China This Week: First Home-Built Carrier Commissioned, Foreign AI Chips Banned, Exports Decline After Two Years

This week in China, we explore key shifts in its domestic and foreign policy landscape. We also take a closer look at the current situation in Mali as well as other important international stories.

China Quote 🗩

“China appreciates Iran’s recent reaffirmation that it has no intention of developing nuclear weapons, and supports Iran’s right to the peaceful use of nuclear energy.”

– Chinese Foreign Minister Wang Yi, in a call with his Iranian counterpart Abbas Araghchi on Wednesday

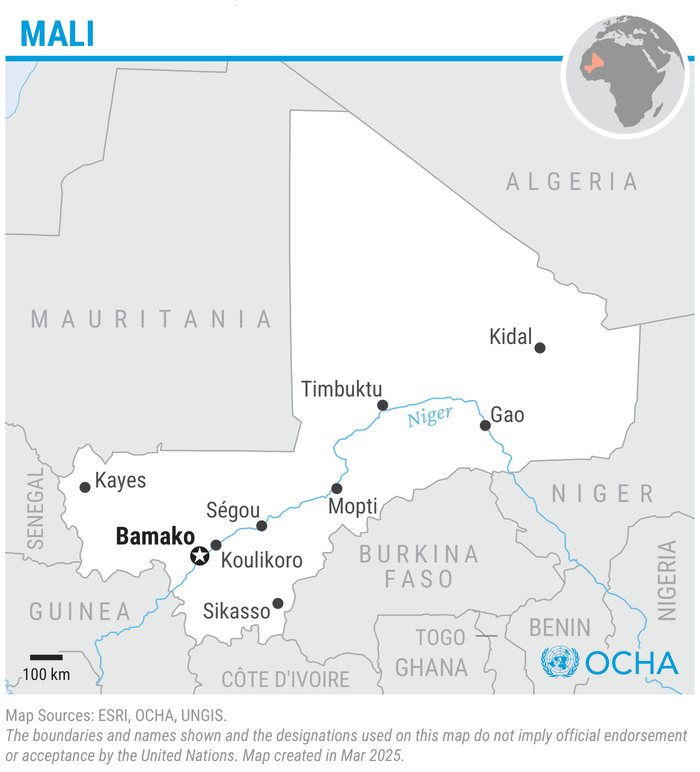

SITREP | Mali — Fuel Blockade, Bamako Strains

As of 7 Nov 2025, 11:00 IST

Executive Summary

A two-month jihadist campaign targeting fuel supply corridors continues to constrict Bamako’s access to petrol and diesel, generating long queues, intermittent station closures, business closures and service disruptions. The junta under Gen. Assimi Goïta is escorting convoys and seeking alternative supplies, including a Russia-linked fuel arrangement; however, near-term relief remains uncertain. Major carriers and embassies are recalibrating posture. Multiple missions advise citizens to depart. The blockade’s strategic aim appears less an immediate push on the capital than a sustained economic coercion to degrade the regime’s legitimacy. At the same time, some commentators hint at Western support from the neo-colonial playbook.

Current Situation

● Fuel & services: Recurrent ambushes and interdictions on western and southern approaches (notably Kayes–Nioro/Diéma and Bougouni–Sikasso axes) have sharply reduced inflows since early September. Bamako faces prolonged queues, sporadic closures of filling stations, and knock-on effects for transport, power and day-to-day activities.

● Education & basic services: Authorities ordered a two-week suspension of schools and universities, citing staff mobility constraints and system-wide shortages.

● Government operations: Security forces continue air/ground actions along threatened routes and escort selected convoys with uneven results. A public narrative from the presidential palace frames the crisis as an attempt to “asphyxiate” the capital while vowing to persevere with escorts.

Political & Leadership Signals

● Junta posture: The regime tightened political space earlier in 2025 (party suspensions/dissolution) and has slipped on transition milestones. The fuel shock heightens strain on the security and economic apparatus, but there are no confirmed public indicators of elite fracture at this hour.

● Information environment: Official messaging emphasises resilience and external plotting; domestic criticism focuses on cost-of-living stress, service degradation, and the viability of alternative supply lines.

International & Commercial Posture

● Carriers: Following government talks, CMA CGM (French shipping giant) has reversed an earlier pause and will maintain bookings to Mali, warning of higher costs and overland delays. This helps general cargo continuity but does not neutralise last-mile interdiction risks for fuel.

● Embassy advisories: Several missions, most prominently the United States, urge citizens to depart on commercial flights. Allied European advisories echo heightened caution, citing blocked roads and supply insecurity.

● Markets lens: Coverage frames the siege as a stress test of external backers. The junta’s ability to manage cascading risks (energy, logistics, prices) under sanctions and isolation.

Actors & Intent

● JNIM (al-Qaeda affiliate): Employing economic coercion—ambushes, intimidation, and interdictions—to raise urban pain and delegitimise the regime, likely seeking leverage rather than immediate urban seizure.

● Junta/Forces de Défense et de Sécurité: Protect convoys, strike staging areas, keep essential services running, and diversify supply (Russia deal). The junta’s response is constrained by limited convoy-protection capacity, escalating insurance and haulage premiums, fragile urban sentiment, and a shortage of strategic lift.

