China This Week: ASEAN-Gulf Trade Bloc Deepens, Debt Pressures Mount, U.S. Targets Chinese Student Visas

This week, we explore China’s deepening ties with ASEAN and Gulf states through a landmark trilateral summit, alongside key developments in its domestic and foreign policy landscape.

China Quote 🗩

“The issue of African critical minerals has been a thorn in US-China relations. The Trump Administration has made it a priority."

Yun Sun, director of the China program at the Stimson Center in Washington.

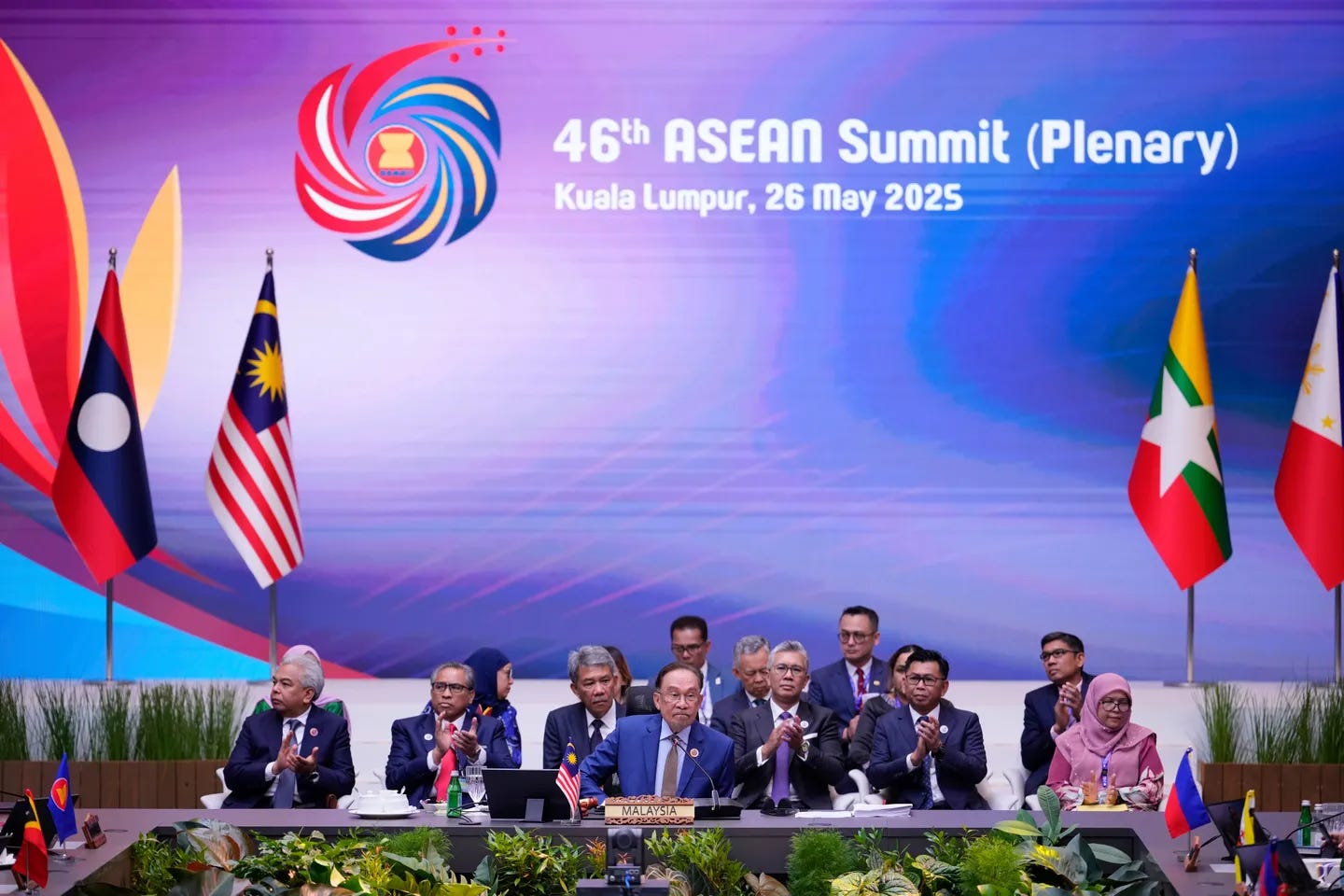

ASEAN, China and Gulf States Build a New Centre of Gravity for Global Trade

On 27 May 2025, leaders from ASEAN, China and the Gulf Cooperation Council (GCC) met in Kuala Lumpur for their first trilateral summit, forming what many are calling a new axis of cooperation in an increasingly tumultuous global landscape. The gathering comes as a response to mounting tariff threats from the United States and rising concerns over economic fragmentation. It also reflects a deeper transformation underway in Asia and the Gulf, one that blends trade strategy, infrastructure investment and image-building into a new kind of global influence.

A key concern driving this convergence is the return of US tariff politics. Former President Donald Trump’s “liberation day” tariffs, though recently overturned in court, have raised alarm across Southeast Asia. Export-driven economies such as Vietnam and Cambodia face proposed levies above 40 percent. ASEAN leaders used the summit to underline that no bilateral deal with the US should come at the cost of regional cohesion. Malaysia’s Prime Minister Anwar Ibrahim confirmed that ASEAN would move ahead with plans for a free trade agreement with the GCC by October, while also seeking upgraded deals with the European Union and China.

Chinese Premier Li Qiang, speaking at the summit, called for a new model of cooperation based on mutual benefit, macroeconomic coordination and cross-cultural openness. He urged ASEAN, China and the GCC to harness their collective potential — over $24 trillion in GDP and more than two billion people — to build what he described as a model of “cross-regional openness.” China and ASEAN have already completed negotiations for Version 3.0 of their existing free trade agreement.

