China and the World: China revives ‘wolf warrior’ diplomacy, Russia–Ukraine War Shifts, China’s Iron Grip in Africa

We track key shifts in China’s domestic and foreign policy landscape and major global developments, including Russia’s escalating strikes on Ukraine’s energy sector and China’s widening role in Africa

China Quote 🗩

“China’s economy is facing pressures from all sides, The strong lift from exports that supported growth in recent quarters will be hard to sustain into next year, even if U.S. import tariffs now turned out lower than feared. That leaves domestic demand to pick up the slack, but without significant further stimulus, it will be hard to reverse recent slowing in both investment and consumption.”

- Fred Neumann, chief Asia economist at HSBC

Russia–Ukraine War Enters a New Phase

The Russia-Ukraine war (2022 – ongoing) has evolved into a theatre of strategic escalation and military adaptation. In its third year, the rapid military invasion that began in February 2022 has turned into a war of attrition – defined by long-range strikes, energy blackouts and a severe diplomatic fatigue that has taken across the West. The latest line of attack adopted by Russia has a simple mission in place – to annihilate Ukraine’s energy grid and to stretch its already precarious air defence networks beyond recovery.

Russia has been attacking Ukraine non-stop with a barrage of drone and missile strikes aiming for their air defence systems. Significant damages have been done to the Khmelnytskyi and Rivne nuclear power plants – implicating that a nuclear fallout is something Russia is not ruling out. The attacks have destroyed thermal power stations in Zmiivska and Trypilska with the intention of making the winters worse for the Ukrainians. Centrenergo, Ukraine’s energy operator has confirmed that power generation has fallen to zero leaving Ukraine highly vulnerable since the beginning of war.

In total, Russia launched 45 ballistic and cruise missiles and 458 Shahed drones across five regions. Ukraine’s air defence units managed to intercept 406 drones but only nine missiles, underscoring the deepening asymmetry between Russia’s offensive and Ukraine’s defensive capacities. President Volodymyr Zelenskyy acknowledged this shortfall, stating that “only a few systems in the world can intercept such missiles effectively — and to protect our entire territory, we need far more.”

Evolution of Russia’s Arsenal: From Missiles to Jet-Powered Glide Bombs

The slew of recent assaults indicates Russia’s growing technical sophistication. Moscow combined Iskander-M ballistic missiles (9K720), known for their evasive manoeuvres, with Kh-101 cruise missiles launched from Tu-95MS bombers, and Kinzhal (Kh-47M2) hypersonic missiles, capable of flying at over Mach 10. Complementing these were Iranian-made Shahed-136 and Shahed-131 drones, cheap and expendable but highly effective for saturating Ukrainian radar networks.

Ukraine on the other hand is highly reliant on western missile systems like Patriot, NASAMS, IRIS-T and SAMP/T that are relevant assets but remain too few to be able to do serious damage. Also, the geographical terrain at which it is dispersed is too large for it to effectively protect the country. As a result, air defence systems are overworked and depleting faster than can be replenished.

Yet, what is truly concerning from the Russian side has been the deployment of Soviet-era ‘dumb bombs’ - these jet powered glide bombs or KABs have been retrofitted with wings, turbojets and guidance kits allowing them a range of up to 200 kms. This allows Russians to strike targets beyond the frontline and can potentially reach regions like Odesa, Mykolayiv and Poltava, previously untouched territories. The deputy head of Ukraine’s military intelligence Vadym Skibitsky believes that this could add heavy strain on an already stretched Ukrainian defence.

Unconfirmed images of one such bomb recovered in Poltava show a Chinese-made turbojet engine — purchasable for just $18,000 on Alibaba — attached to the body of a retrofitted KAB. Recently, a variant of the UMPB-5R hit the Ukrainian town of Lozova in the Kharkiv region, injuring 6 civilians and damaging 11 buildings. The missile flew nearly 140 kms to be able to do so.

Other bombs have been launched from aircraft flying over the Black Sea, with trajectories directed at the southern oblasts. Another model, the Grom-E1, has also appeared, with flight dynamics that could roughly be comparable to a cruise missile as observed by the Ukrainian air force spokesperson Yuriy Ihnat.

While these jet-powered bombs carry smaller payloads of around 250 kilograms, their long reach allows Russian aircraft to operate safely within Russian-controlled airspace, reducing exposure to Ukrainian counterattacks. As missile expert Fabian Hoffmann of the University of Oslo notes, “the main benefit for Russia is that they can launch glide bombs from even further behind the frontline, making the aircraft delivering them less vulnerable.”

A Strained Ukrainian Defence

As Ukraine analyst Pavlo Narozhny has described as “the economy of war,” Russia is pivoting to cheaper munitions. The West is using its interceptors such as the Patriot missile system against Russian equipment (which may cost a few hundred dollars) that can cost $4 million a shot to fire. Narozhny warned that if Russia increases the production of jet-powered bombs and inexpensive drones, it will present “a huge challenge for Ukraine.”