Humanitarian & Economic Effects (near term)

● Operational impacts: Fuel scarcity threatens the power, cold-chain, and water systems of Bamako’s Gabriel-Touré and Point G clinics, as well as humanitarian logistics. Aid flight planning and overland convoys, especially Kayes–Nioro–Diéma/Bougouni–Sikasso, are under pressure. Transport and staple prices are rising, with grey-market premiums likely to persist until corridors stabilise.

● Exposure: The crisis compounds existing needs across central and southern regions; agencies (UNICEF, WFP, MSF) flag access constraints and rising protection concerns as mobility declines.

Outlook (7–14 days)

● Security: Expect continued ambush risk on western and southern corridors; more escorted runs are likely, with episodic successes but no swift neutralisation of interdiction capacity.

● Governance: Watch for emergency decrees on movement, pricing, or media; leadership visibility and any senior reshuffles will be key signals of regime confidence.

● External posture: Additional drawdowns or travel warnings are possible if shortages endure. A concrete delivery schedule for alternative fuel, paired with secure corridor arrangements, would be the most immediate stabiliser.

Indicators & Tripwires

● New embassy drawdowns/evacuations or commercial flight disruptions.

● Multi-day shutdown of major Bamako depots or grid-linked generators.

● Sustained two-axis interdictions (west and south), preventing escorted replenishment.

● Carrier reversals (suspension/rerouting) after fresh incidents.

● Senior security-force reshuffles or arrests indicate stress at the top.

Recommended Immediate Actions (NGOs, firms, missions)

● Continuity: Re-baseline generator runtime/fuel burn; prioritise cold-chain and critical IT/power; pre-position minimal safe stocks.

● Mobility: Avoid predictable convoy patterns; diversify suppliers and staging points; assess the feasibility of limited air-bridge options.

● Duty of care: Align thresholds with the latest embassy guidance; refresh hibernation/relocation plans, and staff communications.

India’s Conglomerate Problem: When Scale Becomes Power

The Adani-Google plan for a large AI data-centre campus in Visakhapatnam points to a deeper shift in India’s economy: a growing concentration of power in the hands of a few conglomerates. Groups such as Adani, Reliance, Tata, Birla, JSW and Vedanta now dominate key sectors that include metals, cement, telecoms, aviation, power, ports and retail. Their scale gives them privileged access to policymakers and finance, which further strengthens their position and makes it harder for smaller firms to survive.

This isn ot a recent trend but has been continuing for decades. Industrial finance in India has long been skewed towards large business houses, first through development finance institutions and later through public-sector banks. The gap is further widened by recent disruptions such as the Insolvency and Bankruptcy Code, demonetisation, GST and the pandemic. These shocks weakened smaller firms, formalised the economy in ways that benefited big players and created acquisition opportunities that cash-rich conglomerates quickly took. Once they reach a certain size, these groups also diversify aggressively, partly to deploy surplus capital and partly because scale offers leverage in heavily regulated sectors.

The result is an economy increasingly shaped by market power. Research by Viral Acharya shows that rising concentration since 2016 has coincided with higher product mark-ups, fewer choices and a sustained upward pressure on prices. Protectionist policies and high tariffs shield domestic giants from global competition, reducing the incentive to innovate. India’s R&D spending remains stuck at 0.7 per cent of GDP, and most large firms focus on domestic arbitrage rather than building global brands.

This produces lopsided wealth, weak innovation and limited global competitiveness. Conglomerates prosper, while consumers and smaller businesses bear the cost. A more open and innovation-led form of capitalism is needed if the country hopes to become a genuinely developed economy.

(This precis is based on Ujval Nanavati’s article Conglomerates, duopolies and domination hamper India published in Morning Context.)

Decypher Rear-view

Smoke as Shield: Britain’s Wartime Pollution Paradox

When the threat of large-scale bombing by the Luftwaffe loomed in mid-1940 and the Battle of Britain was imminent, the British government adopted a surprising strategy. By mid-1940, the Ministry of Home Security issued confidential guidance to certain local authorities and defence industries to use smoke screens for camouflage.

This move sat in sharp contrast to the prior decades-long campaign by the National Smoke Abatement Society (NSAS). The NSAS had been formed in 1929 (via a merger of earlier coal smoke and industrial-smoke leagues) to fight industrial and domestic smoke pollution and to promote smokeless fuel and cleaner combustion. The organisation emphasised that visible smoke was both a waste of fuel and a public-health nuisance.

What this really means is that Britain’s wartime strategy for air defence required the reversal of a domestic environmental policy. Smoke had previously been framed as an “evil” to be suppressed; now it was weaponised for camouflage. The NSAS had argued just months earlier that prevention of wasteful smoke combustion contributed to the war effort via fuel economy and suppressed detection of vulnerable industrial sites. Yet the government’s directive required increased emissions in some regions.

The contradiction had tangible consequences. Firstly, the NSAS pointed out that smoke is a sign of inefficient combustion and wasted fuel – a critical resource in a wartime economy. Secondly, they warned that large smoke palls might inadvertently make industrial concentrations more visible from the air, rather than less, and could impair visibility for the Royal Air Force and ground defences. One military meteorological officer later described “smoke haze” as one of the greatest handicaps of flying during the war.