The inclusion of the GCC in this framework speaks to changing realities. Gulf economies, once viewed narrowly as oil-exporting states, are recasting themselves as technology hubs and cultural hosts. From high-profile football club acquisitions and the 2022 World Cup in Qatar to partnerships in Formula One, golf and mixed martial arts, the Gulf’s global visibility has surged. Sovereign wealth funds from Saudi Arabia, the UAE and Qatar have invested in everything from Monumental Sports in the US to emerging sports leagues across Europe. While some critics frame this as sportswashing, many analysts point to broader ambitions such as economic diversification, tourism promotion and soft power diplomacy.

This is further evident in the region’s embrace of advanced technologies. Chinese robotaxi companies such as Baidu, Pony.ai and WeRide have found strong demand in the Gulf, where supportive regulation and infrastructure are enabling commercial-scale autonomous vehicle trials in Abu Dhabi, Riyadh and Dubai. Gulf authorities have set targets to make 15 to 25 percent of all daily trips driverless by 2030. With Tesla and Waymo also eyeing the region, the Gulf may become a key theatre in the global competition over smart mobility.

Yet China’s expanding footprint comes with complications. A recent study by the Lowy Institute warns that the 75 poorest nations face a combined $22 billion in repayments to China in 2025, most of it tied to loans under the Belt and Road Initiative. Many of these projects, ranging from ports to power stations, were built in countries with few alternative financing options. While some governments see China as a reliable partner, the scale of repayments is straining budgets already under pressure from inflation, climate impacts and post-pandemic recovery. Beijing must now balance its role as a strategic investor with mounting expectations to restructure debts and ease conditions.

Amid these shifting dynamics, ASEAN is repositioning itself. Rather than serve as a battleground for great power rivalry, the bloc is seeking to build its own strategic agency. With the US leaning towards protectionism and Europe grappling with economic stagnation, Southeast Asia is broadening its partnerships across the Global South. ASEAN’s decision to invite both China and the GCC to a single summit is part of this broader shift.