Rates of missile interception in Ukraine have fallen — from 37 percent over the summer to just 6 percent in September, as Russia has deployed more advanced ballistic missiles specifically designed to outfly Patriot interceptors. Similarly, interception of Shahed drones dropped from 97% in February to 80% in October, evidence not only of the improved drone designs but also of Ukraine’s depleted defensive resources.

Ukraine is gradually getting some reinforcements despite limited capacity. Zelenskyy has recently flagged the incoming of more Patriot systems from Germany and that a “multi-component” air defence system is needed to tackle an ever-greater threat coming from Russian aerial movements. But those additions are modest relative to the size of Russia’s aerial onslaught, which increasingly combines high-end precision weapons with mass-produced expendables.

Energy War and Nuclear Risks

Russia’s recent bombardments signal a systematic effort to disrupt Ukraine’s energy infrastructure, like the strategy pursued during the 2022–2023 winter campaign. The International Atomic Energy Agency (IAEA) has raised alarm over the strikes near nuclear plants, arguing that power interruptions can interfere with cooling systems and increase the chance for a radiation incident. Sybiha asked the IAEA board to address the issue urgently and urged countries like China and India to pressure Russia to stop their reckless attacks on nuclear sites.

The fallout of such attacks has been immediate. Major cities such as Kharkiv, Kremenchuk, and Chernihiv have suffered widespread blackouts, leaving residents without electricity, water, or heating for extended periods. Customs operations of the state border service have been suspended due to the outage of the database, and energy companies such as DTEK indicated Russia’s aim is to, “completely destroy Ukraine’s energy system.”

Conclusion: Diplomatic Fallout and the Stalemate in Peace Efforts

The increasing military involvement occurs against a backdrop of stalled diplomatic initiatives to conclude the war. US-led peace talks have failed, Europe is grappling with the fallout of the Trump administration and peace seems like a long shot for Ukraine.

Among the Asian nations, Moscow’s increasing military collaboration with Iran and North Korea, along with economic and technological ties with China, has bolstered the notion that the conflict has expanded beyond the region. In turn, Ukraine’s request for more vocal international condemnation — notably from Beijing and New Delhi — has received muted responses as both states have continued to manage the strategic relationships that they have with Russia.

The diplomatic impasse has left Ukraine reliant on piecemeal Western aid, while Russia leverages its domestic industrial capacity to sustain a long war. The result is a grinding stalemate — militarily, politically, and economically — with devastating consequences for civilians and a growing risk of a nuclear or humanitarian catastrophe.

This diplomatic impasse has left Ukraine reliant on piecemeal Western aid which seems in jeopardy with Donald Trump’s dislike of the President Zelensky. Russia on the other hand has managed to leverage its domestic industrial capacity to sustain long war. Right now, peace talks are at a grinding stalemate where military, political and economic devastation for civilians are at the highest. The growing risk of a nuclear catastrophe with significant human costs cannot be denied.

The Shipper Who Unlocked Africa’s Iron for China

Sun Xiushun’s playbook is geoeconomics in action as he treats logistics as strategy. A decade after pivoting Guinea into China’s dominant bauxite supplier when Indonesia restricted exports, he has applied the same “infrastructure-first” model to Simandou in Guinea, long the world’s largest stranded iron-ore deposit.

The numbers tell the story: a 600-plus-km trans-Guinea railway, tunnels, and bridges to a new deep-water port at Morebaya, and a corridor company (Compagnie du TransGuinéen) with state equity alongside Rio Tinto/Simfer and the Winning Consortium for Simandou. Capitalised at around a $23 billion build, the asset could ultimately supply roughly a tenth of global iron-ore needs, with high-grade (>65% Fe) ore that lowers steelmakers’ emissions intensity and blends.

Simandou is a case study in China’s “corridor diplomacy.” By unifying builder, financer, operator and offtaker (Chinese SOEs and partners like Baowu and Hongqiao) bankability is created inside the network rather than sought from it. Standardised Chinese designs, modular construction, and a builder-operator role have replaced the Western EPC + project-finance sequence, which has repeatedly failed under Africa’s political and permitting risks.

However, speed came with trade-offs, including accident reports and sensitive ecosystem crossings. Nevertheless, it shifted bargaining power: Conakry extracted equity, common-carrier access, and visible national hardware (Guinea’s first new railway in half a century).

Market effects will be profound. High-grade Simandou volumes pressure the Pilbara-Carajás oligopoly (BHP/Rio/Vale), diversify China’s dependence away from Australia, and support Beijing’s decarbonisation cost curve for steel.

Politically, two Guinean coups since 2008 and shifting governance baselines did not derail the project once the corridor became an irreversible fact on the ground, illustrating how “infrastructural power” can outlast cabinets. The Western choice is now stark: co-invest and share standards in mixed consortia, or cede the rule-setting of Africa’s next generation of resource corridors to a logistics-led model that has just proven it can move mountains, literally, to the sea.

In sum, Sun didn’t just chase the prize; he carved the route that made Africa’s ore China’s.

