPC) introduced the Absolutely Independent Trust Property (AITP) theory, which asserts that trust property is entirely separate from the personal assets of all parties involved, making it immune from claims by creditors or personal debts. While this theory seems logical, its practical application has led to complications, including inconsistent rulings and enforcement difficulties.

The AITP theory aims to protect trust assets. This means a trustee cannot use trust property to settle personal debts, a settler cannot reclaim the assets once placed in trust, and a beneficiary’s creditors cannot seize them. In theory, this seems to give security to investors through trust structures of asset management. In practice, however, 252 Chinese court judgments from 2001 to 2023 reveal that courts still treat the trust agreement as a contract instead of a fiduciary relationship, leading to inconsistent rulings. Some courts treat trustees as full owners, while others view them as managers of the property. This lack of clarity undermines trust in the system.

China’s financial sector depends heavily on trust structures for wealth management and investment, making clear classification of trust property crucial. If trust assets aren’t recognised as independent, they could be claimed by creditors or misused by trustees, undermining the system. The SPC aimed to protect trust assets, especially in bankruptcy cases where they could be absorbed into a trustee’s estate.

However, the failure to codify AITP under clear law has seen courts interpret it in different ways since some judges are using principles of contract law. In addition, there is a failure of a centralised registration system for trust property to ascertain whether or not certain assets belong to the trust or personal wealth.

Another challenge is that China's single ownership model under traditional Chinese law requires that every asset must have a specific owner. AITP theory denies this, where it asserts trust property belongs to no one in particular. According to the argument, this position is against the Numerus Clausus principle of limiting new rights in property unless they are adopted by the legislature. This raises questions: If trust property belongs to no one, who controls its use? What happens if it is required to be sold or transferred? Uncertainty complicates international transactions when other countries fail to recognise China's approach to trust ownership.

The strict adherence to AITP has also led to practical problems. If the Settlor continues to retain control of the trust property, courts may challenge whether that particular trust is valid. If a trustee mismanages assets, beneficiaries may be unable to enforce accountability because, technically, they do not "own" the property. Legal risks arise because of these ambiguities. There is also a taxation issue: countries like the U.S. and the U.K. have rules governing tax on trusts; China does not. This absence may lead to tax avoidance. Stricter regulation may make the trust less of an attractive form for investment. This gap may lead to tax avoidance, prompting stricter regulations that could make trusts less attractive for investment.

Enforceable fiduciary duties are also weak in the trust system in China. Trusts have an obligation to the beneficiaries and trustees can be called to account in case of any mismanagement under common law systems. But trust law does not impose that type of liability in China on a trustee. Since the trust property is totally independent, there may be liability assigned for fraud and mismanagement as well, creating uncertainty.

Inconsistent application of AITP by courts worsens the situation. There are still some judges who consider trusts as contracts, therefore, assets in a trust may not always be well-protected. For AITP to be effective, China must reform its trust law. The Chinese Trust Law must be revised and clarify whether residual rights exist on trust property that is held by trustees, settlors, or beneficiaries. Establishing a centralised trust registration system would promote transparency and reduce fraudulent claims. Furthermore, China needs a comprehensive taxation framework to prevent abuse while maintaining the attractiveness of trusts. Judge training programs could improve the consistency of trust law application, and aligning China’s regulations with international standards would facilitate cross-border transactions, making Chinese trusts more appealing to foreign investors.

In conclusion, while AITP clarifies ownership of trust property, the implementation of such an instrument is not free of real-world problems. Judicial inconsistencies and conflicts with the traditional principles of property coupled with enforcement challenges negate its efficacy.

Economic Activity🏦

China Establishes Low-Altitude Economy Department to Drive Future Growth

Chia-Han Lee and Levi Li write in DIGITIMES Asia that China’s National Development and Reform Commission (NDRC) has launched a department to accelerate the low-altitude economy, focusing on drones, air taxis, and electric vertical takeoff and landing (eVTOL) technologies. With projected market growth from CNY500 billion ($68.2 billion) in 2023 to CNY2 trillion by 2030, the sector is key to Beijing’s push for economic self-reliance. However, challenges remain, including airspace restrictions, infrastructure gaps, and concerns over job displacement in traditional logistics sectors.

As Local Officials Strained to Meet FDI Goals, a Fraudster Filled the Gap

Huang Yuxin and Kelly Wang write in Caixin that civil servant-turned-businesswoman Zhou Meixia was sentenced to six and a half years for orchestrating a massive fraud involving nearly 8 billion yuan ($1.1 billion) in illegal foreign exchange trading. Zhou facilitated fake foreign investments into Chinese companies by illegally purchasing U.S. dollars, routing them through offshore firms, and reintroducing them as FDI. She claimed her scheme helped local governments and state-owned enterprises meet investment quotas.