The numbers highlight the opportunity. Despite accounting for a quarter of global population and output, trade between ASEAN, China and the GCC still represents just 5 percent of global trade. Leaders at the summit made clear their intent to grow this figure through better connectivity, financial integration and innovation partnerships.

What emerges is a blueprint for a new kind of international cooperation, shaped not by legacy institutions but by pragmatic interests and regional confidence. If the ASEAN-GCC-China platform can deliver on its goals, it could become one of the most significant engines of global commerce in the years ahead. In doing so, it may mark a lasting shift in where the world’s economic centre of gravity lies.

Economic Activity🏦

Poorest 75 nations face ‘tidal wave’ of debt repayments to China in 2025, study warns

Helen Davidson writes in The Guardian that a Lowy Institute report warns of a record $22bn in repayments due this year from the world’s 75 poorest nations to China, mostly from Belt and Road loans. The debt burden threatens spending on health, education, and climate action, raising concerns over China's leverage and prompting scrutiny of its lending practices amid its own economic slowdown.

European companies cut costs, scale back investments in China as its economy slows

AP News reports that European firms are trimming costs and shelving investments in China amid weak consumer demand, falling profit margins, and industry overcapacity driven by state subsidies. The EU Chamber of Commerce's 2025 survey highlights declining confidence as Chinese competition intensifies and global concerns mount over trade imbalances and underpriced exports like electric vehicles.

How Heineken tapped into China’s beer market

Thomas Hale and Madeleine Speed write in the Financial Times that Heineken defied China’s shrinking beer market with a nearly 20% volume rise in 2024, aided by a strategic tie-up with state-owned China Resources Beer. By leveraging local distribution and targeting premium segments, Heineken expanded nationwide, outpacing rivals like Budweiser and Carlsberg. Despite a €874mn impairment charge, the partnership remains pivotal for Heineken’s China strategy.

The Global Tussle for the Port of Darwin

Bloomberg reports that tensions have resurfaced over the Port of Darwin as Australia moves to reclaim the strategic facility from Chinese company Landbridge, which was granted a 99-year lease in 2015. Beijing has condemned the move as “ethically questionable,” while a U.S. private equity firm has shown interest in acquiring the lease. Prime Minister Albanese now faces a delicate balancing act between China, Australia’s top trading partner, and the U.S., its key defence ally.

Inside China🐉

Former deputy head of China's defense technology agency under probe

China Daily reports that Zhang Jianhua, former deputy head of the State Administration of Science, Technology and Industry for National Defense, is under investigation for suspected serious violations of Party discipline and national law. The 63-year-old veteran official turned himself in, according to the CPC's top anti-corruption bodies.

China introduces rules to protect military-industrial assets from spies and sabotage

Liu Zhen writes in the South China Morning Post that China has issued new regulations to protect key military-industrial facilities from espionage, sabotage, and cyber threats. Effective from September 15, the rules classify sites involved in weapons R&D, production, and storage as “protected areas,” impose strict surveillance, and encourage public reporting of intrusions, reinforcing national security amid rising geopolitical tensions.

5 dead and 6 missing after explosion at Chinese chemical plant

NBC reports that an explosion at the Gaomi Youdao Chemical plant in Shandong, China, killed five people, injured 19, and left six missing. The blast shook buildings, released toxic smoke, and prompted emergency deployment of over 230 personnel. Despite past safety citations, the plant was recently praised for internal hazard management, raising questions about oversight in China’s chemical sector.

China Unveils World’s First AI Nuclear Inspector

Stephen Chen writes in the South China Morning Post that Chinese scientists have developed the world’s first AI system to verify nuclear warheads without revealing design secrets. Developed by the China Institute of Atomic Energy, the tool blends deep learning and cryptography to distinguish real warheads from decoys, aiming to modernise arms control verification amid stalled US–China disarmament talks.