Economic Activity🏦

Trump, Xi reach one-year truce on tariffs and tech curbs amid fentanyl cooperation

Reuters reports that the United States and China agreed to a year-long pause in their trade and technology disputes following talks between Donald Trump and Xi Jinping at the APEC summit in Busan. Washington will halve tariffs on Chinese fentanyl-related goods and suspend new export control expansions, while Beijing will freeze rare-earth export restrictions and resume large-scale purchases of U.S. soybeans. The two sides also pledged closer cooperation to curb the flow of fentanyl precursors to North America.

Mexico imposes permanent duty on Chinese synthetic rubber after dumping probe

SCMP reports that Mexico has introduced a permanent anti-dumping duty on Chinese imports of styrene butadiene styrene (SBS) rubber, following evidence that underpriced shipments severely weakened the country’s lone producer, Dynasol Elastómeros. The duty, set at US$0.8324 per kilogram, comes amid rising trade frictions as Mexico moves to protect domestic industries and Beijing pushes back against tariff proposals affecting Chinese goods.

China’s housing downturn accelerates as October prices fall at fastest rate this year

SCMP reports that China’s new home prices dropped 0.5% month-on-month in October across 70 cities, the steepest decline in a year, despite government support measures. Prices fell 2.6% year-on-year, with only six cities recording gains. Major markets including Beijing, Shenzhen, and Guangzhou all declined, while Shanghai saw a slight 0.3% rise. Analysts said developers are prioritising cash flow over profits amid severe liquidity pressures and debt defaults. Local authorities have issued over 510 policy measures this year to stabilise the sector, but secondary home prices also continued to fall, dropping 0.7% month-on-month and 5.4% year-on-year, highlighting continued weakness in China’s property market.

China uses big data to pursue citizens evading taxes on overseas trading income

Yahoo Finance reports that Chinese authorities have intensified efforts to collect taxes from citizens with offshore investment income, using big data analytics to identify undeclared earnings. Tax bureaus in major cities including Beijing and Shenzhen said they had “reminded and coached” individuals to pay overdue taxes, with some facing multimillion-yuan fines. The campaign reflects Beijing’s push to curb capital flight and boost fiscal revenue amid slowing land sales and tighter local government budgets, marking stricter enforcement of global tax reporting standards adopted since 2018.

PBOC promotes yuan borrowing overseas to accelerate currency internationalisation

Bloomberg reports that the People’s Bank of China plans to expand yuan-denominated financing abroad to strengthen the currency’s global role. In its annual report, the central bank said it would back offshore yuan loans, panda bonds and trade financing to make it easier for foreign companies and institutions to access the currency. The move reflects Beijing’s strategy to boost offshore demand for the yuan amid weaker domestic growth and ongoing efforts to reduce reliance on the U.S. dollar.

SoftBank doubles quarterly profit after $5.8 billion Nvidia sale funds OpenAI bet

The Wall Street Journal reports that SoftBank Group’s quarterly profit surged to $16.2 billion, more than double from a year earlier, driven by gains from its massive investment in OpenAI. The Japanese conglomerate sold its entire $5.8 billion stake in Nvidia last month to finance a $30 billion commitment to the ChatGPT maker, of which $7.5 billion has already been invested. The sale marked SoftBank’s pivot toward artificial intelligence as it seeks new growth after years of losses in its Vision Fund, coinciding with OpenAI’s valuation soaring to $500 billion.

China’s internet platforms cautiously resume lending as regulators ease fintech curbs

The Business Times reports that major Chinese tech firms including Ant Group, Meituan and ByteDance are quietly expanding consumer lending operations as Beijing encourages cheaper household borrowing to boost spending. The move follows government subsidies on consumer loans and signals a more accommodative regulatory environment after years of fintech crackdowns. Analysts say the stable oversight could lift profits across online lending platforms, though rising defaults and weak household incomes remain risks that may prompt regulators to tighten controls again.

Inside China🐉

Xi’s widening military purge raises questions over PLA combat readiness

FT reports that China’s latest round of military purges has removed or sidelined dozens of senior People’s Liberation Army officers, including multiple theatre commanders and political commissars, creating uncertainty over the force’s preparedness. The navy chief, the southern theatre commander and its political commissar were all absent from the recent commissioning of the Fujian aircraft carrier. Analysts say the shake-up is now hitting figures with frontline operational roles, following earlier graft purges in missile forces and procurement. PLA activity around Taiwan has dropped since spring, though experts caution this may reflect a shift in training priorities or political calculations rather than diminished capability.