China’s Manufacturing Activity Contracts for First Time Since September

Thomas Hale writes in Financial Times that China’s manufacturing activity unexpectedly contracted in January, with the official PMI falling to 49.1, below forecasts and marking the first contraction since September. Industrial profits declined for the third consecutive year, despite a year-end rebound. Policymakers face mounting pressure amid a prolonged property slump, weak consumer confidence, deflationary risks, and escalating U.S. trade tensions under Trump, which threaten China's export-driven growth.

China’s Bond Mutual Funds Surge Amid Stock Market Slump

Caixin reports that mutual funds in China held 16.8 trillion yuan ($2.3 trillion) in bonds as of September, surpassing stocks, which made up less than a quarter of total assets. Bond-focused mutual funds dominated new issuances, accounting for two-thirds of over 1 trillion yuan raised last year. The shift is driven by a sluggish stock market since 2015, interest rate cuts fueling a bond rally, and preferential tax policies incentivising institutional investment in bonds.

Inside China🐉

Xi hails fruitful 2024, calls for new progress

Mo Jingxi writes in China Daily that President Xi Jinping lauded China's achievements in 2024, emphasising economic growth, scientific innovation, and poverty alleviation. Speaking at a Spring Festival reception, Xi highlighted China’s role as a key driver of global economic growth and its diplomatic efforts, including Belt and Road cooperation. He reiterated commitments to military modernisation, anti-corruption measures, and long-term development goals set for the upcoming 15th Five-Year Plan (2026-30).

Chinese military leaders urge war readiness in message to troops ahead of Lunar New Year

Amber Wang writes in South China Morning Post that top Chinese military leaders have reinforced calls for war readiness and anti-corruption measures while visiting People’s Liberation Army (PLA) units. Central Military Commission (CMC) vice-chairmen Zhang Youxia and He Weidong emphasised discipline, political loyalty, and combat preparedness amid regional tensions. The visits, part of a pre-Lunar New Year tradition, also highlighted China’s goal of military modernisation by 2027, with a focus on high-tech integration and information warfare.

China builds huge new wartime military command centre in Beijing

Demetri Sevastopulo, Joe Leahy, Ryan McMorrow, Kathrin Hille, and Chris Cook write in the Financial Times that China's military is constructing a massive complex in western Beijing, believed by US intelligence to serve as a wartime command centre.panning approximately 1,500 acres, the facility is expected to be larger than the Pentagon and will feature bombproof bunkers to protect military leaders during conflicts, including potential nuclear wars.onstruction began in mid-2024, reflecting China's efforts to enhance its military capabilities ahead of the People's Liberation Army's centenary in 2027.

Satellite images show China building huge secret fusion research facility, analysts say

Lincoln Feast writes in The Independent that China is constructing a massive laser fusion research facility in Mianyang, potentially advancing nuclear weapons design and clean energy research. The experiment bay is estimated to be 50% larger than the U.S. National Ignition Facility. Analysts note that while laser fusion research is allowed under international treaties, it can provide insights into nuclear detonations, raising concerns about China's nuclear capabilities.

Beijing-backed lending boosts China’s dominance in clean energy minerals

Edward White and Haohsiang Ko write in Financial Times that China has strategically controlled critical mineral supply chains across 19 low- and middle-income countries through state-backed financial institutions, issuing nearly $57bn in loans between 2000 and 2021. More than three-quarters of this funding was tied to Chinese ownership in joint ventures, securing access to copper, cobalt, nickel, lithium, and rare earths. Unlike traditional Belt and Road Initiative loans, this financing network is more diversified, involving both state-owned banks and private entities, reinforcing China’s dominance in clean energy minerals.

Chinese Firm Behind Hacking Operations Against Uyghurs and Tibetans Unveiled

Pierre Gastineau and Geoffroy Pellevoizin write in Intelligence Online that a Chinese contractor linked to the Ministry of Public Security has been identified as responsible for cyber operations targeting Uyghurs and Tibetans both within China and abroad. The firm, reportedly involved in previous state-backed hacking activities, has engaged in surveillance, infiltration, and data extraction efforts against these minority groups. The revelations highlight China’s intensified digital repression strategies amid broader cyber recruitment efforts by Beijing.