China and the World🌏

Rubio says U.S. will 'aggressively' revoke visas for many Chinese students

Emily Feng writes in NPR that U.S. Secretary of State Marco Rubio announced plans to revoke visas of Chinese students, especially those in "critical fields" or linked to the Chinese Communist Party. The move, part of broader Trump-era policies, may impact over 280,000 Chinese students and strain U.S.–China relations, while also hurting American universities reliant on full-fee international enrolments.

ASEAN Opens Summit with Persian Gulf and China as US Tariffs Loom

Eileen Ng writes in AP News that Malaysia hosted the first ASEAN–GCC–China summit to deepen economic cooperation amid global trade turmoil triggered by U.S. tariff threats. Leaders vowed to explore a free trade area, with Chinese Premier Li Qiang emphasising connectivity and resilience. ASEAN reaffirmed its neutrality, seeking balanced ties with both Washington and Beijing.

China Defence Minister Skips Singapore Forum Attended by Hegseth

Josh Xiao and Lucille Liu write in Bloomberg that China’s Defence Minister Dong Jun will not attend the Shangri-La Dialogue in Singapore, breaking a pattern of high-level participation since 2019. Instead, a delegation from the PLA National Defence University will represent Beijing, avoiding a potential face-off with US Defence Secretary Pete Hegseth amidst ongoing US-China tensions.

BRICS Approves Joint Declaration for Fairer, More Inclusive Global Trade

BRICS reports that trade ministers have adopted a Joint Declaration focusing on WTO reform, a renewed 2030 Economic Partnership Strategy, and digital economy cooperation. The bloc criticised unilateral trade barriers, backed a rules-based multilateral system, and proposed frameworks for data governance and sustainable trade. The declaration highlights BRICS’ ambition to shape a more equitable global trade architecture, especially for the Global South.

China offers Pacific Islands increased support in addressing climate change

Reuters reports that Chinese Foreign Minister Wang Yi pledged enhanced climate support to Pacific Island nations, committing to 100 small-scale projects and a $2 million investment in clean energy and sustainable sectors. The initiative, part of China’s Belt and Road strategy, comes amid frozen U.S. aid and growing competition for regional influence. China emphasised the islands’ vulnerability to climate threats.

Prague accuses China of hacking Czech foreign ministry

Antoaneta Roussi writes in Politico that Czechia has accused Chinese state-sponsored group APT31 of a cyberattack that accessed unclassified emails from its foreign ministry dating back to 2022. Foreign Minister Jan Lipavský summoned China’s ambassador, warning the breach damages bilateral ties. The EU and NATO condemned the attack, calling for China to uphold international norms and cease hostile cyber activities.

China improves ability to launch sudden attack on Taiwan, officials say

Kathrin Hille and Demetri Sevastopulo write in the Financial Times that Chinese military reforms have significantly enhanced Beijing’s capacity to launch a rapid assault on Taiwan. U.S. and Taiwanese officials report that the PLA can now swiftly shift from peacetime to wartime operations, with amphibious brigades, air power, and joint rocket systems on constant readiness. The PLA’s integration of firepower and proximity to Taiwan shortens warning times, fuelling fears of a surprise offensive.

Thailand, Singapore and China mask up as COVID-19 reemerges

Apornrath Phoonphongphiphat, Wataru Suzuki, and Dylan Loh report in Nikkei Asia that renewed COVID-19 outbreaks across Asia have prompted governments to reintroduce protective measures. Thailand has recorded over 187,000 cases and 46 deaths this year, while Singapore and China also report surging infections. Mask mandates and public health alerts have returned amid concerns over healthcare readiness and tourism impacts.

India's Bajaj Auto warns China magnet delays will hit EV output by July

Reuters reports that Bajaj Auto has warned of a potential halt in EV production by July due to delays in rare earth magnet exports from China, following Beijing’s April restrictions. Executive Director Rakesh Sharma called it a “dark cloud” over operations, even as the company beat Q4 profit estimates. Indian auto groups have urged government intervention to release magnet shipments stuck at Chinese ports.