International Relations🌏

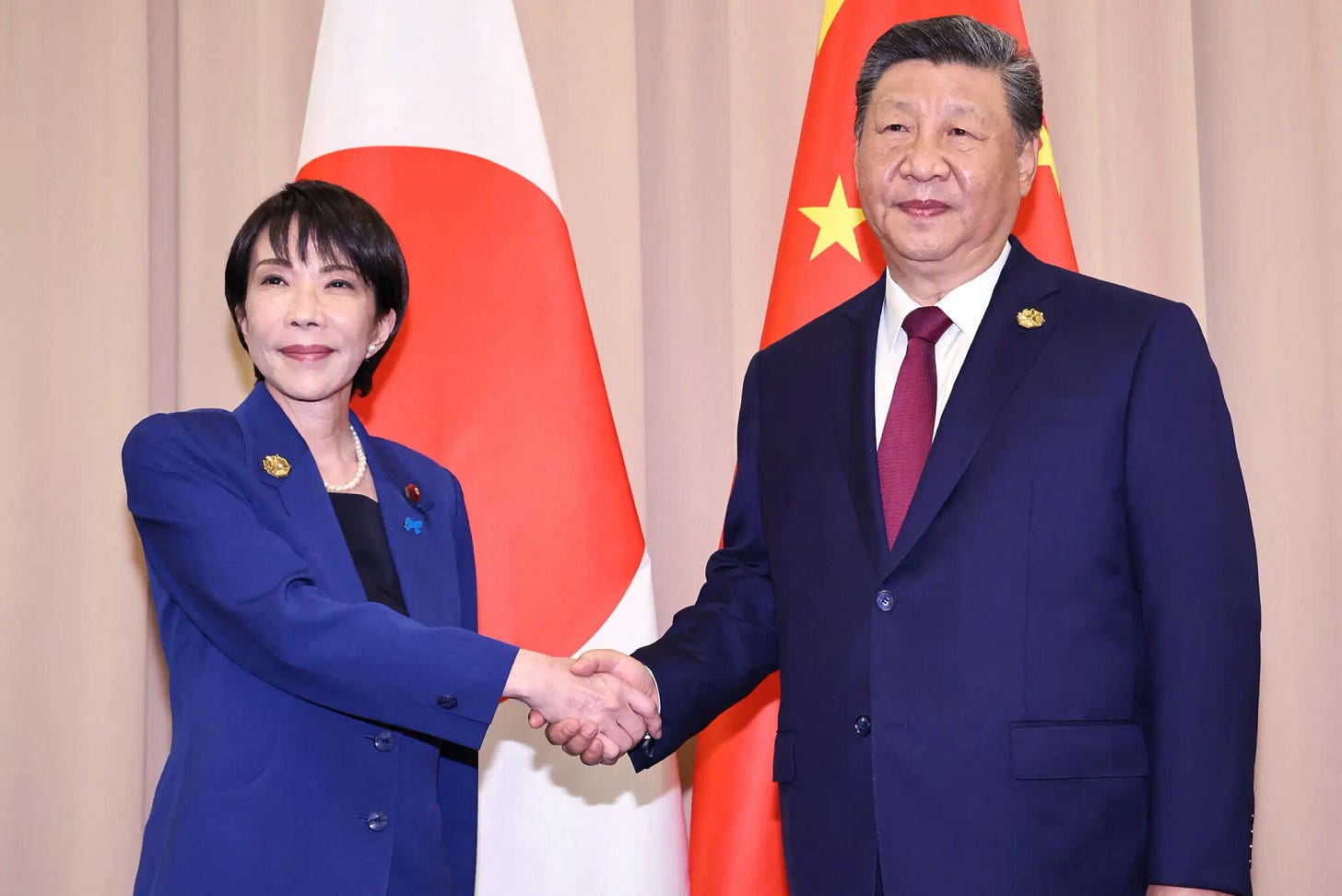

China revives ‘wolf warrior’ diplomacy after Japan PM’s Taiwan remarks

NYT reports that Beijing unleashed fierce attacks on Japan’s new prime minister, Sanae Takaichi, after she warned in Parliament that a Chinese move against Taiwan could trigger a “survival-threatening situation” for Japan. A Chinese consul in Osaka went as far as threatening to “cut off” her “filthy head,” prompting demands in Tokyo for his expulsion. The episode marks a sharp return to China’s combative wolf-warrior style, despite Takaichi later softening her comments and insisting policy had not changed.

Thai king makes historic first state visit to China

BBC reports that King Maha Vajiralongkorn has arrived in Beijing for the first-ever state visit by a reigning Thai monarch, marking 50 years of diplomatic ties. Beijing has pushed for the trip, which reflects Thailand’s deepening shift towards China amid cooler ties with Washington. Xi Jinping will host a state banquet, with the Thai royals visiting cultural and aerospace sites.

Japan and China trade barbs after Tokyo warns a Taiwan attack could threaten Japan’s survival

Politico reports that tensions flared between Japan and China after Prime Minister Sanae Takaichi said a Chinese assault on Taiwan could pose a “survival-threatening situation” for Japan, potentially justifying the use of force. Beijing condemned the remarks as interference in its internal affairs, with a Chinese consul posting a now-deleted online message threatening retaliation. Tokyo lodged a strong protest, calling the comments “extremely inappropriate.” The dispute underscores strained ties despite Takaichi’s recent meeting with Xi Jinping and highlights Japan’s tougher security stance under its new leadership.

