China This Week: Critical Mineral Export Control, DeepSeek Concerns, and Panama Exits BRI Deal

This week's Beyond the Great Wall covers Beijing's ban on critical mineral exports to the U.S., global concerns over DeepSeek, and Panama's exit from the BRI deal.

China Quote 🗩

“Appears to be slow-rolling negotiations for a sale while waiting for a green light from the Chinese government.”- The Washington Post on the TikTok ban

China's Strategic Mineral Export Ban: A Geopolitical and Economic Power Play

By De/Cypher

Escalating Trade Tensions and Strategic Retaliation

On 4 February 2025, Beijing announced export restrictions on critical minerals to the United States, a calculated move with significant geopolitical and economic ramifications. The announcement came mere minutes after US President Donald Trump’s additional 10% tariff on Chinese goods came into effect, marking yet another escalation in the ongoing trade tensions between the two global powers.

The ban applies to key minerals such as germanium, gallium, and antimony, essential for manufacturing semiconductors, defence applications, electric vehicles (EVs), and renewable energy technologies. By tightening control over these resources, China has reinforced its dominance in the global supply chain. This decision was not merely economic but also a strategic response to the growing trade frictions with the United States.

China's Resource Dominance and Market Volatility

China has long held a near-monopoly over the production and refinement of critical strategic minerals such as indium, gallium, tungsten, and various rare earth elements. It accounts for nearly 90% of the world’s refined rare earth production and controls over 90% of global graphite refining capacity. Additionally, China remains the primary producer of gallium, germanium, and antimony, crucial components in high-tech applications, including infrared optics.

The restrictions have triggered market volatility, with prices for tungsten and indium soaring to decade-high levels in January 2025 in anticipation of potential supply disruptions. Previous Chinese restrictions on these minerals resulted in sharp declines in exports, followed by slow recovery periods as companies scrambled to adjust supply chains. The latest restrictions are expected to create similar upheavals.

The United States and its allies have limited domestic mining and refining capabilities for these minerals. For instance, the US ceased tungsten mining in 2015 and has not produced bismuth since 1997, making it heavily dependent on Chinese imports. If licensing procedures delay shipments, industries in Japan, South Korea, and India—major importers of Chinese antimony—could face significant disruptions.

Global Responses and the Search for Alternatives

China’s mineral export controls are a direct response to escalating US trade measures. This move aligns with Beijing’s broader strategy of economic retaliation, as seen in previous trade restrictions. In December 2023, China banned exports of rare earth magnet technology and restricted the export of graphite used in EV batteries. Similarly, in December 2024, it halted shipments of gallium and germanium to the US, demonstrating a clear pattern of leveraging its mineral dominance as a geopolitical tool.

The geopolitical impact extends beyond the US-China rivalry. Major economies, including the European Union, Japan, and South Korea, rely on Chinese mineral supplies for their technological and industrial sectors. In response, the EU has prioritised mineral diversification, while the US has sought to strengthen domestic and allied production through initiatives such as the Inflation Reduction Act and the Minerals Security Partnership with Australia and Canada.

To counter China’s strategic grip on these resources, affected nations are exploring several measures:

Boosting domestic mining and refining capacity: The US Pentagon has already invested in processing facilities to extract critical minerals and reduce reliance on Chinese sources.

Diversifying supply chains: Alternative sources are being explored in India, Australia, and Canada for rare earth elements, tungsten, and gallium.

Advancing recycling and substitution technologies: Research is underway to develop new recycling methods and alternative materials to lessen dependence on Chinese minerals.

Despite these efforts, establishing alternative supply chains will require time and substantial investment. In the short term, industries reliant on Chinese minerals are likely to face cost pressures and supply disruptions, impacting global manufacturing and clean energy transitions.

The Long-Term Implications of China's Strategic Move

China’s new export controls on strategic minerals mark a significant shift in the global economy. By maintaining its dominance over the mining and refining of critical resources, Beijing is exerting economic pressure on Western economies and disrupting global supply chains. The economic impact will be felt through rising prices and logistical hurdles, while the geopolitical fallout is set to deepen the already strained US-China relations.