Operationally, enforcing smoke abatement legislation became impossible during wartime due to staff shortages and suspended regulation (the NSAS noted that by 1943, much routine activity was curtailed). By early 1943, as bombing threats subsided and coal conservation took precedence, smoke-screen operations were phased out.

In hindsight, the episode underscores how wartime exigencies can force trade-offs between environmental regulation and national defence. The immediate logic of turning smoke into a shield may have seemed compelling, but the longer-term cost in fuel waste and atmospheric degradation was real.

Yet the NSAS emerged from the war in a strengthened position. The smoke-generation programme, despite its purpose, helped reinforce the post-war case for stronger air-quality regulation. The Clean Air Act of 1956 responded to the very conditions that the NSAS had warned about for decades.

In sum, Britain’s wartime smoke campaign may have helped defend its skies, but it also betrayed the logic of earlier environmental reform. The war effort won a tactical victory in the air while losing a small skirmish in the battle for cleaner skies.

While Britain’s wartime smoke strategy illustrates the difficult trade-offs in moments of crisis, its legacy offers important lessons for today’s escalating global air pollution challenges. Currently, over 90% of the world’s population lives in areas where air quality does not meet World Health Organisation (WHO) guidelines, resulting in around 7 million premature deaths annually from pollution-related illnesses. Britain’s experience during and after World War II highlights the critical value of timely regulation: although smoke emissions increased during the war, the postwar Clean Air Act of 1956 effectively reduced urban smog and industrial pollution, decreasing particulate matter levels by more than 40% within a decade. This historical precedent underlines that even amid urgent national crises, governments can enact policies that safeguard public health while balancing economic demands. Today, countries facing severe air pollution must similarly prioritise investments in cleaner fuels, advanced technologies, and robust legal frameworks to realise meaningful improvements in air quality and protect future generations.

Economic Activity🏦

China commissions its first domestically built aircraft carrier, the Fujian

Associated Press reports that China has formally commissioned the Fujian, its third and most advanced aircraft carrier, in a ceremony attended by President Xi Jinping on Hainan island. The Fujian, equipped with an electromagnetic launch system similar to the US Navy’s latest carriers, marks a major step in Beijing’s efforts to build a “blue-water navy” capable of operating far from its shores. Analysts say the carrier enhances China’s power projection in the Indo-Pacific and could play a role in deterring US intervention in a potential Taiwan conflict, though China still lags the US in nuclear propulsion, support vessels and overseas bases.

China’s exports fall for first time in nearly two years

CNBC reports that China’s exports dropped 1.1% year-on-year in October, the first decline since March 2024, as shipments to the US fell 25%. Imports rose 1%, missing expectations, while manufacturing activity contracted for the seventh straight month, underscoring continued pressure on the economy.

China emerges as US ‘peer rival’ at Xi–Trump summit

Financial Times reports that China and the US agreed to a one-year suspension of new export controls and tariffs after the first Xi–Trump meeting in six years, held in South Korea. The summit underscored a shifting power balance as Beijing, now economically stronger, forced Washington to compromise on multiple trade issues, including rare earths and semiconductors. Analysts said the détente is tactical, with both sides keeping measures as leverage amid ongoing rivalry over technology, Taiwan, and global influence.

Xi softens ‘wolf warrior’ diplomacy amid economic strain

Nikkei Asia reports that President Xi Jinping has toned down his hardline diplomatic style, making concessions during talks with US President Donald Trump in South Korea. The summit produced a draw, with both sides agreeing to de-escalate tariffs and trade restrictions. Analysts say Xi’s shift reflects mounting domestic economic pressure, as China seeks stability with major partners ahead of hosting the 2026 APEC summit in Shenzhen.

US weighs push for wider global dollar adoption amid China challenge

Financial Times reports that Trump administration officials are exploring ways to encourage more countries to adopt the US dollar as their primary currency, in response to China-led efforts to reduce dollar reliance in global trade. Economist Steve Hanke confirmed discussions with senior White House and Treasury officials about promoting dollarisation, with Argentina, Pakistan and Ghana among potential candidates. The talks aim to bolster the greenback’s global role, though no formal policy has been decided.

China ‘made a mistake’ with rare-earth export curbs, says US Treasury Secretary

Yahoo News reports that US Treasury Secretary Scott Bessent said China’s rare-earth export controls were a “mistake” that revealed its willingness to use critical minerals as leverage. Following the Xi–Trump summit, Beijing agreed to suspend the restrictions for one year, after the curbs rattled markets and disrupted supply chains in strategic sectors. Bessent said the US had “offsetting measures” and that China was “alarmed by the global backlash”.

EU launches anti-subsidy probe into Chinese tyre imports

Reuters reports that the European Commission has opened an anti-subsidy investigation into tyres for cars, light trucks and buses imported from China, following evidence that Chinese manufacturers received grants, tax breaks and cheap loans. The move adds to an existing anti-dumping review and is one of 17 ongoing EU probes targeting Chinese goods amid rising trade tensions. The Commission must conclude the inquiry within 13 months and can impose provisional duties within nine.

Trump seeks to counter China and Russia with Central Asia minerals push

Foreign Policy reports that President Donald Trump hosted leaders of five Central Asian nations in Washington to deepen US engagement in the region and secure critical minerals deals. The talks with Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan and Uzbekistan focused on energy, infrastructure and rare-earth cooperation, as the US seeks alternatives to China’s mineral supply dominance. The summit follows new US-backed investments worth $12.4 billion, but analysts warn that human rights concerns may be sidelined as Washington competes with Beijing and Moscow for influence.