Dutch minister defends Nexperia intervention as EU-China chip standoff ends

The Guardian reports that Dutch economy minister Vincent Karremans has defended the Netherlands’ unprecedented takeover of Chinese-owned chipmaker Nexperia, saying the six-week showdown with Beijing that disrupted global car production was a necessary “wake-up call” for Europe. The Netherlands acted under a Cold War-era law after intelligence suggested Nexperia’s Chinese parent Wingtech was shifting IP and production to China.

China agrees to curb fentanyl precursors in deal with US

Reuters reports that China has agreed to a new plan with Washington to restrict the production and export of fentanyl-related chemicals, following a visit to Beijing by FBI Director Kash Patel. The deal, reached after last month’s Trump–Xi summit in South Korea, requires Beijing to designate 13 precursor substances used in fentanyl manufacturing and regulate seven chemical subsidiaries involved in their production.

China accuses U.S. of masterminding $13 billion Bitcoin theft

Bloomberg reports that China’s cybersecurity agency has accused the U.S. government of orchestrating the 2020 theft of 127,000 Bitcoin—worth about $13 billion—from the LuBian mining pool, calling it a “state-level hacker operation.” The National Computer Virus Emergency Response Center claimed the heist’s stealthy and delayed transactions suggested government involvement rather than criminal activity. The allegation marks one of Beijing’s most serious public accusations of cyber theft against Washington, reflecting escalating digital and geopolitical tensions between the two powers.

US lawmakers press Trump administration over China–Iran chemical shipments

CNN reports that two senior House Democrats have demanded an explanation after revelations that Chinese firms shipped sodium perchlorate to Iran, aiding Tehran’s effort to rebuild its ballistic missile arsenal after the June war with Israel. Western intelligence says about 2,000 tons of the chemical arrived in Bandar Abbas between late September and mid-October, enough for roughly 500 missiles. The lawmakers warned the transfers violate reinstated UN sanctions and deepen concerns about growing coordination between China, Iran, Russia and North Korea.

China escalates rhetoric on Taiwan as part of longer-term policy shift

The Guardian reports that Beijing has sharpened its language and propaganda surrounding Taiwan, signalling a sustained strategy to normalise more assertive behaviour rather than a sudden escalation. Recent state media articles outlined how Taiwan would be governed under a “one country, two systems” model, while China introduced a new “Taiwan Retrocession Day” and released satellite images of Taiwan’s landmarks captioned “under one sky.” Analysts say these moves aim to erode Taiwan’s sovereignty narrative and prepare ground for diplomatic and psychological pressure ahead of a possible Xi-Trump meeting in 2026.

Tech in China🖥️

China tests world’s largest high-altitude power-generating kite

South China Morning Post reports that China has deployed a 5,000-square-metre energy-harvesting kite in Inner Mongolia, designed to capture strong winds at over 300 metres. Developed by the China Energy Engineering Corporation, the system uses tethered kites lifted by helium balloons to drive ground-based generators. Officials say the technology could cut land use by 95 per cent and reduce electricity costs by 30 per cent, with plans to reach altitudes above 5,000 metres for future deployments.

Alibaba preps major revamp of AI app

Bloomberg reports that Alibaba will overhaul its Tongyi mobile apps and relaunch them as “Qwen,” aligning the interface more closely with ChatGPT. The company plans to layer in agentic-AI functions to support shopping across platforms like Taobao, part of a push to close the gap with AI rivals and eventually monetise consumer use.

Tencent posts 15 per cent revenue jump

Business Times reports that Tencent’s quarterly revenue rose to 192.9 billion yuan, outpacing expectations as net income hit 63.1 billion yuan. The company is sustaining strong growth while avoiding heavy AI spending, instead embedding the technology into core businesses like WeChat and gaming. High-margin content and global game hits continue to drive earnings, helping Tencent outperform peers facing price wars and regulatory pressures.

Global Risk🗺️

Delhi blast puts India on alert as U.S. firms deepen investment under renewed ‘China+1’ push

Bloomberg reports that India has heightened security nationwide after a car explosion near Delhi’s Red Fort killed at least eight people, prompting investigations amid speculation of cross-border links. While the Modi government has not labelled it a terror attack, officials promised a “swift and thorough” probe. Separately, the newsletter notes renewed U.S. corporate interest in India as a manufacturing alternative to China. Ford announced a $370 million engine plant investment, joining Google, Apple suppliers, and Micron in expanding operations, as both governments move toward a new trade pact expected to cement India’s position as Washington’s preferred “China+1” partner.

Modi’s alliance on track for sweeping win in Bihar

Reuters reports that India’s ruling National Democratic Alliance is set to comfortably retain Bihar, with leads well above the 122-seat majority. The result marks a significant rebound for Narendra Modi after his 2024 national setback, driven in large part by strong support from women voters following a major cash transfer scheme. Analysts say the victory strengthens the BJP’s grip on the Hindi heartland ahead of key state elections next year.