China and the World🌏

India Voices Alarm Over China’s Plans to Build World’s Largest Dam in Tibet

Andres Schipani, Joe Leahy, and Rachel Millard write in Financial Times that India has raised concerns over China’s plan to construct a 60-gigawatt dam on the Yarlung Tsangpo river in Tibet, three times the size of the Three Gorges Dam. India fears the project could disrupt water flows, cause floods, and provide China with strategic leverage. The dam’s announcement comes amid fragile India-China relations following 2020 border clashes. Bangladesh has also expressed concerns, while China insists the project will not harm downstream countries.

India, China agree to resume flights after almost 5 years

DW reports that India and China have agreed to resume direct passenger flights after nearly five years, following high-level diplomatic engagements. Flights were halted in 2020 due to the COVID-19 pandemic and deteriorating bilateral ties after a deadly border clash. India’s Foreign Ministry confirmed an agreement “in principle,” with technical authorities set to negotiate details. The move signals a thaw in relations, aligning with broader efforts to improve China-India ties within the BRICS framework.

Philippine president offers a deal to China: Stop sea aggression and I’ll return missiles to US

Jim Gomez writes in the Associated Press that Philippine President Ferdinand Marcos Jr. has offered to remove a U.S. missile system from the Philippines if China ceases its aggressive actions in the South China Sea. The U.S. Army had deployed the Typhon mid-range missile system in April last year as part of joint combat training. China has demanded its removal, calling it an instigation of geopolitical tensions. Marcos countered by stating that China’s own missile systems are vastly more powerful. He conditioned the missile withdrawal on China halting territorial claims, harassment of Filipino fishermen, and military provocations. The missile system was recently relocated closer to Manila, keeping Chinese military movements in check.

Plane Crash in South Sudan Kills 20, Only One Survivor

South China Morning Post reports that a plane crashed near the oilfields in Unity State, South Sudan, killing 20 people, with only one survivor, a South Sudanese engineer. The aircraft, chartered by the Greater Pioneer Operating Company (GPOC) and operated by Light Air Services, was en route to Juba. Among the victims were 16 South Sudanese, two Chinese nationals, and one Indian. President Salva Kiir has ordered an investigation into the crash, which is suspected to be due to mechanical failure.

Beijing-Moscow relations sour as Chinese recruits die in Ukraine

Intelligence Online reports that tensions between China and Russia are rising as Beijing expresses concern over its nationals joining Russian military units in Ukraine. At least 10 Chinese fighters have reportedly been killed, with Beijing estimating that hundreds more have enlisted in Russia’s regular forces and militias. Moscow’s recruitment of Chinese migrants for support roles has further strained diplomatic ties, revealing fractures in the China-Russia partnership.

US Investigates DeepSeek’s Alleged Chip Ban Evasion

Alice Truong writes in Bloomberg that US authorities, including the White House and FBI, are probing whether Chinese AI firm DeepSeek bypassed chip export restrictions by acquiring Nvidia chips through Singapore-based middlemen. Nvidia maintains compliance with all laws, while Howard Lutnick, Trump’s Commerce Secretary nominee, suggested DeepSeek circumvented controls. The revelation led to a sharp market reaction, with SK Hynix shares falling 10% and concerns over broader tech market impacts.

US lawmakers concerned about Chinese influence on Panama Canal

Katherine Gypson writes in VOA News that U.S. lawmakers have raised concerns over China’s growing influence in the Panama Canal, a critical global trade route. In a congressional hearing, senators discussed security implications and potential steps to counter Beijing’s economic and strategic foothold. The concerns follow President Donald Trump’s pledge to reassert U.S. control over the canal, amid fears of China leveraging its investments in Panama for geopolitical advantage.

China-Linked Influence Operation Tried to Overthrow Spain’s Government, Report Says

Giselle Ruhiyyih Ewing writes in Politico that a China-linked influence operation, identified as Spamouflage, attempted to incite unrest in Spain following the deadly Valencia floods. Fake social media accounts impersonated the human rights group Safeguard Defenders, spreading anti-government messages on platforms like Facebook, X, and TikTok. The campaign, uncovered by Graphika, marked an escalation in Spamouflage’s activities, which have previously targeted the U.S. and Canada. While China denies involvement, the operation underscores growing concerns about foreign interference in European politics.