China accuses Netherlands of worsening global chip turmoil over Nexperia seizure

South China Morning Post reports that Beijing has accused the Dutch government of escalating global semiconductor supply-chain instability by seizing control of chipmaker Nexperia from its Chinese owners in September. China’s Ministry of Commerce said The Hague had “failed to show a constructive attitude” and warned that its actions, taken under national security grounds and reportedly influenced by US pressure, would “inevitably exacerbate” the global chip crisis.

China’s clean-energy revolution reshapes global markets and geopolitics

The Economist reports that China’s vast expansion in renewable energy has made it the world’s foremost clean-energy superpower, with 887 gigawatts of solar capacity and record wind and solar generation. The country’s low-cost green technologies are transforming global decarbonisation efforts, giving it both economic leverage and geopolitical influence. While coal reliance and political control remain concerns, analysts say China’s dominance in renewables will define future energy markets and accelerate the world’s shift away from fossil fuels.

Shein targets $2 billion profit despite US tariff pressure

Bloomberg reports that Shein Group Ltd. expects to earn $2 billion in net income in 2025, defying weaker online traffic linked to US tariffs. The Singapore-based fast-fashion company plans to sustain profits through price hikes and cost-cutting, while projecting mid-teen sales growth. Despite trade headwinds under President Trump’s tariff policies, Shein’s higher margins and global expansion continue to underpin its strong financial outlook.

Starbucks gives up control of China business amid local competition

CNN reports that Starbucks will sell a 60% stake in its China operations to Boyu Capital, retaining a 40% share as part of a new joint venture valued at $13 billion. The move marks a major retreat from a market once central to its global growth, as the US coffee chain faces fierce competition from local brands like Luckin Coffee and weakening consumer demand.

The human cost of Xiaomi’s pivot from phones to EVs

Bloomberg reports that Xiaomi’s rapid shift into electric vehicles has imposed intense overtime on staff, illustrated by the death of employee Wang Peizhi in August 2024 after sustained long hours while preparing flagship EV showrooms. The piece details heavy internal workloads, company investments of about $1.6bn into suppliers, Xiaomi’s SU7 launch (priced at 215,900 yuan), a 2025 delivery target of 350,000 units, and wider concerns about endemic “996”-style culture across China’s tech sector.

Inside China🐉

China’s domestic violence law fails victims as police prioritise ‘family harmony’

The New York Times reports that a series of high-profile domestic violence cases in China has reignited anger over the country’s failure to protect women from abuse despite a 2016 anti-domestic violence law. Two recent cases, one ending in the death of 43-year-old Zhang Liping and another leaving Ms. Xie from Chengdu severely injured highlight how police, courts and women’s federations often discourage victims from leaving abusive marriages, citing family unity. Activists say the law is advanced on paper but undermined by poor enforcement, lack of training, and a crackdown on NGOs that once supported victims. In 2024, only about two restraining orders per court were issued nationwide, reflecting systemic inaction despite official pledges of “zero tolerance.”

China attracts wave of US scientists amid Trump-era research cuts

The Washington Post reports that Beijing is drawing increasing numbers of American scientists, particularly in STEM fields, as research funding cuts and visa restrictions under President Donald Trump drive talent abroad. Princeton data show about 50 US-based scholars of Chinese descent have relocated to China in 2025 alone, joining more than 850 since 2011. China’s major universities and institutes, backed by an $8 billion national science fund, are offering generous salaries, research grants and a new K visa to attract global talent.

China and the World🌏

Thai King to make first state visit to China in celebration of 50 years of ties

Bloomberg reports that Thailand’s King Maha Vajiralongkorn and Queen Suthida will travel to China from November 13 to 17 for the first-ever state visit by a Thai monarch, marking the 50th anniversary of diplomatic relations between the two countries. President Xi Jinping and his wife Peng Liyuan will host a state banquet for the royal couple, who will also meet Chinese Premier Li Qiang. The visit underscores deepening political and economic ties between Beijing and Bangkok amid China’s growing engagement with Southeast Asia.

China suspected in hack of US Congressional Budget Office

CNN reports that Chinese state-backed hackers are suspected of breaching the US Congressional Budget Office (CBO), potentially compromising communications with lawmakers. The hack, confirmed in an email from the Senate sergeant at arms, remains ongoing, with staff warned not to open links from CBO accounts. The CBO said it has contained the incident and strengthened security, while investigations continue. The breach follows several China-linked cyberattacks in recent months, including one on a Washington law firm involved in US-China trade cases, amid heightened tensions between the two countries.

Beijing rebuffs Afghan opposition amid focus on stability and Taliban ties

Intelligence Online reports that China has rejected appeals from the Afghan opposition, led by Ahmad Massoud of the National Resistance Front, to provide political or logistical backing after months of discreet talks in Beijing. The Chinese leadership, prioritising regional stability and counterterrorism cooperation, has opted to maintain engagement with the Taliban authorities rather than risk destabilising its western border. The decision underscores Beijing’s pragmatic approach to Afghanistan, where it seeks security guarantees for its investments and protection of Chinese nationals amid ongoing militant threats.