Trump threatens $1bn lawsuit against BBC over edited speech in Panorama film

BBC reports that U.S. President Donald Trump has said he feels an “obligation” to sue the BBC for $1 billion in damages, alleging the broadcaster “butchered” and “defrauded” viewers by editing his January 6 speech in a 2024 Panorama documentary. The edit appeared to make Trump sound as if he had incited the Capitol riot, prompting a backlash after a leaked memo exposed internal concerns. BBC chair Samir Shah has apologised for an “error of judgement”, and Director General Tim Davie and Head of News Deborah Turness have resigned. The BBC faces parliamentary scrutiny as it prepares for negotiations over its royal charter renewal in 2027.

India urged to raise R&D spending as government pushes innovation-led growth

The Hindu reports that the Department of Science and Technology (DST) has called for greater investment in research and development, warning that India’s R&D expenditure remains stagnant at 0.64% of GDP—far below the global average of 1.8%. At a workshop with FICCI, DST Secretary Abhay Karandikar said achieving “Viksit Bharat 2047” will require making innovation central to India’s industrial and academic sectors, backed by stronger private participation. Officials highlighted key initiatives such as the ₹1 lakh crore RDI Fund, the National Quantum Mission and the new Anusandhan Research Foundation, while urging industry to close gaps in funding, IP protection and university collaboration.

RSS hires top US lobbyists for influence push in Washington

Prism Reports reveals that India’s Rashtriya Swayamsevak Sangh has, for the first time, hired a major US firm, Squire Patton Boggs, paying $330,000 across 2025 to shape congressional views on US–India relations. The work was filed under domestic lobbying rules rather than the stricter foreign-agent regime, prompting experts to question whether the RSS is evading FARA disclosure. Lobbyists linked to the firm visited RSS facilities in Nagpur, highlighting a broader campaign to soften the organisation’s image abroad.

Ukraine’s anti-corruption agencies probe graft in war-hit energy sector

Politico Europe reports that Ukraine’s National Anti-Corruption Bureau has launched multiple investigations into alleged misconduct across the country’s energy sector, including procurement and repair contracts linked to post-war reconstruction. The probes target officials and private contractors accused of inflating costs and diverting funds intended for restoring critical infrastructure damaged by Russian attacks. Western donors have pressed Kyiv to show accountability as it seeks continued aid and investment, with analysts warning that energy-related corruption could undermine Ukraine’s broader recovery and its bid for EU accession.

South Korea indicts ex-president Yoon Suk Yeol for aiding the enemy and abuse of power

Le Monde reports that former South Korean president Yoon Suk Yeol has been indicted on new charges of aiding the enemy and abusing power. Prosecutors allege Yoon ordered drone flights over North Korea in late 2024 to provoke a hostile reaction and justify declaring martial law, part of an effort to subvert civilian rule. Evidence from a counter-intelligence memo suggests he aimed to create “an unstable situation” to seize power. Yoon was removed from office in April 2025 after deploying armed troops to block parliament from overturning his martial law order and remains on trial for insurrection.

Zohran Mamdani’s election as New York’s first Muslim mayor hailed as milestone for Arab and Muslim Americans

Al-Monitor reports that Zohran Mamdani’s victory in New York City’s mayoral election has been celebrated by Arab and Muslim groups across the United States as a landmark for political inclusion and representation. The 34-year-old democratic socialist defeated Andrew Cuomo with over 50% of the vote, following a campaign centred on housing, transit access and social welfare, alongside outspoken support for Palestinian rights. Despite Islamophobic attacks and criticism of his stance on Israel, Mamdani’s win signals a broader shift in U.S. politics as progressive and Muslim candidates gain traction amid changing public opinion on the Gaza war.

Thailand suspends Trump-brokered peace deal with Cambodia after border blast

Nikkei Asia reports that Thailand has halted implementation of a recent U.S.-brokered peace accord with Cambodia after two Thai soldiers were injured by a landmine along the disputed border. Prime Minister Anutin Charnvirakul ordered all joint activities under the deal suspended, saying “everything must be stopped” until the incident is fully investigated. The agreement, signed in late October during the ASEAN Summit in Kuala Lumpur, was promoted by U.S. President Donald Trump as part of his regional diplomacy push linking trade incentives to political alignment. The setback threatens to inflame tensions between Bangkok and Phnom Penh, where decades-old territorial disputes around Preah Vihear temple and landmine contamination remain unresolved.

UK terror definition ‘too broad’, independent commission to tell Starmer

New Statesman reports that the Independent Commission on Counter-Terrorism will urge Prime Minister Keir Starmer to narrow the UK’s definition of terrorism, arguing it has become a “catch-all” term that undermines effective security policy. The commission will call for stronger parliamentary and judicial oversight of proscription orders, a move likely to cast doubt on the recent ban of the activist group Palestine Action. The findings amount to a critique of the government’s counter-terrorism framework and are expected to spark debate within Labour over civil liberties and political protest.