As affected countries work towards alternative solutions, the coming decade may witness a structural transformation in the global minerals market, potentially diminishing China’s monopoly. However, until viable alternative sources are fully developed, Beijing’s strategic control over these essential resources will remain a formidable geopolitical tool in the landscape of global economic warfare.

Economic Activity🏦

Analysis: China’s Rock Bottom Drug Prices Spark Quality Concerns

Zhou Xinda, Cui Xiaotian, Jiang Moting, and Kelly Wang write in Caixin Global that China's centralised drug procurement policy, aimed at lowering medicine costs, has sparked concerns over quality. The latest round saw price cuts exceeding 70%, raising fears among medical professionals about compromised efficacy. While authorities are gathering feedback, experts call for stricter supervision, better transparency, and structural reforms to balance affordability with quality. Critics also argue that the system limits patient choice and squeezes out brand-name drugs in favour of cheaper local alternatives.

China Touts Record Spending Over Lunar New Year Holiday

John Liu and Hassan Tayir write in CNN that China's domestic travel and spending during the Lunar New Year reached record highs, with 501 million trips made and tourism revenue rising 7% to 677 billion yuan ($93 billion). The surge was driven by increased cross-border travel, government consumption incentives, and a booming box office. However, analysts caution that this spending boost may not indicate sustained economic recovery, as China faces structural economic challenges and rising U.S. tariffs.

Inside China🐉

PLA Navy Explores Training Methods for Carrier-Based Special Mission Aircraft

Liu Xuanzun writes in Global Times that the Chinese PLA Navy is developing training strategies for carrier-based special mission aircraft in preparation for deployment on the Fujian, China's first aircraft carrier with electromagnetic catapults. Using Y-7 transport aircraft, pilots at the PLA Naval Aviation University are simulating carrier-based operations. While the exact aircraft types remain undisclosed, experts suggest they may include early warning, maritime patrol, electronic warfare, and anti-submarine aircraft.

Chinese movie Nezha 2 becomes highest-grossing film in the country

Brenda Goh and Sophie Yu write in Reuters that Nezha 2 has overtaken The Battle at Lake Changjin to become China’s highest-grossing film of all time. Loosely based on the 16th-century novel Investiture of the Gods, the animated film continues China's trend of domestic blockbusters dominating the box office.

China and the World🌏

Xi Holds Talks with Brunei's Sultan

Xinhua reports that Chinese President Xi Jinping met Brunei's Sultan Hassanal Bolkiah in Beijing to enhance strategic coordination and economic cooperation. The leaders reaffirmed their commitment to deepening ties through the Belt and Road Initiative and key projects like the Guangxi-Brunei Economic Corridor. Xi emphasised expanding investment in Brunei’s digital economy and new energy sectors, while Brunei reiterated its commitment to the one-China policy. The meeting concluded with the signing of multiple cooperation agreements.