Myanmar junta regains ground with Chinese backing ahead of disputed elections

DW reports that Myanmar’s military has retaken several key towns and trade routes in recent months, aided by renewed Chinese support, in an effort to consolidate control before elections scheduled for December. Analysts say Beijing has increased diplomatic, economic and limited military backing for the junta, brokering ceasefires with armed groups and curbing cross-border trade with rebels. The regime has also expanded recruitment, improved its drone and airstrike capabilities, and restructured battlefield command under Vice Senior General Soe Win.

Nvidia chief warns China could ‘win the AI race’ amid US regulatory pressures

Axios reports that Nvidia CEO Jensen Huang warned the United States risks losing the global artificial intelligence race to China, citing Beijing’s subsidies and regulatory efficiency compared with growing restrictions in the US. Speaking to the Financial Times, Huang said China is “nanoseconds behind America” in AI and benefits from cheaper energy and a surge in local innovation, with roughly half the world’s AI researchers based there. His comments follow continued US bans on Nvidia’s advanced chip sales to China, even as the company eyes a $50 billion Chinese market and urges Washington to prioritise energy expansion and developer support to retain its lead.

Kuomintang accused of undermining Taiwan’s scientific institutions

Intelligence Online reports that Taiwan’s opposition Kuomintang (KMT) is using its narrow parliamentary majority to impose audits, budget restrictions and cooperation frameworks that critics say weaken the country’s research independence and advantage Beijing. The campaign has reportedly targeted Academia Sinica, Taiwan’s top research institute, alongside the National Science and Technology Council, as part of a broader effort aligned with Chinese-backed interests to constrain academic freedom and shift research priorities in ways that favour cross-strait integration.

China accused of pressuring UK university to halt Uyghur forced labour research

BBC News reports that China carried out a two-year campaign of intimidation against Sheffield Hallam University to force it to stop research into alleged Uyghur forced labour, according to internal documents. University staff in China were reportedly questioned by security officials, and Chinese authorities blocked the university’s websites and emails, disrupting student recruitment. Under pressure and facing a defamation suit, the university suspended Professor Laura Murphy’s research into Chinese supply chains in 2025, a decision it has since apologised for. Murphy accused the university of “trading academic freedom for access to the Chinese student market.”

Tech in China🖥️

China bans foreign AI chips in state data centre projects to boost tech self-reliance

IDN Financials reports that Beijing has issued new rules barring state-funded data centre projects from using foreign-made AI chips, requiring facilities still under 30 percent construction to remove or cancel foreign chip installations. The move, first reported by Reuters, marks China’s strongest step yet to achieve semiconductor self-sufficiency amid intensifying tech competition with the US. The policy could significantly impact Nvidia, which once held over 90 percent of China’s AI chip market, while benefiting domestic firms such as Huawei and Cambricon.

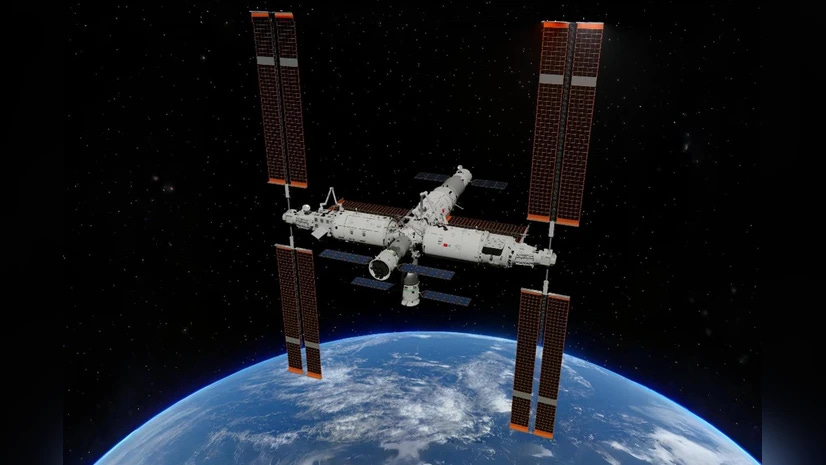

China’s Shenzhou 21 docks with Tiangong space station in record time

Arab News reports that China’s Shenzhou 21 spacecraft successfully docked with the Tiangong space station in just 3.5 hours, setting a national speed record. Launched from the Jiuquan Satellite Launch Center on October 31, the mission’s three astronauts — Zhang Lu, Wu Fei and Zhang Hongzhang — will spend six months conducting 27 scientific projects, including the first experiment with mice in orbit. The China Manned Space Agency also confirmed progress toward its goal of a crewed lunar landing by 2030 and announced plans to train two Pakistani astronauts, one of whom will join a future short-term mission.

Global Risk🗺️

Blood spilled in Sudan can be seen from space, says columnist

The Guardian reports Nesrine Malik’s commentary that the fall of El Fasher to the Rapid Support Forces has produced mass killings visible by satellite, with reports of hundreds slaughtered in a single maternity hospital. Malik argues the RSF’s campaign, backed by the United Arab Emirates according to the piece, has driven a crisis that has killed an estimated 150,000, displaced millions and left more than 30 million requiring humanitarian aid, and she urges urgent international action.