CENTCOM reports fresh operations against Islamic State in Syria

Jerusalem Post reports that US Central Command supported 22 operations between 1 October and 6 November, killing five Islamic State members and detaining 19. The actions come as Syria undertakes nationwide pre-emptive raids after signing a cooperation pact with the anti-ISIS coalition. Reuters also notes that Washington is preparing a military presence in Damascus to support a US-brokered Syria–Israel security deal following last year’s fall of Bashar al-Assad.

Syria joins US-led coalition against Islamic State after Trump–al-Sharaa meeting

BBC reports that Syria will join the US-led international coalition to combat the Islamic State group, marking a major reversal in Washington’s Middle East policy. The announcement followed President Donald Trump’s White House meeting with Syrian President Ahmed al-Sharaa, a former jihadist leader recently removed from the US terrorist list. The Trump administration will temporarily suspend sanctions under the Caesar Act and allow Syria to reopen its embassy in Washington as part of the rapprochement. Trump called al-Sharaa a “fighter” capable of rebuilding Syria, while critics note the new president’s record of sectarian violence and ongoing human rights abuses.

Syria’s elite back al-Sharaa as Trump moves to lift sanctions

Al-Monitor reports that Syrian President Ahmed al-Sharaa’s upcoming White House visit will formalise Syria’s entry into the US-led coalition against ISIS and pave the way for repealing Caesar Act sanctions. While welcomed by Damascus’s business elite, Kurdish leaders criticised their exclusion from the talks and warned the deal risks sidelining minorities. Critics in Washington say unconditional US backing for al-Sharaa, accused of sectarian abuses, could undermine hopes for an inclusive post-war Syria.

Iran-backed militias seek electoral gains in Iraq

FT reports that Iraq’s Shia militias, long central to Tehran’s regional network, are using upcoming elections to entrench political power after sidestepping post-October 7 conflicts that damaged other Iranian allies. Groups such as the Popular Mobilisation Units and Asaib Ahl al-Haq are rebranding themselves as reformist civilian actors while expanding patronage networks financed by a rising state budget. Critics warn the factions still operate as armed organisations accused of corruption, coercion and violence, and fear their growing electoral presence will accelerate Iraq’s slide towards militia dominance of the state.

Israeli intelligence aide Yoni Koren stayed at Epstein’s Manhattan apartment, documents show

Drop Site News reports that leaked emails and House Oversight documents reveal former Israeli intelligence officer Yoni Koren, a top aide to ex–Prime Minister Ehud Barak, stayed at Jeffrey Epstein’s Manhattan apartment multiple times between 2013 and 2016 while conducting official business. The records include a 2015 email from Barak to Epstein containing Koren’s bank details for a wire transfer, and correspondence suggesting coordination with US intelligence figures such as former CIA Director Leon Panetta. The findings deepen evidence of Epstein’s role as a conduit between American and Israeli intelligence circles, according to the report.

Heritage Foundation faces resignations over defence of Tucker Carlson interview

CBS News reports that the Heritage Foundation has been hit by internal turmoil after its president Kevin Roberts defended Tucker Carlson for hosting white nationalist Nick Fuentes, prompting at least six resignations, including members of the think tank’s antisemitism task force and Roberts’ chief of staff. Roberts later apologised for his remarks and language, but senior staff accused him of damaging Heritage’s reputation and questioned his ability to lead the organisation.

Young Turks lose faith amid arrests and repression under Erdoğan

Bloomberg reports that growing arrests of students, YouTubers and artists have deepened disillusionment among Turkey’s youth, most of whom have known no leader other than President Recep Tayyip Erdoğan. The detentions of a popular girl band and online comedians have fuelled anger over limits on free expression, while economic stagnation and job insecurity push many to emigrate. Analysts say Turkey’s younger generation feels excluded from politics but still holds out hope for democratic change within the next decade.

Qatar-linked firms spied on ICC prosecutor’s accuser, leaked files reveal

The Guardian reports that two British private intelligence companies ran a covert operation on behalf of a Qatari state unit to gather sensitive data on a woman who accused International Criminal Court prosecutor Karim Khan of sexual abuse. Leaked files show attempts to obtain her passport details, online passwords, and information about her family to undermine her credibility. Khan denies the allegations and has stepped aside pending a UN inquiry, while Qatar has dismissed the claims as “unfounded.” The revelations deepen the turmoil surrounding the ICC after Khan’s 2024 arrest warrants for Israeli leaders.

Iran warns of possible Tehran evacuation amid historic water crisis

Associated Press reports that Iranian President Masoud Pezeshkian has warned that Tehran may face water rationing or even evacuation if rain does not arrive soon, as dam reservoirs fall to their lowest levels in six decades. The capital is in its sixth straight year of drought, with the key Latyan Dam only 9% full. Officials say the shortage is also crippling hydropower output, while experts blame decades of mismanagement, water-intensive industries, and inefficient farming for deepening the crisis.

ING forecasts rupee rebound on trade optimism

Bloomberg reports that the Indian rupee is expected to post the strongest gains among Asia’s high-yield currencies next year, according to ING Bank. Economists at the bank project the rupee to rise to 87 per US dollar by end-2026 — about 2% higher than current levels — driven by prospects of a trade deal with the United States and undervaluation based on real effective exchange rate metrics. ING said the rupee remains one of the region’s most attractive currencies for appreciation after lagging behind peers in 2025.