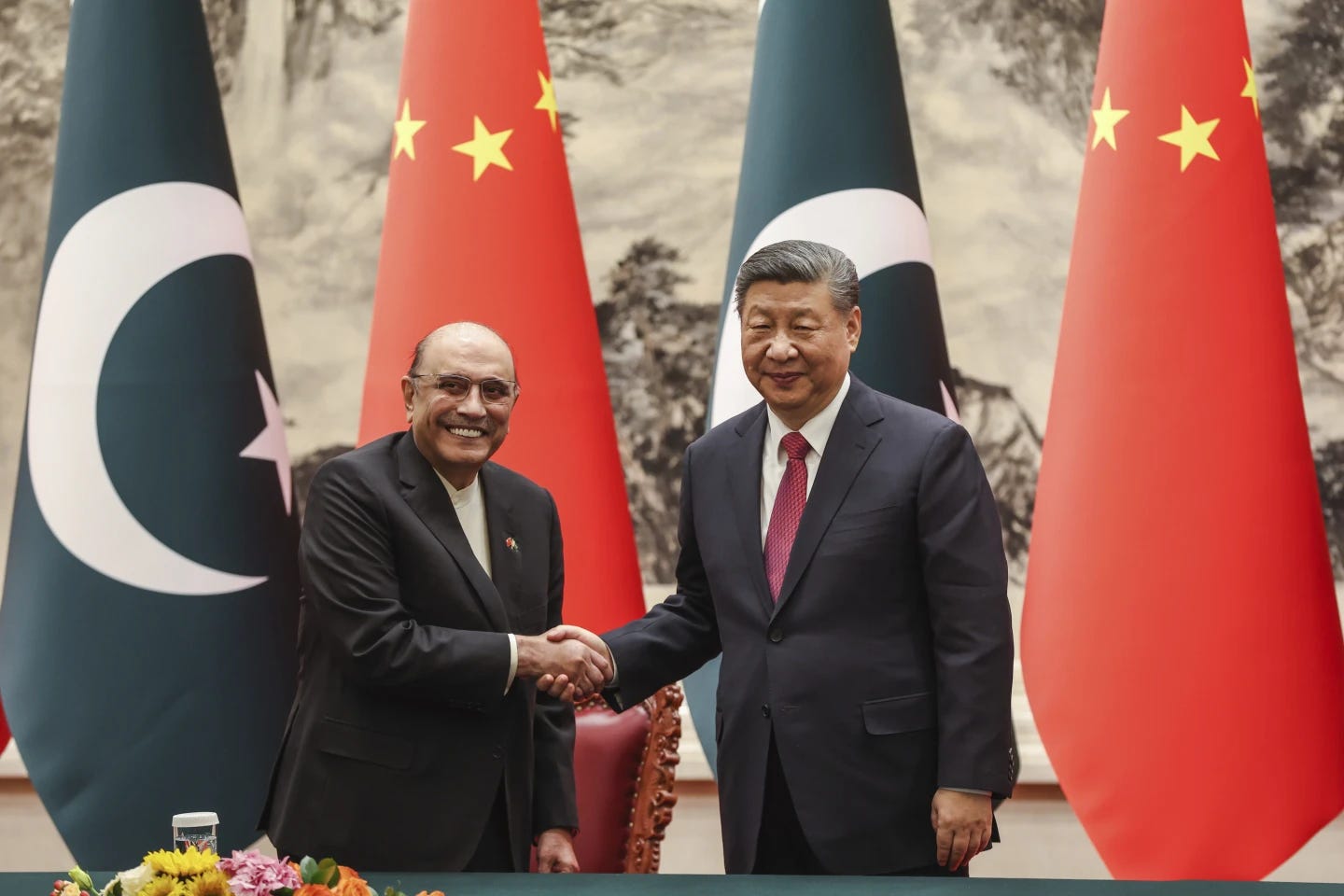

Pakistan’s President Says Extremist Attacks Won’t End Friendship with China

AP News reports that Pakistani President Asif Ali Zardari reaffirmed strong ties with China despite extremist attacks targeting Chinese nationals in Pakistan. Meeting with President Xi Jinping in Beijing, Zardari emphasised that Pakistan remains committed to its “all-weather friendship” with China. Attacks on Chinese workers, particularly in Balochistan, have raised concerns, yet both nations continue to advance the China-Pakistan Economic Corridor (CPEC). Xi pledged further cooperation, including modernisation support, as Pakistan navigates regional security challenges.