Ten hospitalised after stabbing attack on UK train

Associated Press reports that ten people were hospitalised, including nine with life-threatening injuries, following a mass stabbing aboard a London-bound train on Saturday evening. The attack occurred on a Doncaster to King’s Cross service as it approached Huntingdon station in Cambridgeshire. Police arrested two suspects and declared a major incident, briefly invoking the national “Plato” alert for a potential terror attack. Counterterrorism officers are assisting the investigation, though no motive has been confirmed.

Technical glitch at Delhi airport causes major flight delays

DW reports that air traffic at Delhi’s Indira Gandhi International Airport was disrupted on Friday due to a technical failure in the Air Traffic Control’s Automatic Message Switching System. Controllers were forced to process flight plans manually, causing average delays of around 55 minutes. Major carriers including IndiGo, Air India and SpiceJet were affected, as technical teams worked to restore normal operations at one of the world’s busiest airports, which handled more than 110 million passengers in 2025.

Trump and Kim likely to hold summit in 2026, says South Korea’s spy agency

NBC News reports that South Korea’s National Intelligence Service believes there is a “high possibility” of a Trump–Kim Jong Un summit next year, as Pyongyang prepares “behind the scenes” for dialogue. The agency said Kim could seek talks after US–South Korea military drills in March 2026, which North Korea routinely denounces. While Washington said no meetings are planned, the White House reiterated that President Trump remains open to talks without preconditions. The two leaders last met in 2019, before denuclearisation talks collapsed over sanctions disputes.

NATO surpasses Russia in ammunition output, says Rutte

The Kyiv Independent reports that NATO has overtaken Russia’s ammunition production, marking a reversal after Moscow previously outpaced the alliance’s output. Speaking at the NATO-Industry Forum in Bucharest on 6 November, Secretary General Mark Rutte said member states have opened “dozens of new production lines” and pledged to raise defence spending to 5% of GDP by 2035. He warned that Russia’s cooperation with China, Iran, and North Korea poses a long-term threat and urged allies to “outgun, outproduce, and outsmart” their adversaries.

DGSE reformer Bernard Bajolet faces trial over intimidation case

Intelligence Online reports that former French foreign intelligence chief Bernard Bajolet—who led the DGSE from 2013 to 2017 and oversaw its response to the Paris terrorist attacks of November 2015—is standing trial this month near Paris. Bajolet is accused of using intimidation tactics against financier Alain Duménil, whom the DGSE suspected of embezzling around €15 million from its covert funds. The case marks the first time a former head of France’s foreign intelligence agency has been tried in criminal court, highlighting rare judicial scrutiny of DGSE operations.

UN lifts sanctions on Syria’s Sharaa ahead of Washington visit

Al-Monitor reports that the UN Security Council has voted to remove sanctions on Syrian President Ahmed al-Sharaa and Interior Minister Anas Khattab, in a decision backed by 14 members with China abstaining. The move, driven by the United States, comes just days before Sharaa’s scheduled White House visit on 10 November, where he is expected to sign a cooperation agreement joining the US-led anti-ISIS coalition. The decision marks a major diplomatic shift, as Sharaa once sanctioned for his ties to extremist groups now leads what Washington calls a “new era” in Syria’s political transition.

Lebanon draws US and Arab envoys as border tensions with Israel intensify

Al-Monitor reports that escalating Israeli airstrikes in southern Lebanon, including attacks on the town of Ansar on 17 October, have prompted visits from US and Arab envoys to Beirut aimed at preventing a wider conflict. The surge in violence follows Israeli operations targeting Hezbollah positions, while Lebanese officials, including President Joseph Aoun, have warned against a return to all-out war. Regional mediators are seeking to reinforce the fragile ceasefire agreement as both sides trade accusations amid mounting civilian casualties and cross-border strikes.

Iran president proposes relocating capital as Tehran faces acute water stress

Financial Times reports President Masoud Pezeshkian has ordered feasibility studies to move the capital from Tehran, saying the megacity of about 10 million is “unlivable” after decades of groundwater depletion, land subsidence and air pollution. He suggested building a new seat of government on the Makran Gulf of Oman coast, but urban planners and experts warned the proposal is premature given the costs, US sanctions and war-related strains on the economy, and urged investment in regional development and repairs to Tehran’s infrastructure such as new metro works and the Taleghan dam water transfer.

Mexico’s president launches review of sexual harassment laws after public assault

Al Jazeera reports President Claudia Sheinbaum has ordered a review of Mexico’s anti-sexual harassment laws after being groped by a man during a public event in Mexico City. The incident, caught on video, has reignited debate over women’s safety in a country where nearly 800 women were killed in 2024 due to gender-based violence. Sheinbaum, Mexico’s first female president, said she would press charges and urged a national campaign to unify state laws on harassment, as only half of Mexico’s 32 regions currently criminalise it.

Takaichi government launches plan for long-term growth blueprint

The Japan Times reports that Prime Minister Sanae Takaichi has directed her Cabinet to draft a comprehensive economic growth strategy by next summer, identifying 17 priority sectors including AI, defence, semiconductors, telecommunications, and shipbuilding. The initiative, led by Growth Strategy Minister Minoru Kiuchi, aims to strengthen Japan’s supply base, boost incomes, and stimulate private investment without raising taxes.