EU Offers Teamwork with US on China in Bid to Woo Trump

Camille Gijs and Jakob Weizman write in Politico that EU Trade Commissioner Maroš Šefčovič has proposed deeper EU-US cooperation to counter China’s economic influence, aiming to align with President Trump’s stance. The EU seeks to strengthen trade security while balancing its economic ties with China, its third-largest trade partner. Amid US tariff threats, Brussels has also signaled readiness to boost imports of American liquefied natural gas to ease tensions. This follows past EU-US-Japan cooperation against Beijing’s industrial policies.

Panasonic to Boost Vietnam Wiring Device Output to Fend Off China

Yuji Nitta writes in Nikkei Asia that Panasonic Holdings plans to expand wiring device production at its Vietnam plant and enter the Cambodian market to counter growing competition from Chinese manufacturers. Wiring devices, including outlets and switches, are a core business for Panasonic, now managed by its in-house division Panasonic Electric Works. The move aims to solidify Panasonic’s leading market position in Asia amid intensifying regional competition.

Tech in China🖥️

China’s CXMT Memory Chip Breakthrough Beats US Export Controls

Debby Wu writes in Bloomberg that ChangXin Memory Technologies Inc. (CXMT) has developed DDR5 DRAM chips using a 16-nanometer half pitch, surpassing US-imposed export restrictions. This advancement, unexpected before 2026, underscores China's resilience amid restrictions limiting access to sub-18nm DRAM manufacturing technology. Despite trailing industry leaders like Samsung and Micron by three years, CXMT’s breakthrough follows Huawei's recent progress in advanced chipmaking, signaling China's growing independence in semiconductor development.

China’s AI Race Heats Up as Alibaba Challenges DeepSeek

Onome writes in AutoGPT that Alibaba has launched Qwen 2.5-Max, an AI model it claims surpasses DeepSeek-V3, OpenAI’s GPT-4o, and Meta’s Llama-3.1-405B. The surprise release, coinciding with Lunar New Year, signals Alibaba’s urgency to stay competitive in China’s AI landscape. DeepSeek has rapidly gained attention with cost-effective, high-performance AI models, pressuring established giants like Baidu, Tencent, and ByteDance. As China’s AI arms race intensifies, industry observers are watching for DeepSeek’s next move and how US tech giants will respond.

De/Cypher Data Dive📊

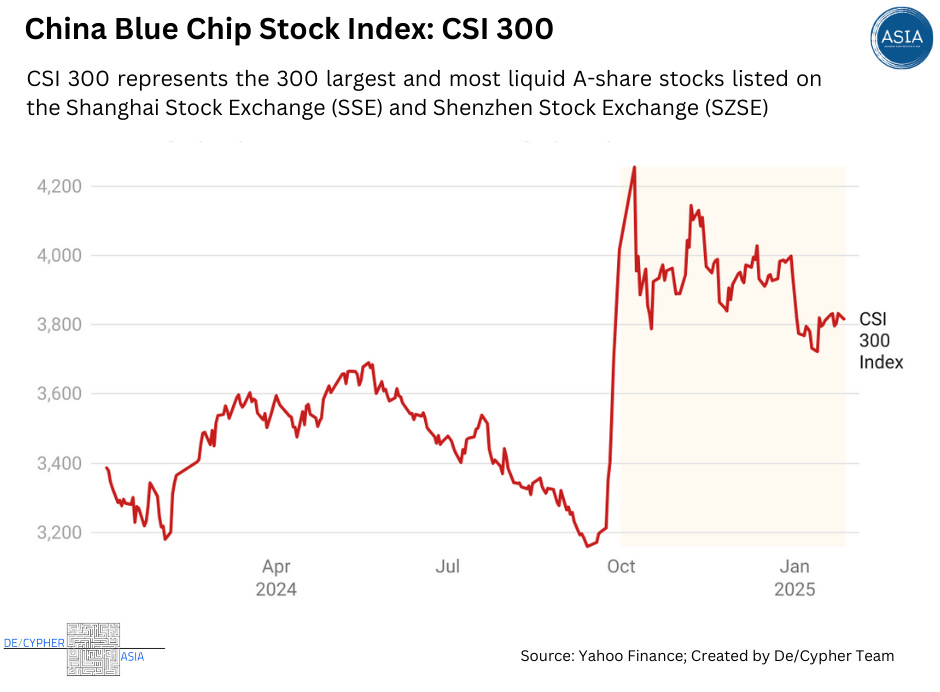

The 2015–16 stock market selloff (The Great Fall of China) saw a dramatic drop in the SSE Composite Index, spurred by fears of a slowing economy and yuan devaluation. January 2025, China's stock market faced another significant downturn, with the CSI 300 Index hitting its lowest point since September 2024.

Image of the Week📸

- - -