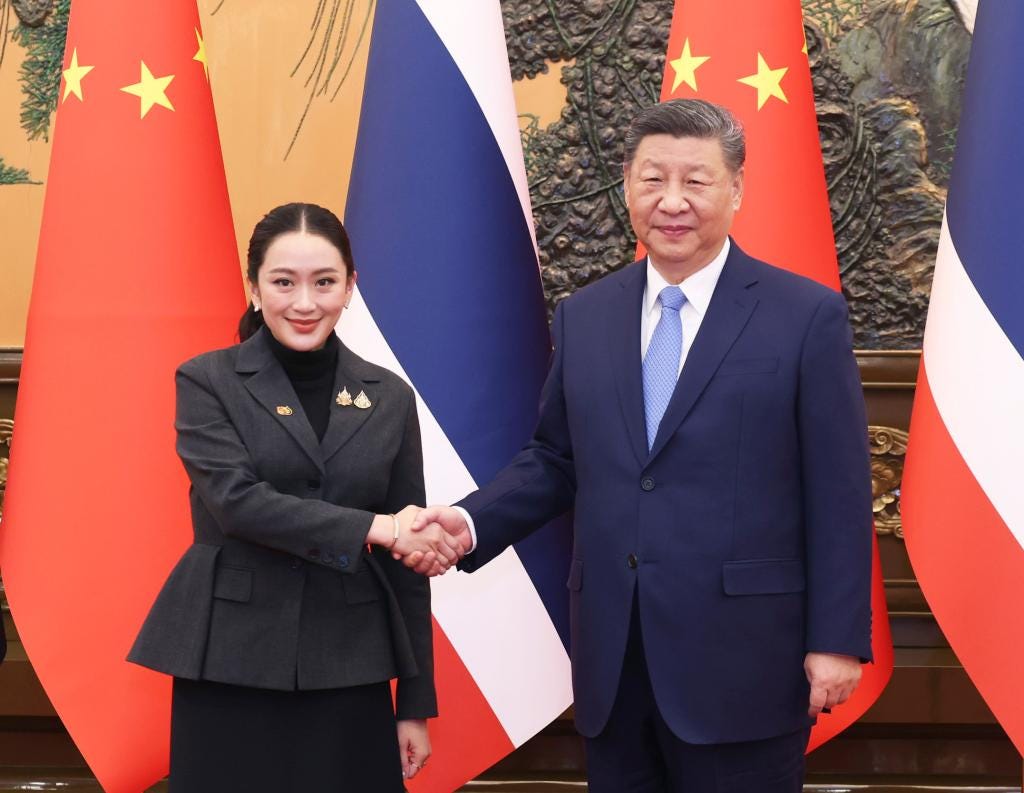

China’s Xi and Thailand’s Leader Vow to Crack Down on Scam Networks

Huizhong Wu writes in AP News that Chinese President Xi Jinping and Thai Prime Minister Paetongtarn Shinawatra have pledged to strengthen cooperation in tackling online scam networks in Southeast Asia. The meeting, marking 50 years of China-Thailand diplomatic ties, also covered economic projects, including a high-speed railway link and collaboration in the electric vehicle sector. Xi reiterated support for Thailand’s anti-fraud measures, while Paetongtarn affirmed Thailand’s commitment to the one-China policy.