Carney unveils CA$280B budget, doubling Canada’s deficit

Verity News reports that Canadian Prime Minister Mark Carney has presented a CA$280 billion federal budget, doubling the deficit to CA$78.3 billion. The plan includes large infrastructure and defence spending, CA$60 billion in operational cuts, and a 10% reduction in federal jobs by 2028, while retaining childcare and dental care programmes.

Labour membership may have fallen below Reform UK’s, insiders warn

New Statesman reports fears within Labour that its membership has dropped below Reform UK’s amid a steep decline since Keir Starmer took over. Official figures showed Labour had 333,235 members at the end of 2024 and around 309,000 by February 2025, while Reform claims over 260,000 and is rapidly gaining. Party officials have stopped disclosing updated totals to the NEC, making membership one of Labour’s most closely guarded figures.

UK right-wing voters more anti-immigrant than Trump supporters, survey finds

Financial Times reports that supporters of Britain’s Conservative and Reform UK parties hold stronger anti-immigrant and anti-diversity views than backers of Donald Trump’s Republican Party. A National Centre for Social Research survey found two-thirds of British right-wing voters were “uncomfortable” hearing foreign languages in public, compared with less than half of Trump voters, and over half said a multiracial society “weakened” Britain. Analysts said the findings show immigration has polarised UK politics, with Nigel Farage’s Reform UK capitalising on these sentiments as it polls above 30 per cent support.

Rachel Reeves refuses to rule out tax rises ahead of autumn budget

The Guardian reports Chancellor Rachel Reeves has declined to rule out income tax increases in this month’s budget, saying she must “deal with the world as I find it” amid worsening public finances. Reeves warned that global tariffs, inflation and defence spending have intensified fiscal pressures and said she would prioritise stability over “political convenience”. Critics, including Conservative leader Kemi Badenoch, accused her of avoiding responsibility, though markets were reassured by her commitment to fiscal rules, with UK bond yields falling slightly after her speech.

FDNY commissioner Robert Tucker resigns day after Mamdani’s election

NBC New York reports Fire Commissioner Robert Tucker announced his resignation less than 24 hours after Zohran Mamdani was elected New York City mayor. Tucker, appointed in 2024 under Mayor Eric Adams, will step down on 19 December, with an interim commissioner to be named before Mamdani assumes office on 1 January 2026. He did not specify reasons for leaving but thanked Adams for the opportunity, calling his tenure “the honour of a lifetime.”

Jeffries distances Democrats’ future from Mamdani amid party tensions

The Hill reports House Minority Leader Hakeem Jeffries said he does not view New York mayoral candidate Zohran Mamdani as “the future of the Democratic Party,” despite endorsing him after his surprise primary win over Andrew Cuomo. Jeffries dismissed concerns that Mamdani’s leftist views could harm Democrats in the 2026 midterms, saying Republicans’ failures would decide control of the House. Cuomo has called Mamdani “the most divisive candidate” in New York politics, accusing him of alienating key communities, while progressives like Bernie Sanders have defended Mamdani as part of the party’s new generation.

US credit market faces $200bn wave of AI-related bond sales

Financial Times reports that US companies have issued more than $200 billion in bonds this year to fund artificial intelligence infrastructure projects, marking what Goldman Sachs calls a “banner year” for AI-linked debt. Meta’s $30 billion bond sale—the largest in its history—was oversubscribed with $125 billion in orders, while Oracle raised $18 billion in September for AI data centres leased to OpenAI. Analysts warn that such “jumbo” AI-driven issuance could heighten concentration risks, inflate corporate leverage, and expose credit investors to long-term interest rate sensitivity if the AI boom falters.

Old MS drug Rebif now costs over $140,000 a year in the US

Bloomberg reports that the price of Rebif, a multiple sclerosis medication introduced in 2003 at $17,500 a year, has surged to more than $140,000 annually—rising four times faster than inflation. Despite its age, Rebif remains costly because it is a complex biologic drug that is difficult to copy. Patients like 70-year-old Jean Kay have faced severe financial and insurance challenges, while experts say weak generic competition and opaque pricing allow manufacturers to sustain such high costs.

AI-driven stock rally shows signs of strain as Nasdaq slides

Quartz reports that a selloff in Palantir and the Nasdaq has sparked concerns that the US stock market’s AI-fuelled rally may be losing momentum. Despite Palantir’s 63 percent revenue surge and record profits, its shares fell over 7 percent amid fears that AI optimism has peaked. Analysts warn that major indices, heavily driven by AI giants such as Nvidia and Microsoft, have become overly dependent on continued enthusiasm for artificial intelligence, leaving markets vulnerable to correction if investor confidence wanes.

Perplexity AI accuses Amazon of ‘bullying’ over Comet browser legal threat

CNBC reports that Perplexity AI has accused Amazon of “bullying” after receiving a cease-and-desist letter demanding it stop users from making purchases on Amazon via its AI browser, Comet. Amazon alleged the company was committing computer fraud by allowing AI agents to access its store without authorisation. Perplexity rejected the claim, calling the move an attempt to suppress open AI innovation, while Amazon argued that unauthorised agents degrade the shopping experience. The dispute comes as Amazon expands its own AI tools, including its “Buy For Me” agent and shopping chatbot Rufus.