Nvidia and Qualcomm back coalition to grow India’s deep tech ecosystem

TechCrunch reports that Nvidia and Qualcomm Ventures have joined a coalition of US and Indian investors to support India’s emerging deep tech startups. The India Deep Tech Alliance (IDTA), launched in September with over $1 billion in commitments, aligns with the government’s new ₹1 trillion ($12 billion) Research, Development and Innovation scheme. Nvidia will act as a strategic adviser, offering technical training and policy input, while Qualcomm will invest alongside firms such as Accel, Blume Ventures, and Premji Invest. The alliance aims to expand funding and mentorship for Indian ventures in fields like AI, semiconductors, robotics, and quantum computing over the next decade.

Quantinuum unveils ion-based quantum computer with simplified error correction

MIT Technology Review reports that US–UK company Quantinuum has launched Helios, its third-generation quantum computer, which uses barium ions as qubits to improve control and reduce error rates. Helios employs 98 qubits and requires only two ions per logical qubit for error correction—far fewer than the 9–105 used by superconducting systems from Amazon, IBM, and Google. The ion-based design allows “all-to-all connectivity,” meaning any qubit can interact with any other, simplifying scaling. Quantinuum says Helios achieves 99.921% fidelity in entanglement tests and demonstrated real-time error correction using Nvidia GPUs. The firm plans to build a larger 192-qubit successor, Sol, by 2027 and a fault-tolerant system, Apollo, by 2029.

Blind students endure 12-hour marathon in South Korea’s Suneung exam

BBC reports that blind test-takers sit the longest and most gruelling version of South Korea’s college entrance exam, stretching close to 13 hours without a dinner break. Braille papers are six to nine times thicker than standard booklets, forcing students to rely on fingertip reading and audio tools for the entire day. Delays in producing braille study materials leave them months behind sighted peers, compounding the challenge of an already punishing exam.

Decypher Data Dive📊

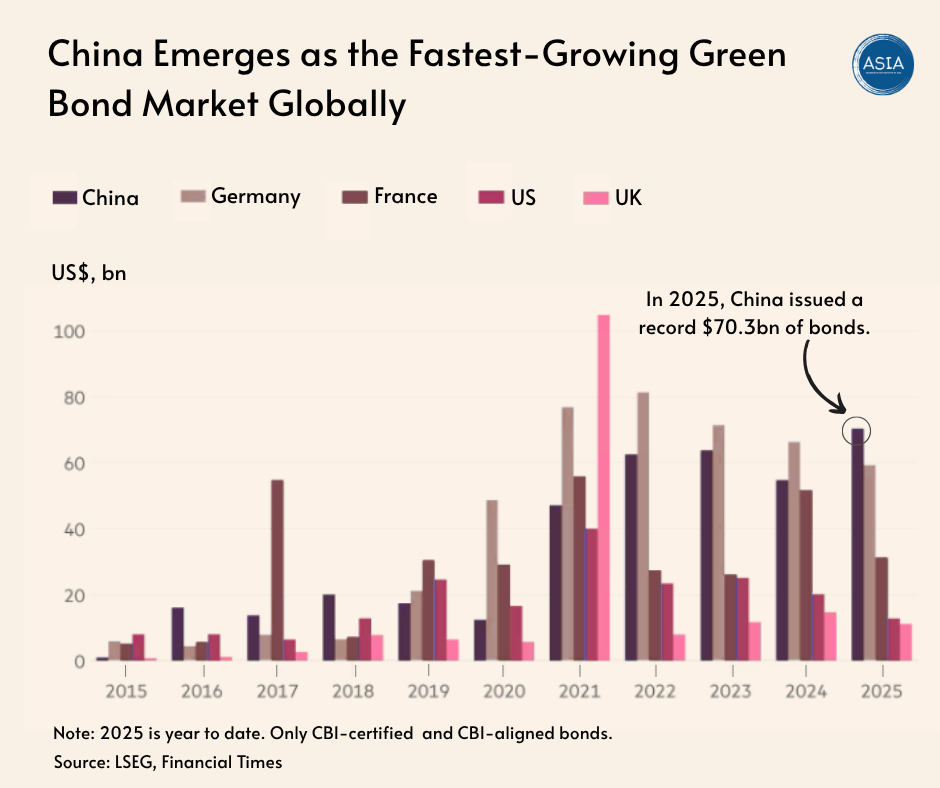

China has become the world’s leading issuer of green bonds, delivering a record $70.3 billion in Climate Bond Initiative (CBI)-certified or aligned bonds in 2025. That accounts for over 17% of global issuance compared with just 3% from the US. Green bonds are a form of debt issued by companies and sometimes governments where the proceeds are earmarked for spending on environmental projects.

— — —

Microessays by Priyanka & Manash

Data By Bhupesh

Edited By Aurko

Produced by Decypher Team in New Delhi, India

— — —