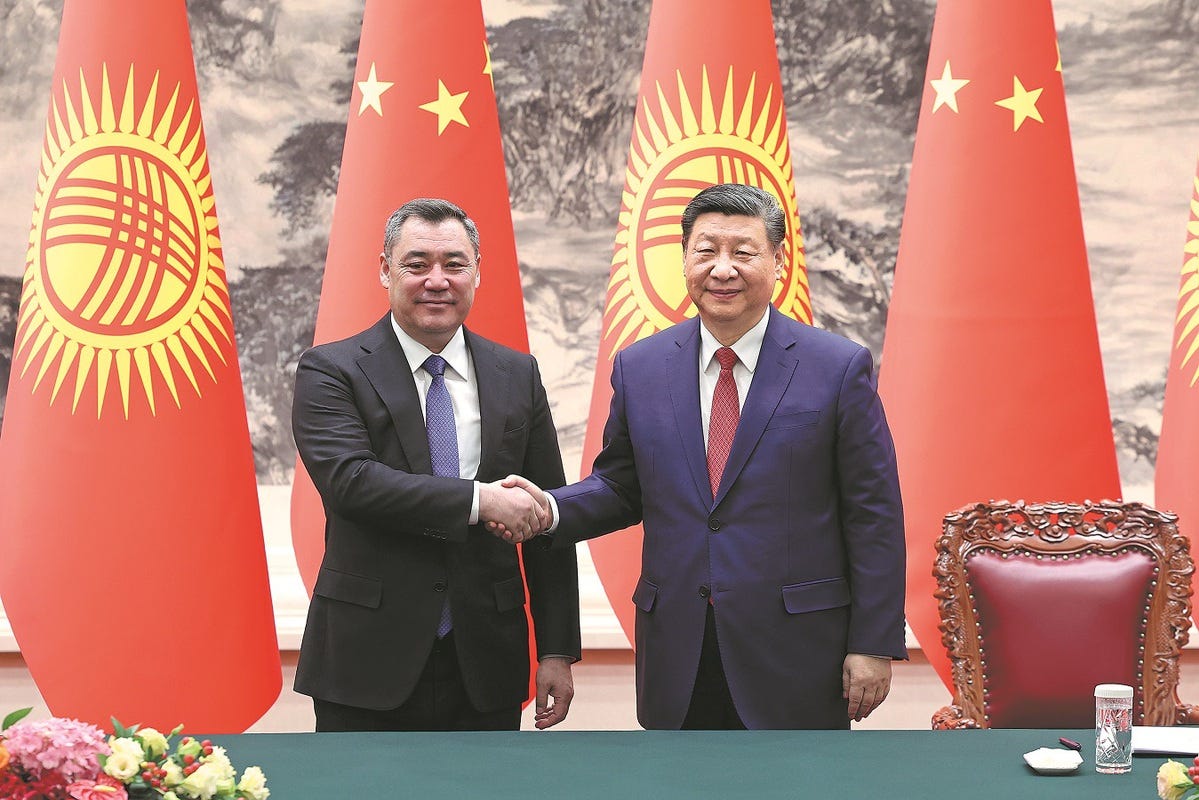

China, Kyrgyzstan to Advance Belt and Road Cooperation

Mo Jingxi writes in China Daily that Chinese President Xi Jinping and Kyrgyz President Sadyr Japarov have reaffirmed their commitment to high-quality Belt and Road cooperation during Japarov’s state visit to China. The two leaders signed agreements in diplomacy, trade, and infrastructure, with a focus on completing the China-Kyrgyzstan-Uzbekistan railway. China remains Kyrgyzstan’s largest trading partner, with bilateral trade reaching $22.71 billion in 2024. Xi emphasised expanding digital and industrial cooperation, while Japarov pledged to enhance business conditions for Chinese investors.

Lu Shaye, China’s Controversial Ex-Envoy to France, Handed New Role for Europe

Finbarr Bermingham writes in SCMP that Lu Shaye, China's former ambassador to France known for his abrasive diplomatic style, has been appointed Beijing’s special representative for European affairs. His tenure in Paris was marked by controversies, including questioning the sovereignty of former Soviet states and clashes with EU officials over China’s ties with Russia. Lu’s appointment comes as the EU signals openness to improving relations with China, raising questions about Beijing’s diplomatic strategy amid ongoing trade and geopolitical tensions.

PLA Wary of 'Joint Patrols' in South China Sea

Jiang Chenglong writes in China Daily that the PLA’s Southern Theater Command conducted a routine patrol in the South China Sea following joint US-Philippines air patrols. The PLA accused Manila of “colluding with outside countries” to justify its “illegal claims” in the region. Beijing has condemned the patrols as destabilising and reaffirmed its maritime rights. The PLA also defended its naval operations through the Basilan Strait, rejecting Philippine criticisms and asserting compliance with international law.

China is Infiltrating Taiwan’s Armed Forces

The Economist reports in The Economist that Taiwan is struggling to counter Chinese espionage within its military, with a rising number of spies being recruited through financial incentives, online platforms, and psychological pressure. China’s tactics have evolved from extracting intelligence to using infiltrators for psychological warfare, such as filming "surrender videos." Taiwan has intensified counter-espionage efforts, but China is leveraging these cases to deepen political divisions within the island.

China Slams Politicisation of Tech as Nations Restrict DeepSeek

CGTN reports that China has criticised the restrictions placed on DeepSeek, a Chinese AI service, by several countries, calling them an overreach of national security concerns. Foreign Ministry spokesperson Guo Jiakun stated that China adheres to strict data privacy laws and condemned the politicisation of technological advancements. DeepSeek, known for its open-source AI models, has influenced competitors to adopt similar strategies, with OpenAI and Alibaba responding by offering more accessible AI services.