Tesla shareholders approve record $878 billion pay plan for Elon Musk

Reuters reports Tesla investors have approved the largest corporate compensation package in history, granting CEO Elon Musk stock options worth up to $878 billion tied to long-term growth milestones. Backed by more than 75% of shareholders, the plan links Musk’s payout to Tesla reaching targets such as 20 million vehicle deliveries, one million robotaxis, and an $8.5 trillion market valuation. Despite criticism from some major investors and governance groups, supporters said the package secures Musk’s leadership as he pivots Tesla toward AI and robotics, unveiling plans for a “Cybercab” and next-generation Roadster in 2026.

Trump renominates Jared Isaacman to lead NASA amid internal power struggle

Scientific American reports President Donald Trump has re-nominated billionaire entrepreneur and private astronaut Jared Isaacman to head NASA, months after abruptly withdrawing his first nomination. The move follows tensions with acting administrator Sean Duffy, who reportedly sought to place NASA under his own department. A leaked “Project Athena” memo outlining Isaacman’s plans for sweeping NASA reforms—cutting the Space Launch System after Artemis III, expanding commercial partnerships, and developing nuclear-electric rockets—has divided opinion in Congress and the space industry.

Disinformation surges ahead of Brazil climate summit as UN pushes for information integrity

Deutsche Welle reports that fake news and AI-generated content targeting COP30 in Belém has risen by 267 percent since July, with over 14,000 false or misleading posts identified by global watchdogs. The Coalition Against Climate Disinformation and the Observatory for Information Integrity said online campaigns are undermining support for the energy transition, fuelled by fossil fuel interests and political figures like Donald Trump. In response, Brazil and the UN have launched a new Global Initiative for Information Integrity on Climate Change, aiming to counter denial and greenwashing through research, journalism, and public transparency.

US skips UN climate summit in Brazil amid global concern over Trump’s policies

The New York Times reports the United States will not send any top officials to COP30 in Belém, Brazil, marking the first time in 30 years it has skipped the annual UN climate summit. The Trump administration, which has withdrawn from the Paris Agreement, has been accused of pressuring other countries to abandon climate initiatives and blocking global efforts such as a carbon fee on shipping. While some diplomats fear Washington’s absence could stall progress, others welcome it, arguing talks may proceed more smoothly without US obstruction. California Governor Gavin Newsom and several Democratic leaders will attend independently to signal continued subnational climate engagement.

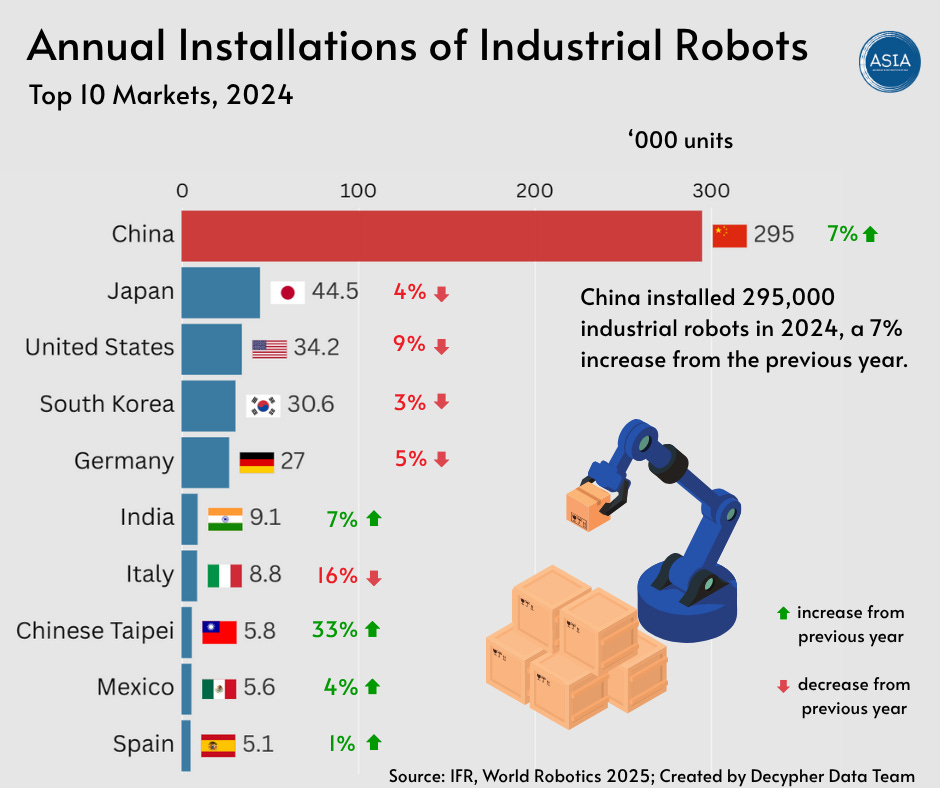

Decypher Data Dive📊

Country-level data on robot installations highlights which nations are investing most in automation. In 2024, China dominated the field with 295,000 new industrial robots about six times Japan’s total and more than eight times that of the United States.

— — —

SitRep by Manash

Precis by Shivani

Rear-View by Khushi

Data By Bhupesh

Edited By Aurko

Produced by Decypher Team in New Delhi, India

— — —