Nvidia beats on Q1 revenue, says it expects an additional $8 billion charge on H20 losses in Q2

Daniel Howley writes in Yahoo Finance that Nvidia posted Q1 revenue of $44.1 billion, beating forecasts, but missed on adjusted EPS due to U.S. export bans on H20 chip sales to China. The company expects a further $8 billion hit in Q2. Despite the setback, surging AI demand lifted shares by nearly 5%, with CEO Jensen Huang calling AI “essential infrastructure.”

Tech in China🖥️

China launches Tianwen-2 mission to sample near Earth asteroid

Andrew Jones reports in SpaceNews that China has launched its Tianwen-2 mission to collect samples from the near-Earth asteroid Kamoʻoalewa, with a planned return by 2027. The mission will later visit comet 311P/PANSTARRS. Designed to test complex small-body exploration techniques, Tianwen-2 positions China alongside global planetary defence efforts and expands its capabilities in space science and astrobiology.

De/Cypher Data Dive📊

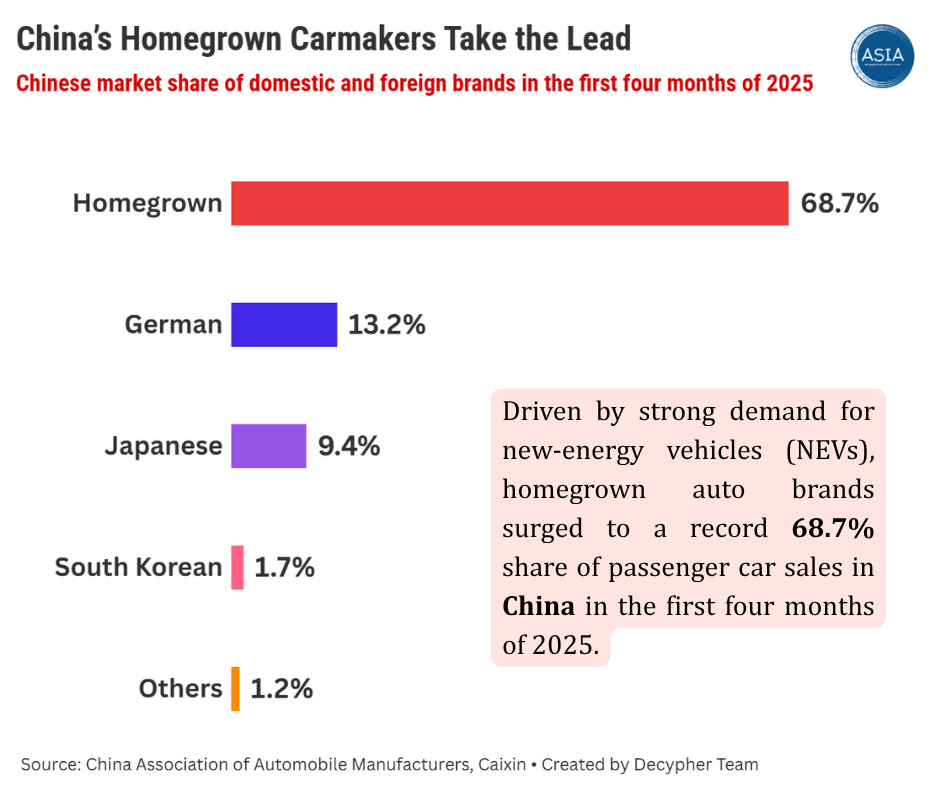

Foreign carmakers, once dominant in China, are now struggling to keep up after failing to adapt quickly to the country’s fast shift toward electric vehicles (NEVs). In contrast, Chinese automakers have soared, accounting for a record 68.7% of passenger car sales in early 2025, up from 38.4% in 2020. To recoup ground, multinational companies are collaborating with local firms and supply chains to compete more effectively in the world's largest auto market.

Image of the Week📸

— — —

Microessay By Aurko

Data By Bhupesh

Edited By Aurko

Produced by Decypher Team in New Delhi, India