Rubio welcomes Panama’s move to exit Chinese infrastructure plan as ‘great step forward’

Helen Davidson and Reuters write in The Guardian that U.S. Secretary of State Marco Rubio praised Panama’s decision to let its participation in China’s Belt and Road Initiative (BRI) expire, calling it a significant step for U.S.-Panama relations. The move follows diplomatic pressure from the U.S., with President Mulino hinting at an early termination of the agreement. Analysts see this as a strategic victory for the Trump administration’s efforts to counter China’s influence in Latin America.

McKinsey Partners Debate China Presence as US Tensions Rise

Ambereen Choudhury and Chanyaporn Chanjaroen write in Bloomberg that McKinsey & Co. partners are debating the firm's continued presence in China due to rising geopolitical tensions with the US. Some senior partners argue that the risks outweigh the benefits, especially with Donald Trump’s re-election and his stance on China. Others believe the firm's global strategy necessitates maintaining operations in the country, despite the challenges.

China Weighs Probe Into Apple’s App Store Fees, Practices

Pei Li writes in Bloomberg that China’s antitrust regulator is preparing a potential investigation into Apple's App Store policies, including its 30% commission on in-app purchases and restrictions on third-party app stores. This move comes amid rising trade tensions between Beijing and Washington, following new U.S. tariffs on Chinese tech. The probe could escalate regulatory scrutiny on foreign tech firms operating in China.

China Counters with Tariffs on US Products, Investigates Google

Ken Moritsugu and Huizhong Wu write in AP News that China has imposed retaliatory tariffs on key US imports and launched an antitrust investigation into Google in response to new tariffs introduced by US President Donald Trump. Beijing's measures include tariffs on American coal, liquefied natural gas, crude oil, and automobiles, while also restricting exports of critical minerals. Additionally, China has blacklisted US firms PVH Group and Illumina, citing violations against Chinese businesses. Analysts warn of escalating trade tensions that could impact global economic growth.

USPS Resumes Accepting Packages from China and Hong Kong After Temporary Suspension

CBS News reports that the U.S. Postal Service reversed its suspension of incoming packages from China and Hong Kong just a day after halting shipments in response to President Trump’s new tariffs. The suspension, which excluded letters and flats, had threatened trade, particularly for Chinese online retailers like Shein and Temu. USPS is now working on a tariff collection mechanism to minimise disruptions. Meanwhile, Beijing criticised the move as “unreasonable suppression” of Chinese firms, while Trump plans to discuss trade tensions with President Xi Jinping.

Tanzania, Burundi Sign $2.15bn Railway Construction Deal with Chinese Firms

Railway Technology reports that Tanzania and Burundi have signed a $2.15 billion agreement with China Railway Engineering Group and China Railway Engineering Design and Consulting Group to build a 282km standard gauge railway (SGR). The project, backed by the African Development Bank, aims to transport three million metric tonnes of minerals annually, boosting trade between the two nations. Expected to be completed in 72 months, the railway will connect key mining regions to Tanzania’s port city of Dar es Salaam, strengthening infrastructure links in Eastern and Central Africa.

Tech in China🖥️

Huawei Hits $118B Revenue, Fastest Growth in 4 Years

Tech in Asia reports that Huawei's revenue for 2024 surged to 860 billion yuan (US$118.27 billion), marking a 22% increase from the previous year and its fastest growth in four years. The company attributed this success to expansion across multiple business segments. In 2023, Huawei reported total revenue of 704.2 billion yuan (US$96.82 billion), highlighting the significant year-on-year growth.

Chinese Developer Completes Delivery of Liqing-2 Rocket Engine

CGTN reports that China has completed the delivery of its Liqing-2 liquid oxygen kerosene rocket engine, developed by CAS Space. Designed for the Lijian rocket series, the engine features a thrust range of 50-100% and a maximum ground thrust of 110 tonnes. The development began in 2023, with production starting in 2024. This marks a milestone in China's commercial spaceflight sector, with the Lijian-1 series having already launched 57 satellites across five missions.

De/Cypher Data Dive📊

China holds a dominant position in global supply chains, accounting for 94% of gallium production, 83% of germanium, and 56% of antimony. In December 2024, the Chinese government implemented an export ban on these critical minerals to the United States, further intensifying ongoing technological trade disputes between the two nations. The restrictions have led to substantial increases in global prices for gallium, germanium, and antimony.

Image of the Week📸

- - -